Question: Question Completion Status Moving to the next question prevents changes to this answer Quesulon 22 of 37 Question 22 3 points Caren's Cances is considering

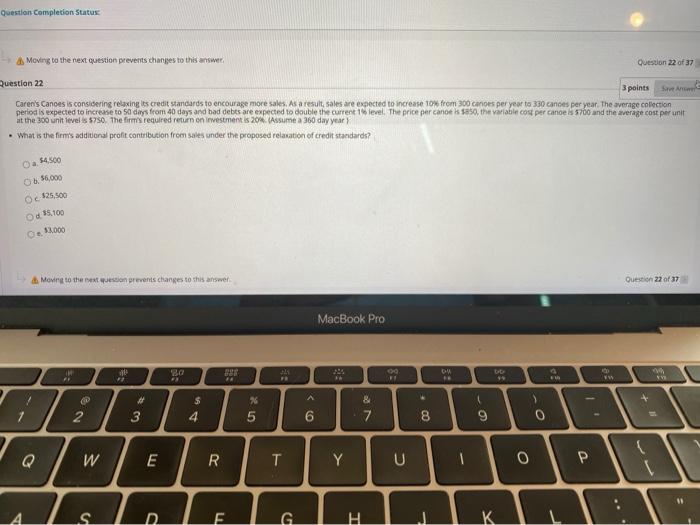

Question Completion Status Moving to the next question prevents changes to this answer Quesulon 22 of 37 Question 22 3 points Caren's Cances is considering relaxing its credit standards to encourage more sales. As a result, sales are expected to increase To from 300 cances per year to 330 cances per year. The average collection period is expected to increase to 50 days from 30 days and bad debts are expected to double the current level. The price per canoe's $350, the variable cost per Canoes 5700 and the average cost per unit at the 300 unit levels 5750. The firm's required return on investment is 20%. Assume a 360 day year . What is the firm's additional profit contribution from sales under the proposed relaxation of credit standards? $4.500 Ob 16.000 O $25.500 Od 15.100 Ge 13.000 Moving to the won grevents changes to this answer Question 22 of 37 MacBook Pro Ba 24 GU w * 22 $ 4 % 5 & 7 2 3 6 8 9 0 Q W E R T Y U 0 P S. E G H

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts