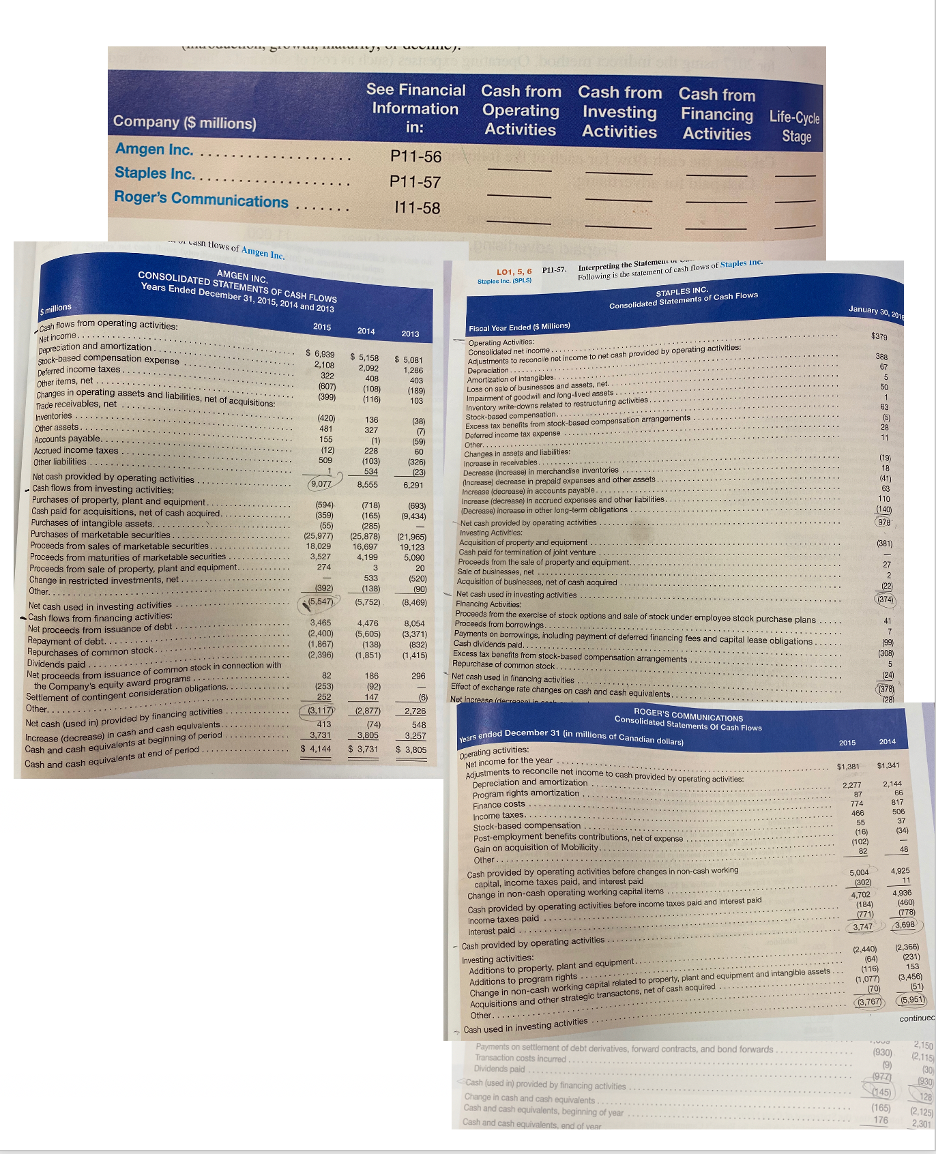

Question: Question E11-39 from Financial Accounting for MBAs 7th edition Using the Company's Statements of cash flows as reported in assignments referenced below. Complete the Table

Question E11-39 from Financial Accounting for MBAs 7th edition

Using the Company's Statements of cash flows as reported in assignments referenced below. Complete the Table to indicate the sign of the cash flow (exam + - +) and identify the companys life cycle stage

Company ($ millions) Amgen Inc. Staples Inc. ... Roger's Communications ....... See Financial Cash from Cash from Cash from Information Operating Investing Financing Life-Cycle in: Activities Activities Activities Stage P11-56 P11-57 111-58 - Lantlows of Amgen Inc. AMGEN INC. CONSOLIDATED STATEMENTS OF CASH FLOWS Years Ended December 31, 2015, 2014 and 2013 LO1, 5, 6 PU-S7 toplore SPA Interpreting the Statement Hallowing is the statement of cash flows of Staples Inc STAPLES INC. Consolidated Statements of Cash Flowa smilions January 30, 2017 2015 2014 2013 $275 $ 6,899 2,102 322 1807) (399) $ 5,158 2.092 403 (109) (116) $ 5.081 1.286 403 (189) 10S 328 07 5 50 1 89 (420) 28 11 481 155 (12) 509 136 327 (1) 228 (103) 534 8.565 381 (7) 1591 50 (326) 123 6.291 (9,077 shows from operating activities: Net income................... Depreciation and amortization. Stock-based compensation expenso Deferred income taxes . . . . Other items, net .......................... Changes in operating assets and liabilities, net of acquisitions Trade receivables, net ...... Inventories....... Other assets..... Accounts payable. Accrued income taxes Other liabilities ...... Net cash provided by operating activities Cash flows from investing activities: Purchases of property, plant and equipment Cash paid for acquisitions, not of cash acquired Purchases of intangible assets............ Purchases of marketable securities........ Proceeds from sales of marketable Securities Proceeds from maturities of marketable securities Proceeds from sale of property, plant and equipment. Change in restricted investments, net Other..... Net cash used in investing activities - Cash flows from financing activities: Nat proceeds from issuance of debt Repayment of debt........... Repurchases of common stock. Dividends paid. Fiscal Year Ended (5 Millions) Operating Activities: Consolidated net income...... Austments to reconcile not income to net cash provided by operating Activities Depreciation... Amortization of Intangibles Lose on aslo of businesses and assets, net. Impairment of goodwill and long-lived sets Inventory write-downs related to restructuring clities -based compensation................... Excess tax benefits from stock-based compensation arrangements Datorred income tax expense ...... Other...................... Changes in assets and liabilities: Increase in receivables............. Decrease increase in merchandise inventories ... (Increasej decrease in prepaid expenses and other assets Increaso decrease in accounts payable............. Increase (decrease in accrued expenses and other labilities Decrease) increase in other long-term obligations Net cash provided by operating activities........ Investing Activities: Acquisition of property and equipment.. Cash paid for temination of joint venture Proceeds from the sale of property and equipment Sale of busines999, net .................. Acquisition of businesses, net of cash acquired Net cash used in investing activities Financing Activities Proceeds from the exercise of stock options and sale of stock under er ployee stock purchase plans Proceeds from borrowings Payments on borrowings, including payment of deferred financing fees and capital lase obligations. da. Cash didends paid............................................ Excess tax benefit from stock-based compensation arrangements Repurchase of common stock 119 18 (411 63 110 (140 92 (693) 15M) (359) (55) (25,977) 18,029 3,527 274 (718) (165) (285) 125,878) 16,697 4,199 (381) 27 121,965) 19.123 5,090 20 (520) 190) (8,469) 1992 (5,547) 533 (138) (5,752) 122 1274 3,465 (2,400) (1,887) 4,476 15,605) (138) (1,851) 3,064 13,371) 1832) (1,415) 12.9961 41 7 199 305) 5 124) ((3781 1281 296 188 192) 147 12,877) 82 253) 252 (3,117) ) 413 3,731 $ 4,144 Netch used in froncing activities ..... Effect of exchange rate changes on cash and cash equivalents Net Incideco ROGER'S COMMUNICATIONS Consolidated Statements of Cash Flows Other...-..--. Net proceeds from issuance of common stock in connection with the Company's equity award programs Settlement of contingent consideration obligations.. Net cash (used in provided by financing activities Increase (cecrease in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period 18) 2.726 548 3.257 $ 3,805 3,805 $ 3,731 years ended December 31 (in millions of Canadian dollars 2015 2014 Operating activities Not income for the year ................. Adjustments to reconcile net income to cash provided by operating activities $1,381 $1.341 Depreciation and amortization .................. Program rights amortization...................... 2.277 774 486 55 (16) (102) 82 2,144 FA 817 506 37 (34) 40 Finance costs Income taxes...................... Stock-based compensation Post-employment benefits contributions, net of expense . Gain on acquisition of Mobilicily................ Other.................................. Cash provided by operating activities before changes in non-cash working capital, income taxes paid, and interest paid Change in non-cash operating working capital items ....................... Cash provided by operating activities before income taxes paid and Interest paid Income taxes paid ............... Interest paid ....... - Cash provided by operating activities....... Investing activities: Additions to property, plant and equipment. Additions to program rights ... Change in non-cash working capital related to property, plant and equipment and intangible assets 5,004 4.925 (302 11 4,702 4936 (184) (460) ) (771) (778) 3.747 3,693 (2.440) 164 (115) (1.077 1701 (3,767 12.355) (231) 153 13.456) 151) (5.961) Acquisitions and other strategic transactons, net of cash acquired Other.................................. Cash used in Investing activities ........... continued Payments on settlement of debt derivatives, forward contracts, and bond forwards Transaction costs incurred Dividends paid... . Cash used in provided by financing activities Change in cash and cash equivalents Cash and cash equivalents, beginning of your Cash and cash equivalents, and of war 1930) 19) 1977 2.150 12,115 30 1930 MAS (165) 176 2.125 2.301 Company ($ millions) Amgen Inc. Staples Inc. ... Roger's Communications ....... See Financial Cash from Cash from Cash from Information Operating Investing Financing Life-Cycle in: Activities Activities Activities Stage P11-56 P11-57 111-58 - Lantlows of Amgen Inc. AMGEN INC. CONSOLIDATED STATEMENTS OF CASH FLOWS Years Ended December 31, 2015, 2014 and 2013 LO1, 5, 6 PU-S7 toplore SPA Interpreting the Statement Hallowing is the statement of cash flows of Staples Inc STAPLES INC. Consolidated Statements of Cash Flowa smilions January 30, 2017 2015 2014 2013 $275 $ 6,899 2,102 322 1807) (399) $ 5,158 2.092 403 (109) (116) $ 5.081 1.286 403 (189) 10S 328 07 5 50 1 89 (420) 28 11 481 155 (12) 509 136 327 (1) 228 (103) 534 8.565 381 (7) 1591 50 (326) 123 6.291 (9,077 shows from operating activities: Net income................... Depreciation and amortization. Stock-based compensation expenso Deferred income taxes . . . . Other items, net .......................... Changes in operating assets and liabilities, net of acquisitions Trade receivables, net ...... Inventories....... Other assets..... Accounts payable. Accrued income taxes Other liabilities ...... Net cash provided by operating activities Cash flows from investing activities: Purchases of property, plant and equipment Cash paid for acquisitions, not of cash acquired Purchases of intangible assets............ Purchases of marketable securities........ Proceeds from sales of marketable Securities Proceeds from maturities of marketable securities Proceeds from sale of property, plant and equipment. Change in restricted investments, net Other..... Net cash used in investing activities - Cash flows from financing activities: Nat proceeds from issuance of debt Repayment of debt........... Repurchases of common stock. Dividends paid. Fiscal Year Ended (5 Millions) Operating Activities: Consolidated net income...... Austments to reconcile not income to net cash provided by operating Activities Depreciation... Amortization of Intangibles Lose on aslo of businesses and assets, net. Impairment of goodwill and long-lived sets Inventory write-downs related to restructuring clities -based compensation................... Excess tax benefits from stock-based compensation arrangements Datorred income tax expense ...... Other...................... Changes in assets and liabilities: Increase in receivables............. Decrease increase in merchandise inventories ... (Increasej decrease in prepaid expenses and other assets Increaso decrease in accounts payable............. Increase (decrease in accrued expenses and other labilities Decrease) increase in other long-term obligations Net cash provided by operating activities........ Investing Activities: Acquisition of property and equipment.. Cash paid for temination of joint venture Proceeds from the sale of property and equipment Sale of busines999, net .................. Acquisition of businesses, net of cash acquired Net cash used in investing activities Financing Activities Proceeds from the exercise of stock options and sale of stock under er ployee stock purchase plans Proceeds from borrowings Payments on borrowings, including payment of deferred financing fees and capital lase obligations. da. Cash didends paid............................................ Excess tax benefit from stock-based compensation arrangements Repurchase of common stock 119 18 (411 63 110 (140 92 (693) 15M) (359) (55) (25,977) 18,029 3,527 274 (718) (165) (285) 125,878) 16,697 4,199 (381) 27 121,965) 19.123 5,090 20 (520) 190) (8,469) 1992 (5,547) 533 (138) (5,752) 122 1274 3,465 (2,400) (1,887) 4,476 15,605) (138) (1,851) 3,064 13,371) 1832) (1,415) 12.9961 41 7 199 305) 5 124) ((3781 1281 296 188 192) 147 12,877) 82 253) 252 (3,117) ) 413 3,731 $ 4,144 Netch used in froncing activities ..... Effect of exchange rate changes on cash and cash equivalents Net Incideco ROGER'S COMMUNICATIONS Consolidated Statements of Cash Flows Other...-..--. Net proceeds from issuance of common stock in connection with the Company's equity award programs Settlement of contingent consideration obligations.. Net cash (used in provided by financing activities Increase (cecrease in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period 18) 2.726 548 3.257 $ 3,805 3,805 $ 3,731 years ended December 31 (in millions of Canadian dollars 2015 2014 Operating activities Not income for the year ................. Adjustments to reconcile net income to cash provided by operating activities $1,381 $1.341 Depreciation and amortization .................. Program rights amortization...................... 2.277 774 486 55 (16) (102) 82 2,144 FA 817 506 37 (34) 40 Finance costs Income taxes...................... Stock-based compensation Post-employment benefits contributions, net of expense . Gain on acquisition of Mobilicily................ Other.................................. Cash provided by operating activities before changes in non-cash working capital, income taxes paid, and interest paid Change in non-cash operating working capital items ....................... Cash provided by operating activities before income taxes paid and Interest paid Income taxes paid ............... Interest paid ....... - Cash provided by operating activities....... Investing activities: Additions to property, plant and equipment. Additions to program rights ... Change in non-cash working capital related to property, plant and equipment and intangible assets 5,004 4.925 (302 11 4,702 4936 (184) (460) ) (771) (778) 3.747 3,693 (2.440) 164 (115) (1.077 1701 (3,767 12.355) (231) 153 13.456) 151) (5.961) Acquisitions and other strategic transactons, net of cash acquired Other.................................. Cash used in Investing activities ........... continued Payments on settlement of debt derivatives, forward contracts, and bond forwards Transaction costs incurred Dividends paid... . Cash used in provided by financing activities Change in cash and cash equivalents Cash and cash equivalents, beginning of your Cash and cash equivalents, and of war 1930) 19) 1977 2.150 12,115 30 1930 MAS (165) 176 2.125 2.301

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts