Question: Question e 1. Consider a firm that exists in a world with two periods (time 0 and time 1) and two equally likely states of

Question e

Question e

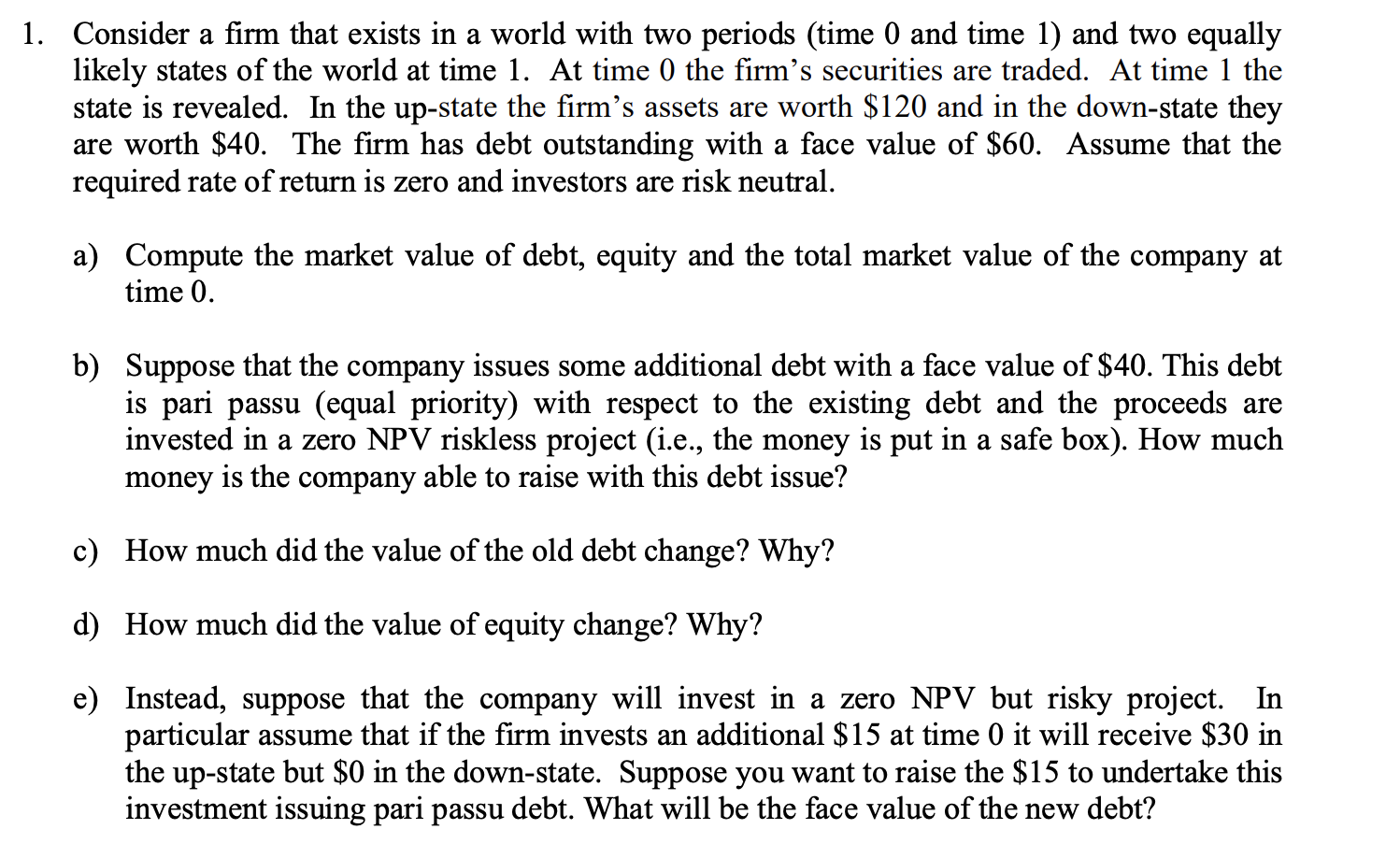

1. Consider a firm that exists in a world with two periods (time 0 and time 1) and two equally likely states of the world at time 1. At time 0 the firm's securities are traded. At time 1 the state is revealed. In the up-state the firm's assets are worth $120 and in the down-state they are worth $40. The firm has debt outstanding with a face value of $60. Assume that the required rate of return is zero and investors are risk neutral. a) Compute the market value of debt, equity and the total market value of the company at time 0. b) Suppose that the company issues some additional debt with a face value of $40. This debt is pari passu (equal priority) with respect to the existing debt and the proceeds are invested in a zero NPV riskless project (i.e., the money is put in a safe box). How much money is the company able to raise with this debt issue? c) How much did the value of the old debt change? Why? d) How much did the value of equity change? Why? e) Instead, suppose that the company will invest in a zero NPV but risky project. In particular assume that if the firm invests an additional $15 at time 0 it will receive $30 in the up-state but $0 in the down-state. Suppose you want to raise the $15 to undertake this investment issuing pari passu debt. What will be the face value of the new debt? 1. Consider a firm that exists in a world with two periods (time 0 and time 1) and two equally likely states of the world at time 1. At time 0 the firm's securities are traded. At time 1 the state is revealed. In the up-state the firm's assets are worth $120 and in the down-state they are worth $40. The firm has debt outstanding with a face value of $60. Assume that the required rate of return is zero and investors are risk neutral. a) Compute the market value of debt, equity and the total market value of the company at time 0. b) Suppose that the company issues some additional debt with a face value of $40. This debt is pari passu (equal priority) with respect to the existing debt and the proceeds are invested in a zero NPV riskless project (i.e., the money is put in a safe box). How much money is the company able to raise with this debt issue? c) How much did the value of the old debt change? Why? d) How much did the value of equity change? Why? e) Instead, suppose that the company will invest in a zero NPV but risky project. In particular assume that if the firm invests an additional $15 at time 0 it will receive $30 in the up-state but $0 in the down-state. Suppose you want to raise the $15 to undertake this investment issuing pari passu debt. What will be the face value of the new debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts