Question: Question: a) How does a commodity exchange ensure that trade volatility does not go beyond an acceptable level? b) What is basis risk and why

Question:

a) How does a commodity exchange ensure that trade volatility does not go beyond an acceptable level?

b) What is basis risk and why does it arise?

c) On September 1, an investor holds 10,000 shares of a certain stock. The market price is $62.50 per share. The investor is interested in hedging against movements in the market over the next month and decides to use the September S&P 500 futures contract. The futures price on the index is currently 1,000 and one contract is for delivery of $250 times the index. The beta of the stock is 0.8. Using the information above, answer the following questions:

i) With a hedging motive, which position should the investor take in S&P500 futures and in how many contracts?

ii) If the market goes down and the index settles at 750 next month, what will be the gain/loss on the investor's stock portfolio? Will her futures position help her recover the loss? Explain through relevant computations.

d) The spot price for a dividend paying stock is selling for $50 today. The stock will pay a $0.50 dividend in 2 months from now. The 2-month risk-free rate is 2% p.a. compounded continuously and the 6-month risk-free rate is 4% p.a. compounded continuously. A 6-month forward contract on the stock is available at a forward price of $52. Can an arbitrageur gain from this situation? If so, compute the arbitrage profit. What should be the true forward price?

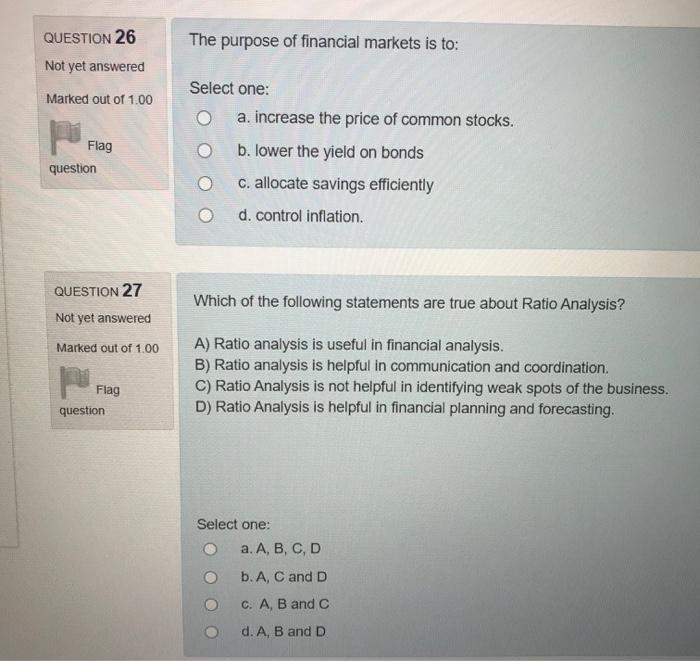

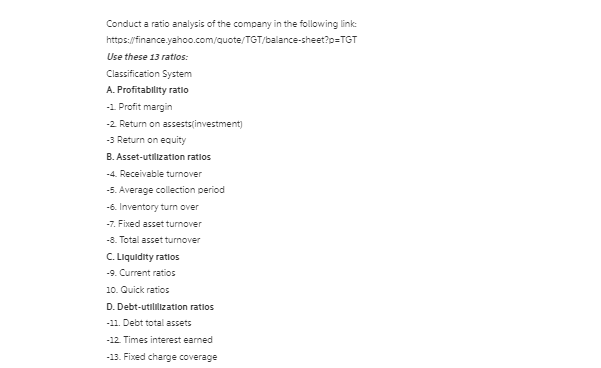

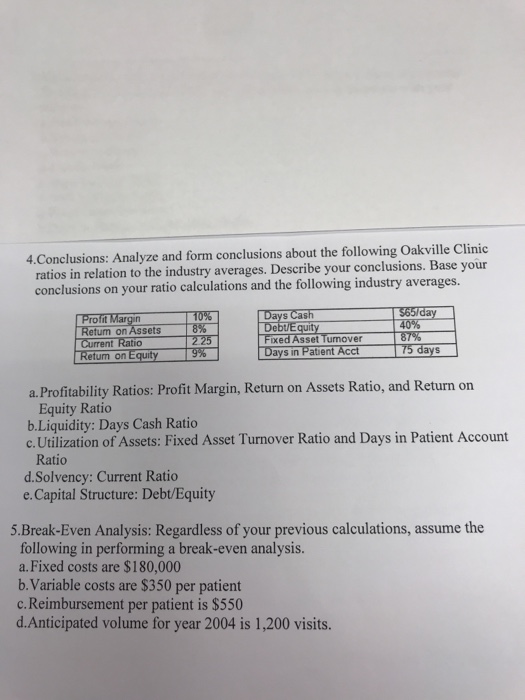

QUESTION 26 The purpose of financial markets is to: Not yet answered Select one: Marked out of 1.00 O a. increase the price of common stocks. Flag O b. lower the yield on bonds question O c. allocate savings efficiently O d. control inflation. QUESTION 27 Which of the following statements are true about Ratio Analysis? Not yet answered Marked out of 1.00 A) Ratio analysis is useful in financial analysis. B) Ratio analysis is helpful in communication and coordination. Flag C) Ratio Analysis is not helpful in identifying weak spots of the business. question D) Ratio Analysis is helpful in financial planning and forecasting. Select one: O a. A, B, C, D O b. A, C and D O C. A, B and C O d. A, B and DConduct a ratio analysis of the company in the following link: https://finance.yahoo.com/quote/TGT/balance-sheet?p=TGT Use these 13 ratios: Classification System A. Profitability ratio -1. Profit margin -2. Return on assests( investment] -3 Return on equity B. Asset-utilization ratlos -4. Receivable turnover -5. Average collection period -6. Inventory turn over -7. Fixed asset turnover -8. Total asset turnover C. Liquidity ratios -9. Current ratios 10. Quick ratios D. Debt-utililization ratlos -11. Debt total assets -12. Times interest earned -13. Fixed charge coverage4.Conclusions: Analyze and form conclusions about the following Oakville Clinic ratios in relation to the industry averages. Describe your conclusions. Base your conclusions on your ratio calculations and the following industry averages. Profit Margin 10% Days Cash $65/ day Return on Assets 8% Debt/Equity 40% Current Ratio 2.25 Fixed Asset Turnover 87% Return on Equity 9% Days in Patient Acct 75 day's a. Profitability Ratios: Profit Margin, Return on Assets Ratio, and Return on Equity Ratio b.Liquidity: Days Cash Ratio c. Utilization of Assets: Fixed Asset Turnover Ratio and Days in Patient Account Ratio d.Solvency: Current Ratio e. Capital Structure: Debt/Equity 5.Break-Even Analysis: Regardless of your previous calculations, assume the following in performing a break-even analysis. a. Fixed costs are $180,000 b. Variable costs are $350 per patient c. Reimbursement per patient is $550 d.Anticipated volume for year 2004 is 1,200 visits