Question: Question no 2 Solvethe case study: Suppose afirm will need $100000 20 years from now to replace some equipment.itplans to make 20 equal payments,

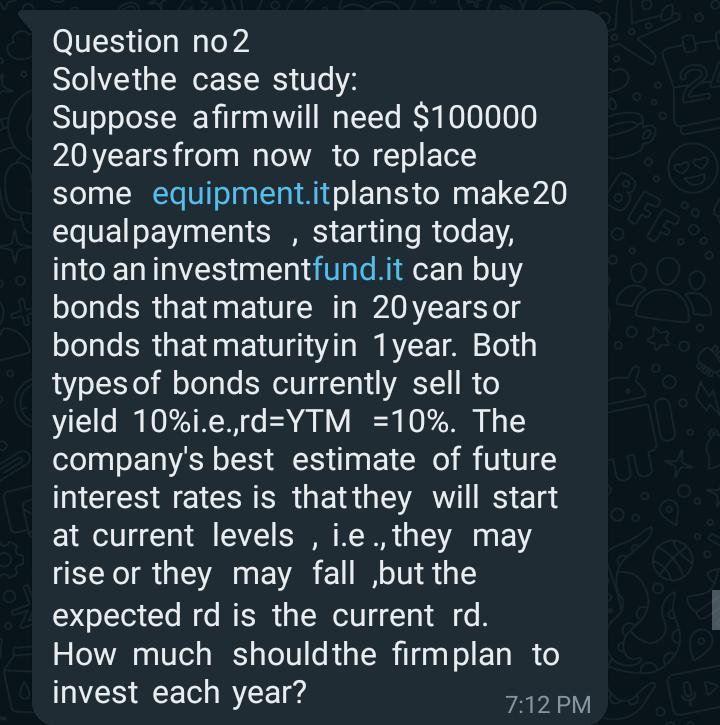

Question no 2 Solvethe case study: Suppose afirm will need $100000 20 years from now to replace some equipment.itplans to make 20 equal payments, starting today, into an investmentfund.it can buy bonds that mature in 20 years or bonds that maturity in 1 year. Both types of bonds currently sell to yield 10%i.e.,rd=YTM = 10%. The company's best estimate of future interest rates is that they will start at current levels, i.e., they may rise or they may fall ,but the expected rd is the current rd. How much should the firm plan to invest each year? 7:12 PM 24 BFF 10%

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

The firm should plan to invest ... View full answer

Get step-by-step solutions from verified subject matter experts