Question: * Question Completion Status: QUESTION 11 4 points Save Answer In December 2020, suppose two parties enter a 1-year interest rate swap to exchange one-year

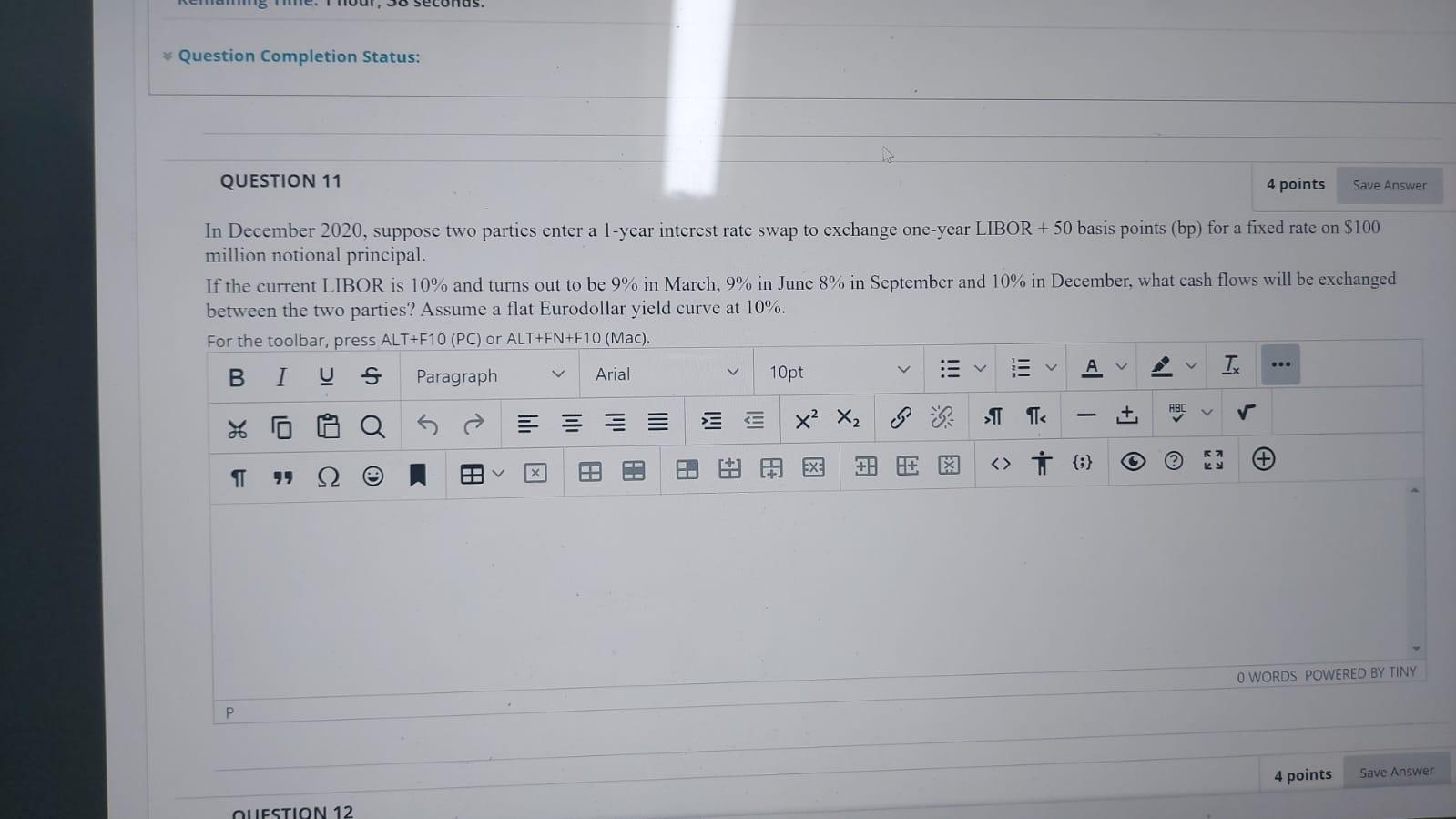

* Question Completion Status: QUESTION 11 4 points Save Answer In December 2020, suppose two parties enter a 1-year interest rate swap to exchange one-year LIBOR + 50 basis points (bp) for a fixed rate on $100 million notional principal. If the current LIBOR is 10% and turns out to be 9% in March, 9% in June 8% in September and 10% in December, what cash flows will be exchanged between the two parties? Assume a flat Eurodollar yield curve at 10%. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). s Paragraph Arial 10pt Ix TIT V TT X2 X 8 +1 ABE O EX: HP + X Ra + 6:} f + 19 C O WORDS POWERED BY TINY 4 points Save Answer QUESTION 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts