Question: question: Formulate an LP model for this case The Wolverine Retirement Fund Kelly Jones is a financial analyst for Wolverine Manufacturing, a company that produces

question: Formulate an LP model for this case

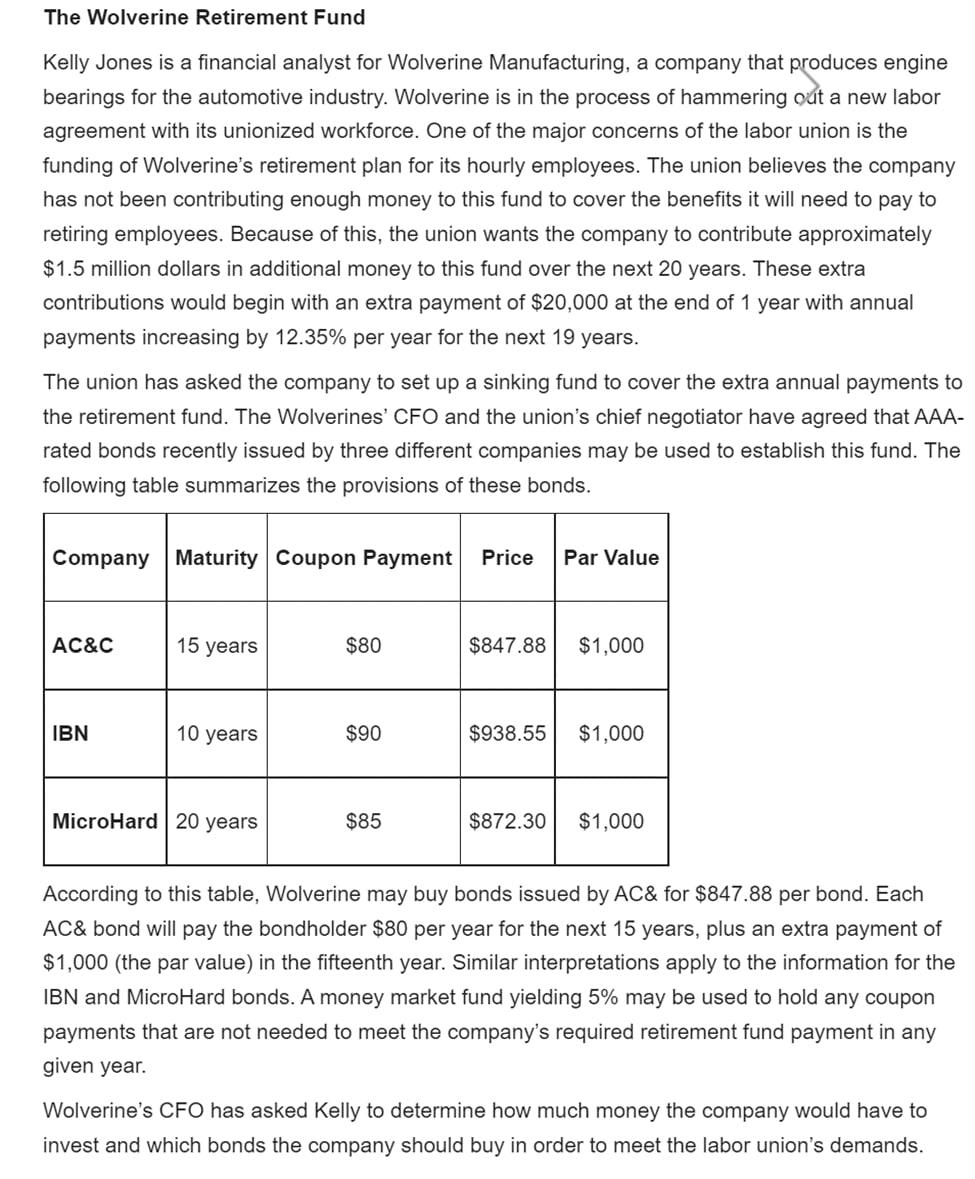

The Wolverine Retirement Fund Kelly Jones is a financial analyst for Wolverine Manufacturing, a company that produces engine bearings for the automotive industry. Wolverine is in the process of hammering cat a new labor agreement with its unionized workforce. One of the major concerns of the labor union is the funding of Wolverine's retirement plan for its hourly employees. The union believes the company has not been contributing enough money to this fund to cover the benefits it will need to pay to retiring employees. Because of this, the union wants the company to contribute approximately $1.5 million dollars in additional money to this fund over the next 20 years. These extra contributions would begin with an extra payment of $20,000 at the end of 1 year with annual payments increasing by 12.35% per year for the next 19 years. The union has asked the company to set up a sinking fund to cover the extra annual payments to the retirement fund. The Wolverines' CFO and the union's chief negotiator have agreed that AAArated bonds recently issued by three different companies may be used to establish this fund. The following table summarizes the provisions of these bonds. According to this table, Wolverine may buy bonds issued by AC& for $847.88 per bond. Each AC\& bond will pay the bondholder $80 per year for the next 15 years, plus an extra payment of $1,000 (the par value) in the fifteenth year. Similar interpretations apply to the information for the IBN and MicroHard bonds. A money market fund yielding 5% may be used to hold any coupon payments that are not needed to meet the company's required retirement fund payment in any given year. Wolverine's CFO has asked Kelly to determine how much money the company would have to invest and which bonds the company should buy in order to meet the labor union's demandsStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock