Question: Question Completion Status: A Moving to another question will save this response. Question 4 Assume that a single APT factor describes risk and return, and

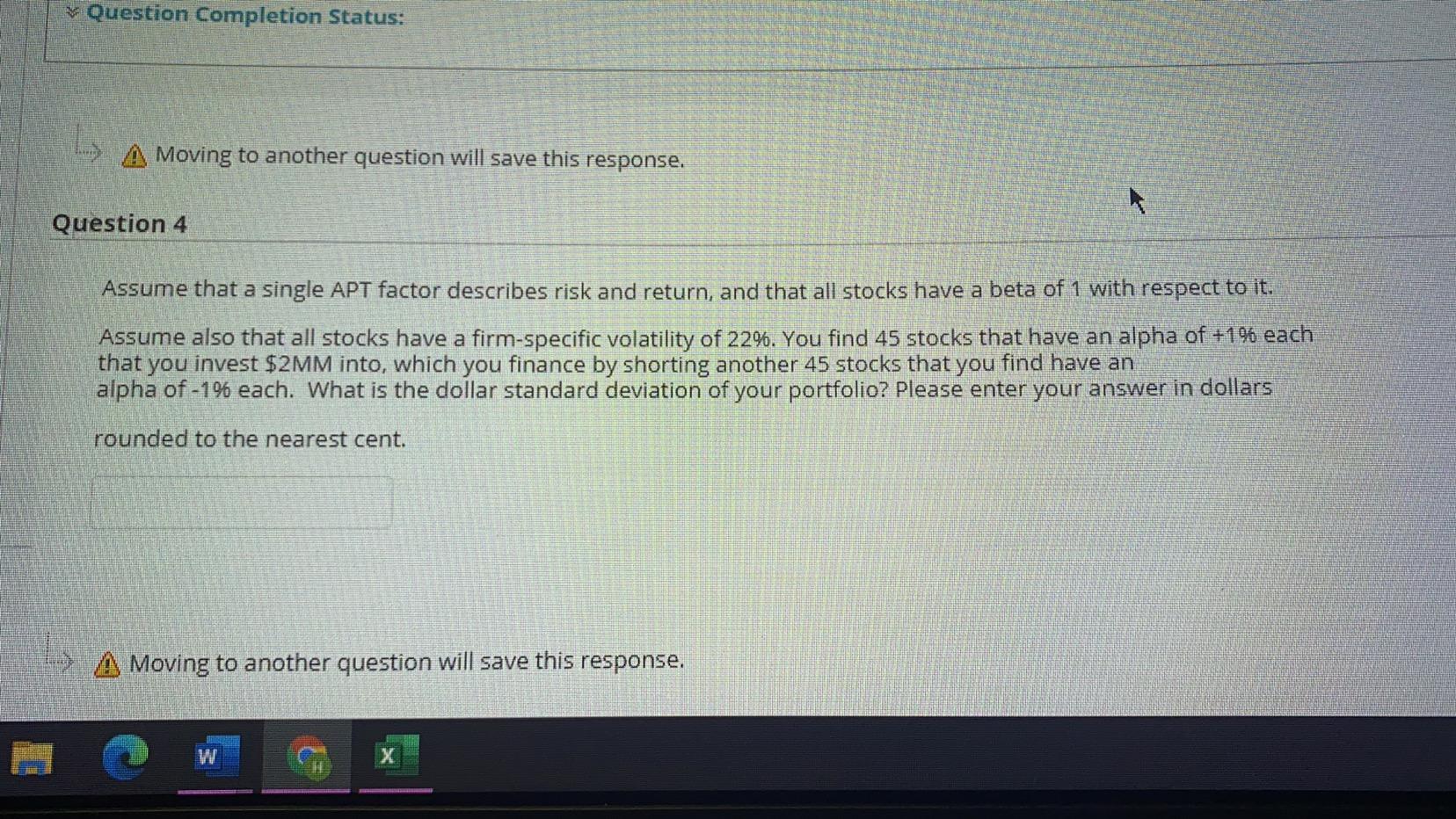

Question Completion Status: A Moving to another question will save this response. Question 4 Assume that a single APT factor describes risk and return, and that all stocks have a beta of 1 with respect to it. Assume also that all stocks have a firm-specific volatility of 22%. You find 45 stocks that have an alpha of +1% each that you invest $2MM into, which you finance by shorting another 45 stocks that you find have an alpha of -1% each. What is the dollar standard deviation of your portfolio? Please enter your answer in dollars rounded to the nearest cent. ) A Moving to another question will save this response. W Question Completion Status: A Moving to another question will save this response. Question 4 Assume that a single APT factor describes risk and return, and that all stocks have a beta of 1 with respect to it. Assume also that all stocks have a firm-specific volatility of 22%. You find 45 stocks that have an alpha of +1% each that you invest $2MM into, which you finance by shorting another 45 stocks that you find have an alpha of -1% each. What is the dollar standard deviation of your portfolio? Please enter your answer in dollars rounded to the nearest cent. ) A Moving to another question will save this response. W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts