Question: Question. Monet Industries currently does not pay a dividend but expects to pay a dividend of $1.70 next year. Thereafter, the dividend is expected to

Question.

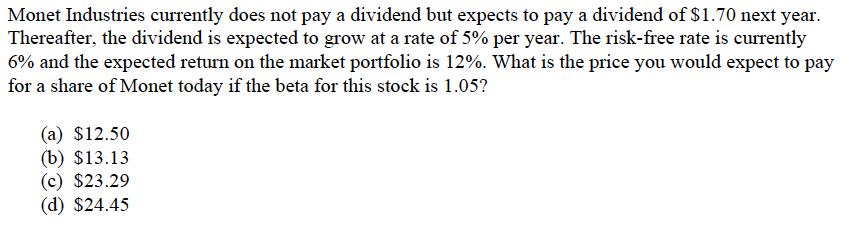

Monet Industries currently does not pay a dividend but expects to pay a dividend of $1.70 next year. Thereafter, the dividend is expected to grow at a rate of 5% per year. The risk-free rate is currently 6% and the expected return on the market portfolio is 12%. What is the price you would expect to pay for a share of Monet today if the beta for this stock is 1.05? (a) $12.50 (b) $13.13 (c) $23.29 (d) $24.45

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

ANSWER Step 1 Calculation of cost of equity using Capital Asset Pricing Model Cost of Equ... View full answer

Get step-by-step solutions from verified subject matter experts