Question: Question Completion Status: Question 14 5 points Save Answer a. A 2-year, zero-coupon bond offers 8% per annum while a 1-year, zero coupon bond offers

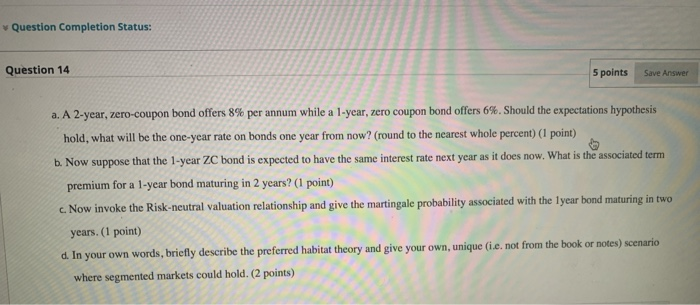

Question Completion Status: Question 14 5 points Save Answer a. A 2-year, zero-coupon bond offers 8% per annum while a 1-year, zero coupon bond offers 6%. Should the expectations hypothesis hold, what will be the one-year rate on bonds one year from now?(round to the nearest whole percent) (1 point) b. Now suppose that the 1-year ZC bond is expected to have the same interest rate next year as it does now. What is the associated term premium for a 1-year bond maturing in 2 years? (1 point) c. Now invoke the Risk-neutral valuation relationship and give the martingale probability associated with the lyear bond maturing in two years. (1 point) d. In your own words, briefly describe the preferred habitat theory and give your own, unique (.e. not from the book or notes) scenario where segmented markets could hold. (2 points) Question Completion Status: Question 14 5 points Save Answer a. A 2-year, zero-coupon bond offers 8% per annum while a 1-year, zero coupon bond offers 6%. Should the expectations hypothesis hold, what will be the one-year rate on bonds one year from now?(round to the nearest whole percent) (1 point) b. Now suppose that the 1-year ZC bond is expected to have the same interest rate next year as it does now. What is the associated term premium for a 1-year bond maturing in 2 years? (1 point) c. Now invoke the Risk-neutral valuation relationship and give the martingale probability associated with the lyear bond maturing in two years. (1 point) d. In your own words, briefly describe the preferred habitat theory and give your own, unique (.e. not from the book or notes) scenario where segmented markets could hold. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts