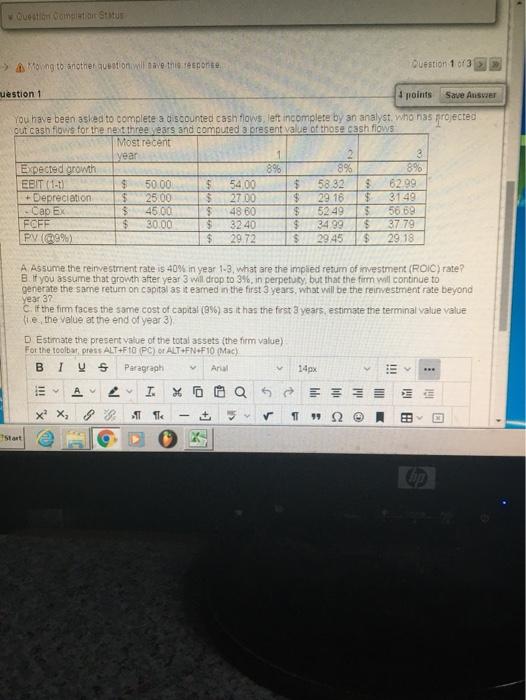

Question: Question come Status -> Moving to another question will tave these porte Question 13 uestion 1 4 points Save Answer cu You have been asked

Question come Status -> Moving to another question will tave these porte Question 13 uestion 1 4 points Save Answer cu You have been asked to complete a discounted cash flows lett incomplete by an analyst, who has projected out cash flows for the next three wears and computed present value of those cash flows Most recent year 1 Expected growth 8% 8% EBIT (1-1) $ 50.00 $ 54.00 $ 58.32 $ 62.99 +Depreciation $ 25.00 $ 27.00 $ 29 16 $ 3149 Cap EX $ 45.00 48.60 $ 52.49 56 69 FOFF $ 30.00 $ 3240 $ 3499 $ 3779 PV (9% $ 29.72 $ 2945 29.18 A Assume the reinvestment rate is 40% in year 1-3, what are the impied return of investment (ROIC) rate? B. If you assume that growth after year 3 will drop to 3%, in perpetuty, but that the firm will continue to generate the same retum on capital as it eamed in the first 3 years, what will be the reinvestment rate beyond Year 32 Cif the tim faces the same cost of capital (9%) as it has the first 3 years, estimate the terminal value value fie, the value at the end of year 3) D Estimate the present value of the total assets (the firm value) For the toolbar, press ALT+F10 PC) OR ALT FN4F10 (Mac) B IVS Paragraph Ana 140x A I Q6 Ini x x x, B & T The 1 9992 PA stat op

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts