Question: Question : Appropriation statement for the year ended 31 December 2020.(please refer picture below) NOTES : I want tou answer this question based on example

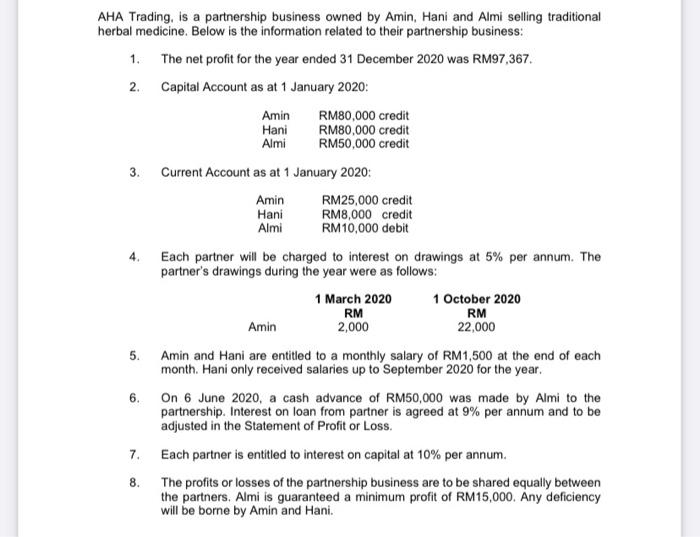

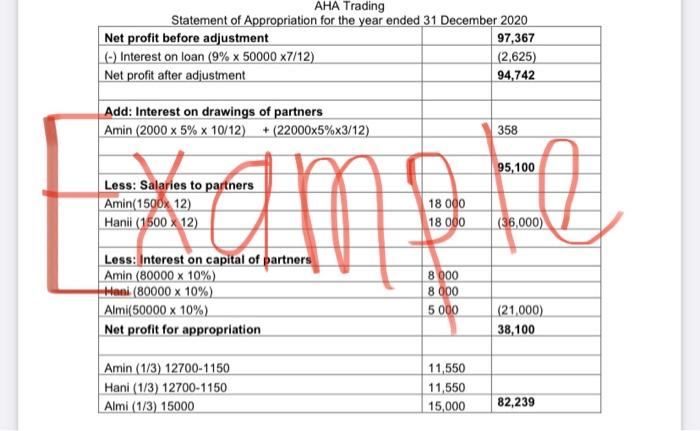

AHA Trading, is a partnership business owned by Amin. Hani and Almi selling traditional herbal medicine. Below is the information related to their partnership business: 1. The net profit for the year ended 31 December 2020 was RM97,367. 2. Capital Account as at 1 January 2020: 3. Current Account as at 1 January 2020: 4. Each partner will be charged to interest on drawings at 5% per annum. The partner's drawings during the year were as follows: 5. Amin and Hani are entitled to a monthly salary of RM1,500 at the end of each month. Hani only received salaries up to September 2020 for the year. 6. On 6 June 2020, a cash advance of RM50,000 was made by Almi to the partnership. Interest on loan from partner is agreed at 9% per annum and to be adjusted in the Statement of Profit or Loss. 7. Each partner is entitled to interest on capital at 10% per annum. 8. The profits or losses of the partnership business are to be shared equally between the partners. Almi is guaranteed a minimum profit of RM15,000. Any deficiency will be borne by Amin and Hani. AHA Trading

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts