Question: Question Help Problem 8-4 (algorithmic) The Smiths save $48,000 per year for retirement. They are now in their mid-thirties, and they expect to have $2

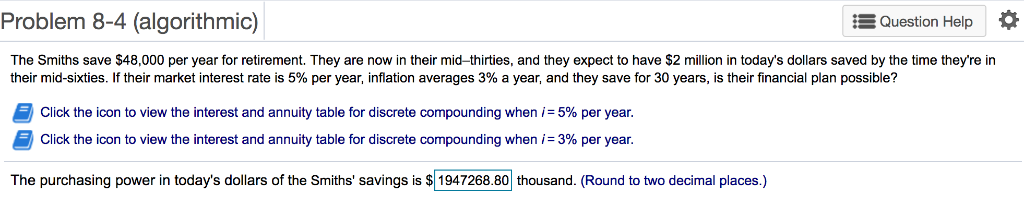

Question Help Problem 8-4 (algorithmic) The Smiths save $48,000 per year for retirement. They are now in their mid-thirties, and they expect to have $2 million in today's dollars saved by the time they're in their mid-sixties. If their market interest rate is 5% per year, inflation averages 3% a year, and they save for 30 years, is their financial plan possible? Click the icon to view the interest and annuity table for discrete compounding when i -5% per year. Click the icon to view the interest and annuity table for discrete compounding when is 3% per year The purchasing power in today's dollars of the Smiths' savings is $ 1947268.80 thousand. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts