Question: question b how to answer BMAN30111 QUESTION 2 a) At time t=-1, a publicly listed firm owns some assets in place and a positive NPV

question b how to answer

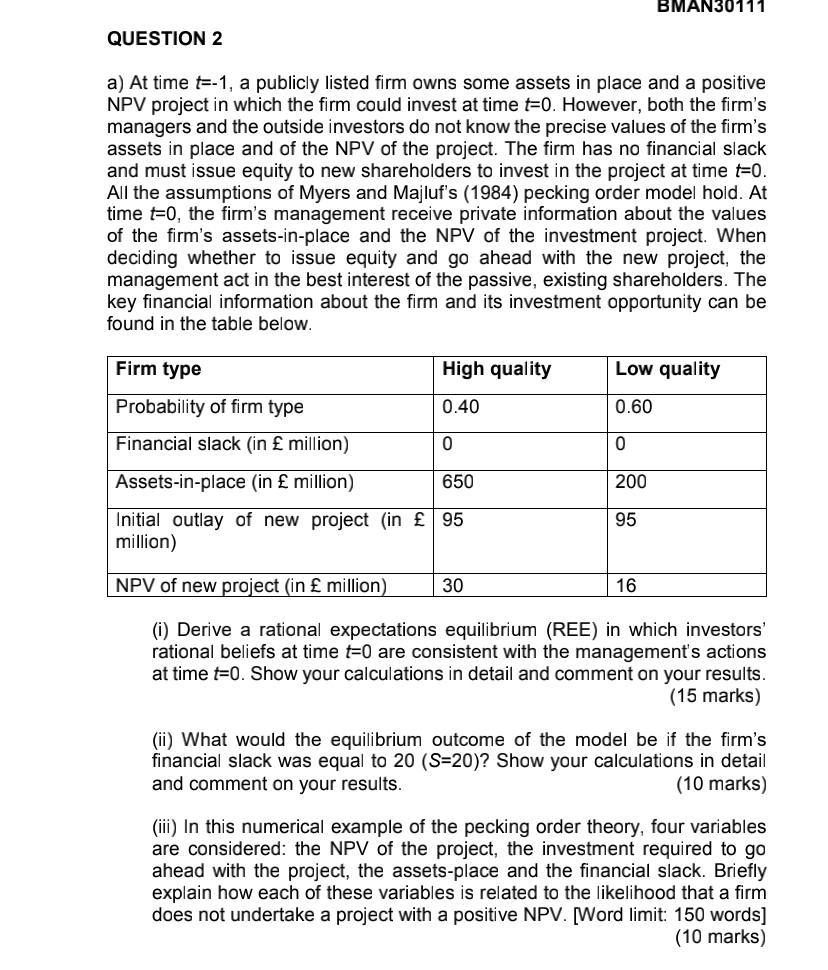

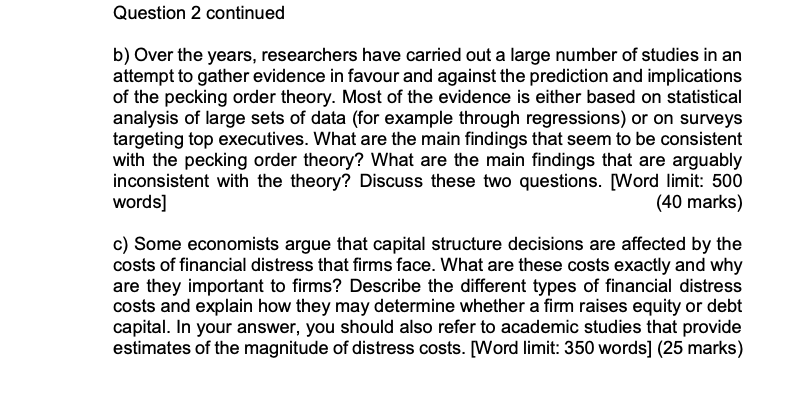

BMAN30111 QUESTION 2 a) At time t=-1, a publicly listed firm owns some assets in place and a positive NPV project in which the firm could invest at time t=0. However, both the firm's managers and the outside investors do not know the precise values of the firm's assets in place and of the NPV of the project. The firm has no financial slack and must issue equity to new shareholders to invest in the project at time t=0. All the assumptions of Myers and Majluf's (1984) pecking order model hold. At time t=0, the firm's management receive private information about the values of the firm's assets-in-place and the NPV of the investment project. When deciding whether to issue equity and go ahead with the new project, the management act in the best interest of the passive, existing shareholders. The key financial information about the firm and its investment opportunity can be found in the table below. Firm type High quality Low quality Probability of firm type 0.40 0.60 Financial slack (in million) 0 0 Assets-in-place (in million) 650 200 95 Initial outlay of new project in 95 million) NPV of new project (in million) 30 16 (i) Derive a rational expectations equilibrium (REE) in which investors' rational beliefs at time t=0 are consistent with the management's actions at time t=0. Show your calculations in detail and comment on your results. (15 marks) (ii) What would the equilibrium outcome of the model be if the firm's financial slack was equal to 20 (S=20)? Show your calculations in detail and comment on your results. (10 marks) (iii) In this numerical example of the pecking order theory, four variables are considered: the NPV of the project, the investment required to go ahead with the project, the assets-place and the financial slack. Briefly explain how each of these variables is related to the likelihood that a firm does not undertake a project with a positive NPV. [Word limit: 150 words] (10 marks) Question 2 continued b) Over the years, researchers have carried out a large number of studies in an attempt to gather evidence in favour and against the prediction and implications of the pecking order theory. Most of the evidence is either based on statistical analysis of large sets of data (for example through regressions) or on surveys targeting top executives. What are the main findings that seem to be consistent with the pecking order theory? What are the main findings that are arguably inconsistent with the theory? Discuss these two questions. Word limit: 500 words] (40 marks) c) Some economists argue that capital structure decisions are affected by the costs of financial distress that firms face. What are these costs exactly and why are they important to firms? Describe the different types of financial distress costs and explain how they may determine whether a firm raises equity or debt capital. In your answer, you should also refer to academic studies that provide estimates of the magnitude of distress costs. [Word limit: 350 words) (25 marks) BMAN30111 QUESTION 2 a) At time t=-1, a publicly listed firm owns some assets in place and a positive NPV project in which the firm could invest at time t=0. However, both the firm's managers and the outside investors do not know the precise values of the firm's assets in place and of the NPV of the project. The firm has no financial slack and must issue equity to new shareholders to invest in the project at time t=0. All the assumptions of Myers and Majluf's (1984) pecking order model hold. At time t=0, the firm's management receive private information about the values of the firm's assets-in-place and the NPV of the investment project. When deciding whether to issue equity and go ahead with the new project, the management act in the best interest of the passive, existing shareholders. The key financial information about the firm and its investment opportunity can be found in the table below. Firm type High quality Low quality Probability of firm type 0.40 0.60 Financial slack (in million) 0 0 Assets-in-place (in million) 650 200 95 Initial outlay of new project in 95 million) NPV of new project (in million) 30 16 (i) Derive a rational expectations equilibrium (REE) in which investors' rational beliefs at time t=0 are consistent with the management's actions at time t=0. Show your calculations in detail and comment on your results. (15 marks) (ii) What would the equilibrium outcome of the model be if the firm's financial slack was equal to 20 (S=20)? Show your calculations in detail and comment on your results. (10 marks) (iii) In this numerical example of the pecking order theory, four variables are considered: the NPV of the project, the investment required to go ahead with the project, the assets-place and the financial slack. Briefly explain how each of these variables is related to the likelihood that a firm does not undertake a project with a positive NPV. [Word limit: 150 words] (10 marks) Question 2 continued b) Over the years, researchers have carried out a large number of studies in an attempt to gather evidence in favour and against the prediction and implications of the pecking order theory. Most of the evidence is either based on statistical analysis of large sets of data (for example through regressions) or on surveys targeting top executives. What are the main findings that seem to be consistent with the pecking order theory? What are the main findings that are arguably inconsistent with the theory? Discuss these two questions. Word limit: 500 words] (40 marks) c) Some economists argue that capital structure decisions are affected by the costs of financial distress that firms face. What are these costs exactly and why are they important to firms? Describe the different types of financial distress costs and explain how they may determine whether a firm raises equity or debt capital. In your answer, you should also refer to academic studies that provide estimates of the magnitude of distress costs. [Word limit: 350 words) (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts