Question: The professional simulation for this chapter asks you to address questions related to the balancesheet. KWW Professional Simulation Balance Sheet Time Remaining 3 hours 10

The professional simulation for this chapter asks you to address questions related to the balancesheet.

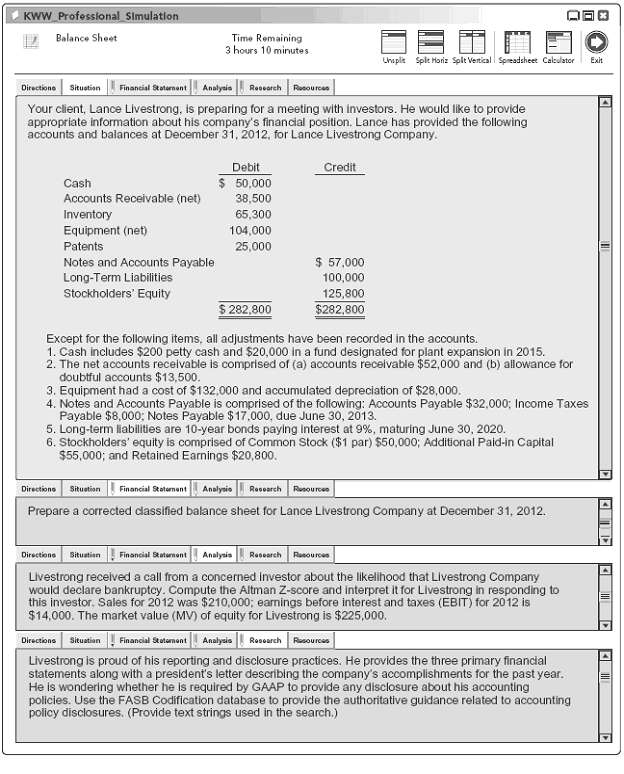

KWW Professional Simulation Balance Sheet Time Remaining 3 hours 10 minutes Lhaplie Sple Horiz Splt Vertical Spreadsheet Calculator Exit Financial Staternent Analyaie Roosarch Rosources Directione Situstion Your client, Lance Livestrong, Is preparing for a meeting with investors. He would like to provide appropriate information about his company's financial position. Lance has provided the following accounts and balances at December 31, 2012, for Lance Livestrong Company. Debit $ 50,000 Credit Cash Accounts Receivable (net) Inventory Equipment (net) 38,500 65,300 104,000 Patents 25,000 $ 57,000 Notes and Accounts Payable Long-Term Liabilities 100,000 Stockholders' Equity 125,800 $282,800 $ 282,800 Except for the following items, all adjustments have been recorded in the accounts. 1. Cash includes $200 petty cash and $20,000 in a fund designated for plant expansion in 2015. 2. The net accounts receivable is comprised of (a) accounts recelvable $52,000 and (b) allowance for doubtful accounts $13,500. 3. Equipment had a cost of $132,000 and accumulated depreciation of $28,000. 4. Notes and Accounts Payable is comprised of the following: Accounts Payable $32,000; Income Taxes Payable $8,000: Notes Payable $17.000, due June 30, 2013. 5. Long-term liabilities are 10-year bonds paylng Interest at 9%, maturing June 30, 2020. 6. Stockholders' equity is comprised of Common Stock ($1 par) $50,000; Additional Paid-in Capital $55,000; and Retained Earnings $20,800. Research Rusourcee Financial Staternent Analysie Directione Situstion Prepare a corrected dlassifed balance sheet for Lance Livestrong Company at December 31, 2012. Research Resourous Directione Bitustien Financial Staturnont Analysis Livestrong recelved a call from a concerned investor about the likelihood that Livestrong Company would declare bankruptcy. Compute the Altman Z-score and interpret it for Livestrong in responding to this investor, Sales for 2012 was $210.000; eamings before interest and taxes (EBIT) for 2012 is $14,000. The market value (MV) of equity for Livestrong is $225,000. Financial Stetemont Analysis Research Rusources Directions Situatian Livestrong is proud of his reporting and disclosure practices. He provides the three primary financial statements along with a president's letter describing the company's accomplishments for the past year. He is wondering whether he Is required by GAAP to provide any disclosure about his accounting policies. Use the FASB Codification database to provide the authoritative guidance related to accounting policy disclosures. (Provide text strings used in the search.)

Step by Step Solution

3.32 Rating (164 Votes )

There are 3 Steps involved in it

FINANCIAL STATEMENT LANCE LIVESTRONG COMPANY Balance Sheet December 31 2012 Assets Current assets Cash 50000 20000 30000 Accounts receivable 38500 135... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

51-B-A-B-S-C-F (394).docx

120 KBs Word File