Question: Strummer Plc is currently trying to calculate its weighted average cost of capital. As the company's finance director, you have been asked to perform the

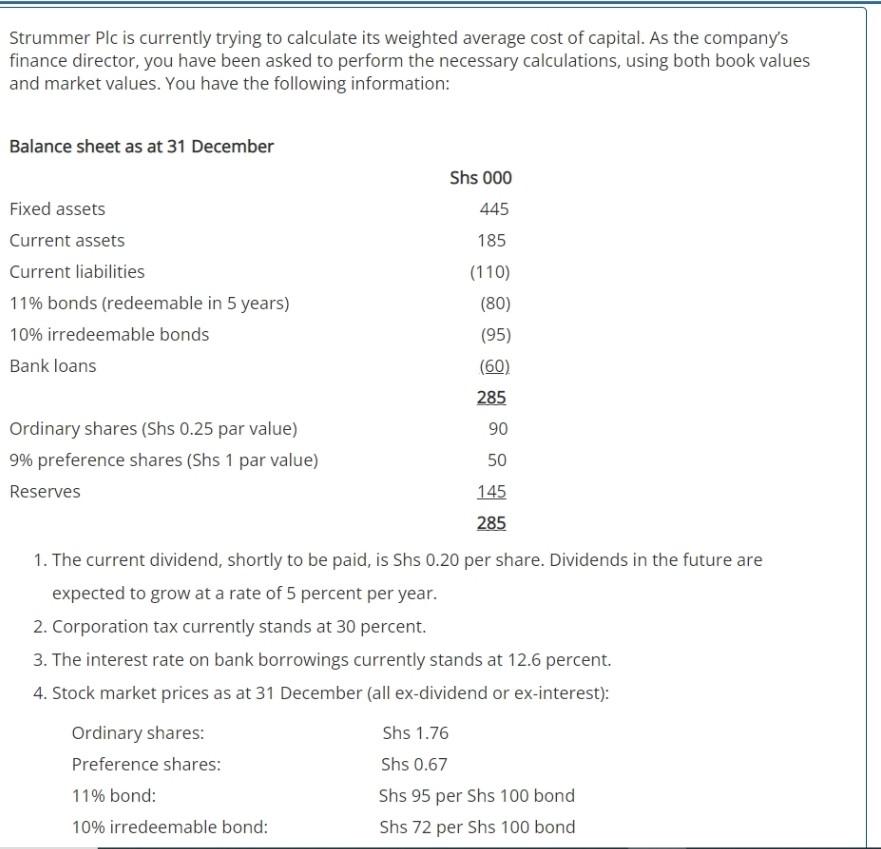

Strummer Plc is currently trying to calculate its weighted average cost of capital. As the company's finance director, you have been asked to perform the necessary calculations, using both book values and market values. You have the following information: Balance sheet as at 31 December Shs 000 445 185 Fixed assets Current assets Current liabilities 11% bonds (redeemable in 5 years) 10% irredeemable bonds Bank loans (110) (80) (95) (60) 285 90 Ordinary shares (Shs 0.25 par value) 9% preference shares (Shs 1 par value) Reserves 50 145 285 1. The current dividend, shortly to be paid, is Shs 0.20 per share. Dividends in the future are expected to grow at a rate of 5 percent per year. 2. Corporation tax currently stands at 30 percent. 3. The interest rate on bank borrowings currently stands at 12.6 percent. 4. Stock market prices as at 31 December (all ex-dividend or ex-interest): Ordinary shares: Shs 1.76 Preference shares: Shs 0.67 11% bond: Shs 95 per Shs 100 bond 10% irredeemable bond: Shs 72 per Shs 100 bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts