Answered step by step

Verified Expert Solution

Question

1 Approved Answer

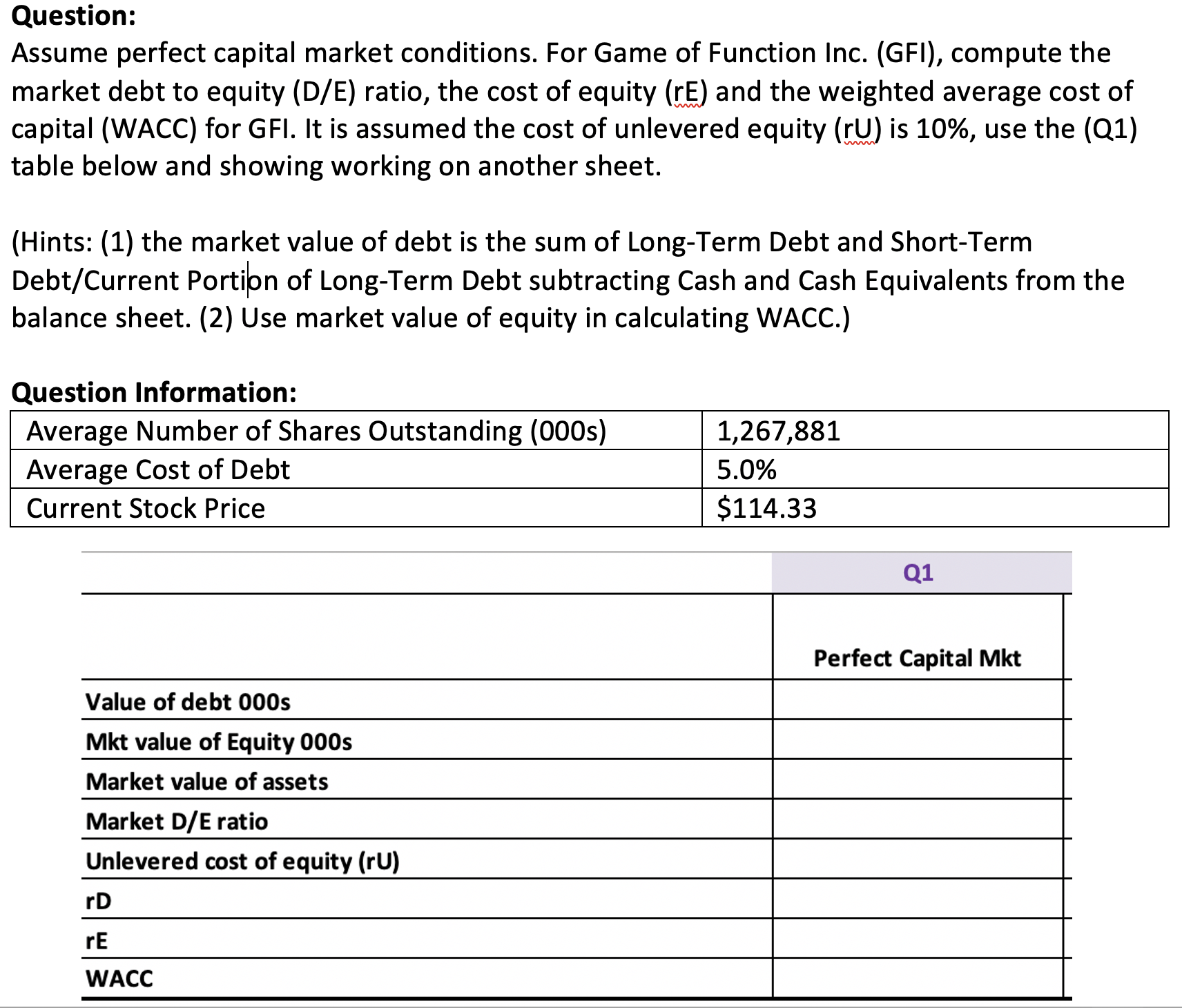

Question: Assume perfect capital market conditions. For Game of Function Inc. (GFI), compute the market debt to equity (D/E) ratio, the cost of equity

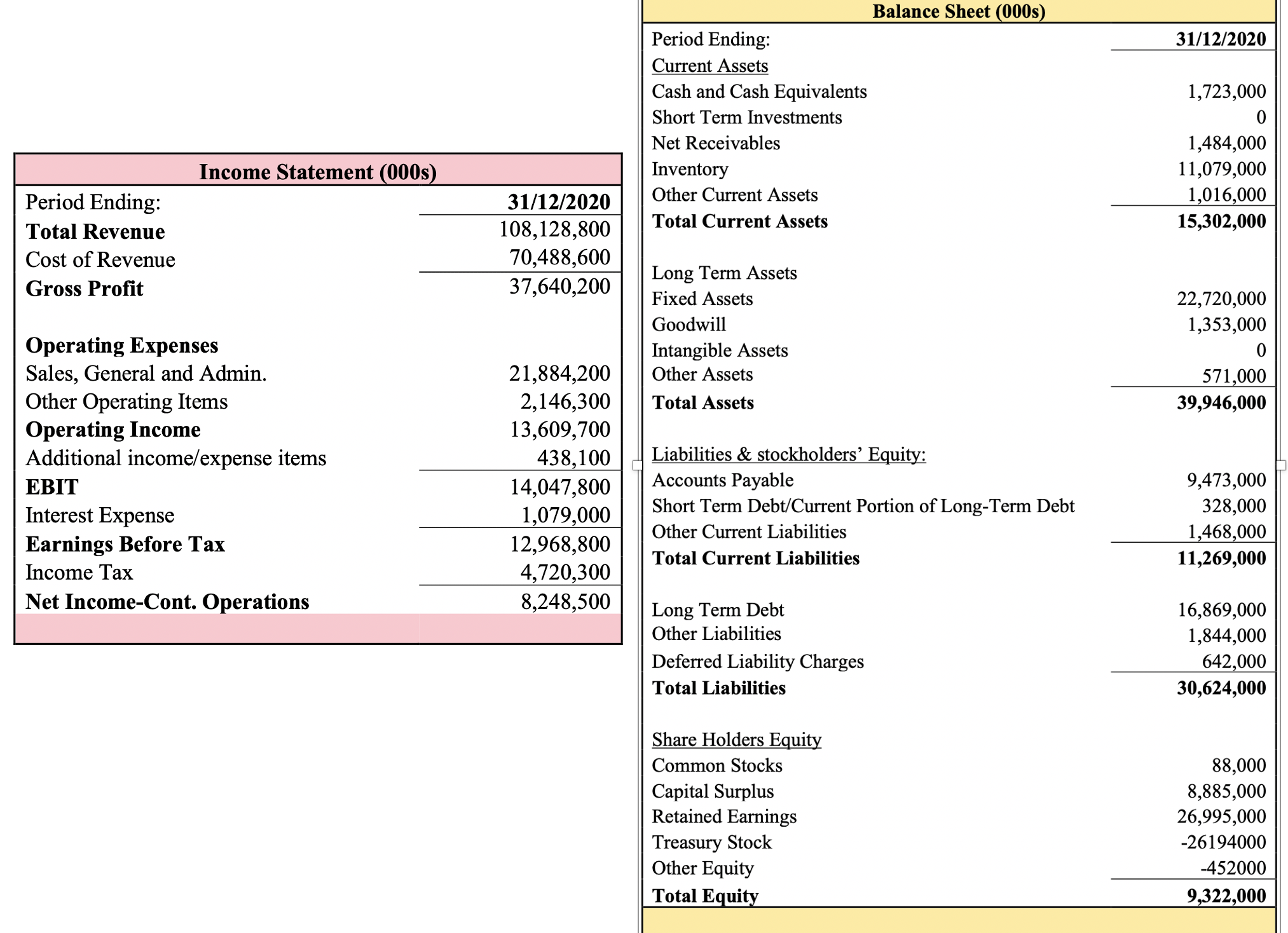

Question: Assume perfect capital market conditions. For Game of Function Inc. (GFI), compute the market debt to equity (D/E) ratio, the cost of equity (rE) and the weighted average cost of capital (WACC) for GFI. It is assumed the cost of unlevered equity (rU) is 10%, use the (Q1) table below and showing working on another sheet. (Hints: (1) the market value of debt is the sum of Long-Term Debt and Short-Term Debt/Current Portion of Long-Term Debt subtracting Cash and Cash Equivalents from the balance sheet. (2) Use market value of equity in calculating WACC.) Question Information: Average Number of Shares Outstanding (000s) Average Cost of Debt Current Stock Price 1,267,881 5.0% $114.33 Q1 Value of debt 000s Mkt value of Equity 000s Market value of assets Market D/E ratio Unlevered cost of equity (ru) rD rE WACC Perfect Capital Mkt Period Ending: Current Assets Cash and Cash Equivalents Short Term Investments Balance Sheet (000s) 31/12/2020 1,723,000 Income Statement (000s) Net Receivables Inventory 1,484,000 Period Ending: Total Revenue Cost of Revenue Gross Profit 31/12/2020 Other Current Assets 11,079,000 1,016,000 108,128,800 Total Current Assets 15,302,000 70,488,600 Long Term Assets 37,640,200 Fixed Assets Goodwill Operating Expenses Intangible Assets Sales, General and Admin. 21,884,200 Other Assets Other Operating Items 2,146,300 Total Assets 22,720,000 1,353,000 0 571,000 39,946,000 Operating Income 13,609,700 Additional income/expense items 438,100 Liabilities & stockholders' Equity: EBIT 14,047,800 Accounts Payable 9,473,000 Interest Expense 1,079,000 Short Term Debt/Current Portion of Long-Term Debt 328,000 Other Current Liabilities Earnings Before Tax 1,468,000 12,968,800 Total Current Liabilities 11,269,000 Income Tax 4,720,300 Net Income-Cont. Operations 8,248,500 Long Term Debt 16,869,000 Other Liabilities 1,844,000 Deferred Liability Charges 642,000 30,624,000 Total Liabilities Share Holders Equity Common Stocks Capital Surplus Retained Earnings Treasury Stock Other Equity Total Equity 88,000 8,885,000 26,995,000 -26194000 -452000 9,322,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started