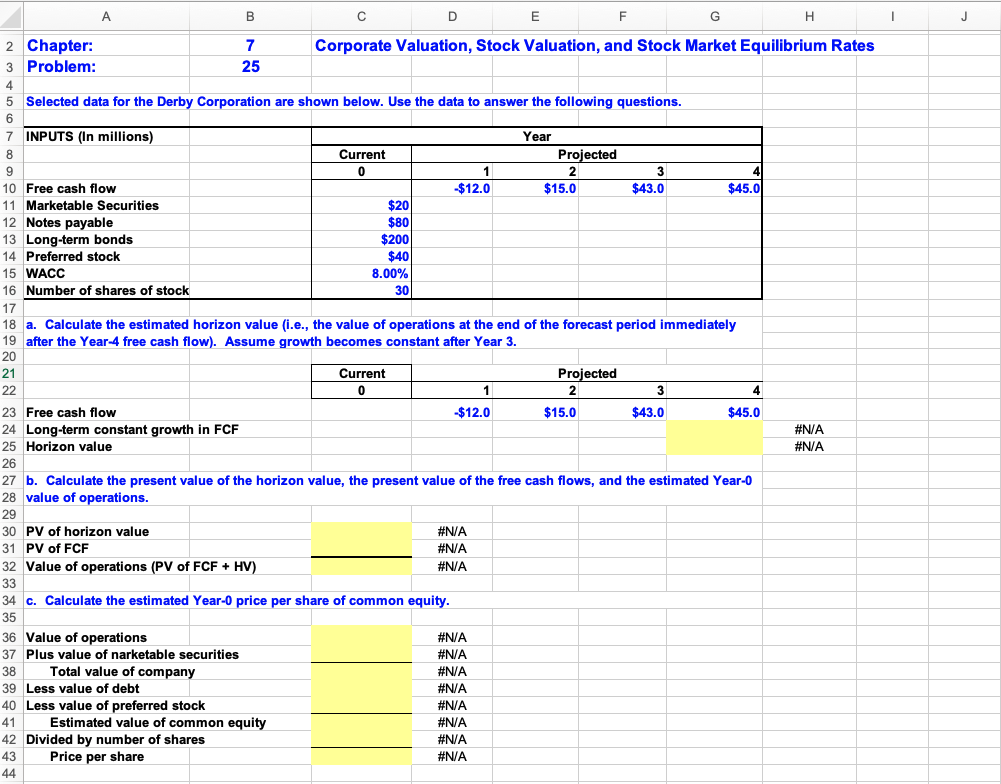

Question: Question Chapter: 7 Problem: 2 5 Selected data for the Derby Corporation are shown below. Use the data to answer the following questions. Please show

Question

Chapter:

Problem:

Selected data for the Derby Corporation are shown below. Use the data to answer the following questions. Please show calculations for each input of data. Also show all formulas for cells highlighted in yellow in the attached picture. This is meant to be completed in an excel spreadsheet using formals and is problem from Financial Management: Theory and Practice th edition.

Free cash flows FCF:

Year :

Year :

Year :

Year :

Marketable Securities:

Notes Payable:

LongTerm Bonds:

Preferred Stock:

Weighted Average Cost of Capital WACC:

Number of Common Shares Outstanding:

a Calculate the estimated horizon value.

This is the value of operations at the end of Year immediately after the Year free cash flow assuming that free cash flows grow at a constant rate beyond Year

Use the formula:

Horizon Value HV FCF in Year WACC g

Where g is the constant longterm growth rate in FCF

b Calculate the present value at Year of the following:

The horizon value calculated in part a

The projected free cash flows for Years and

The estimated total value of operations at Year which is the sum of the present values from steps and above

c Calculate the estimated Year price per share of common equity:

Start with the total value of operations from part b

Add the value of marketable securities

Subtract the value of debt notes payable and longterm bonds

Subtract the value of preferred stock

The result is the estimated value of common equity

Divide the common equity value by the number of common shares outstanding

The result is the estimated price per share

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock