Question: QUESTION Materiality Overall Materiality Prior Year's Materiality (use the same basis as you have determined for the current year) 2. Calculation of overall materiality Materiality

QUESTION

Materiality

- Overall Materiality

Prior Year's Materiality (use the same basis as you have determined for the current year)

2. Calculation of overall materiality

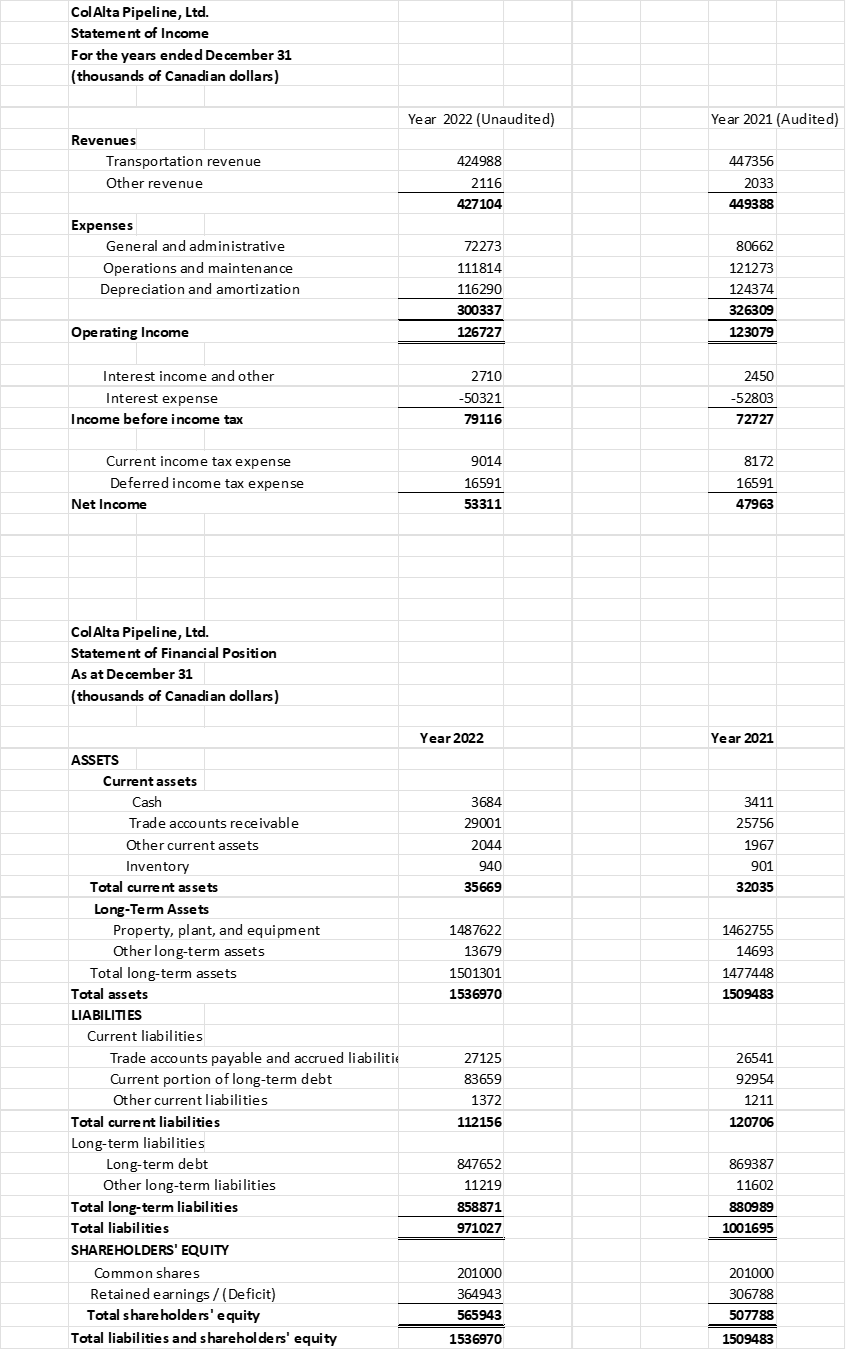

| Materiality Benchmark | Benchmark applied | Explanations | |

| Net Income | 3% to 7% of pre-tax "normalized" net income | ||

| Gross Revenue | 1% to 3% of revenue | ||

| Total Assets | 1% to 3% of Total Assets | ||

| Equity | 3% to 5% of Equity |

Recommendation

| Amount | Reasoning for why selected |

|

|

3. Calculation of performance materiality

B. Performance Materiality

Set performance materiality at an amount based upon, but lower than, overall materiality (between 60 percent and 85 percent of overall materiality). Use professional judgment about expectations of misstatements that could arise in the current period. Consider the business and fraud risks identified, the results of performing risk assessment procedures, and the nature/extent of misstatements in prior audits.

| Amount ($ 000's) | Rationale | Explanation | |

| Previous Period | |||

| Preliminary |

4. Trivial misstatements

This is an amount below which misstatements would be clearly trivial and not recorded on the summary of audit differences: $ (thousands of Canadian dollars) Note: In practice, the trivial amount is between 1% and 5% of materiality.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts