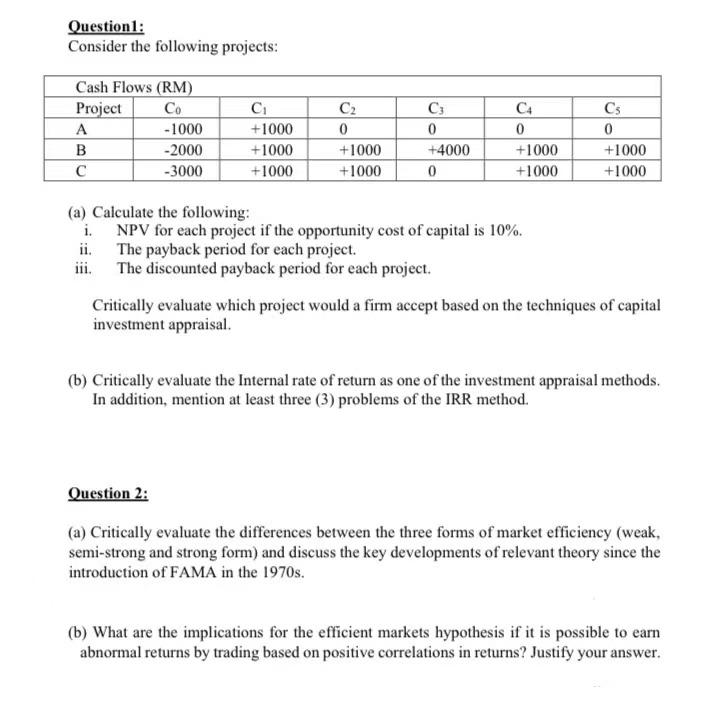

Question: Question: Consider the following projects: C1 Cash Flows (RM) Project Co A -1000 B -2000 -3000 +1000 +1000 +1000 C2 0 +1000 +1000 C; 0

Question: Consider the following projects: C1 Cash Flows (RM) Project Co A -1000 B -2000 -3000 +1000 +1000 +1000 C2 0 +1000 +1000 C; 0 +4000 0 0 +1000 +1000 CS 0 +1000 +1000 (a) Calculate the following: i. NPV for each project if the opportunity cost of capital is 10%. ii. The payback period for each project. iii. The discounted payback period for each project. Critically evaluate which project would a firm accept based on the techniques of capital investment appraisal (b) Critically evaluate the Internal rate of return as one of the investment appraisal methods. In addition, mention at least three (3) problems of the IRR method. Question 2: (a) Critically evaluate the differences between the three forms of market efficiency (weak, semi-strong and strong form) and discuss the key developments of relevant theory since the introduction of FAMA in the 1970s. b) What are the implications for the efficient markets hypothesis if it is possible to earn abnormal returns by trading based on positive correlations in returns? Justify your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts