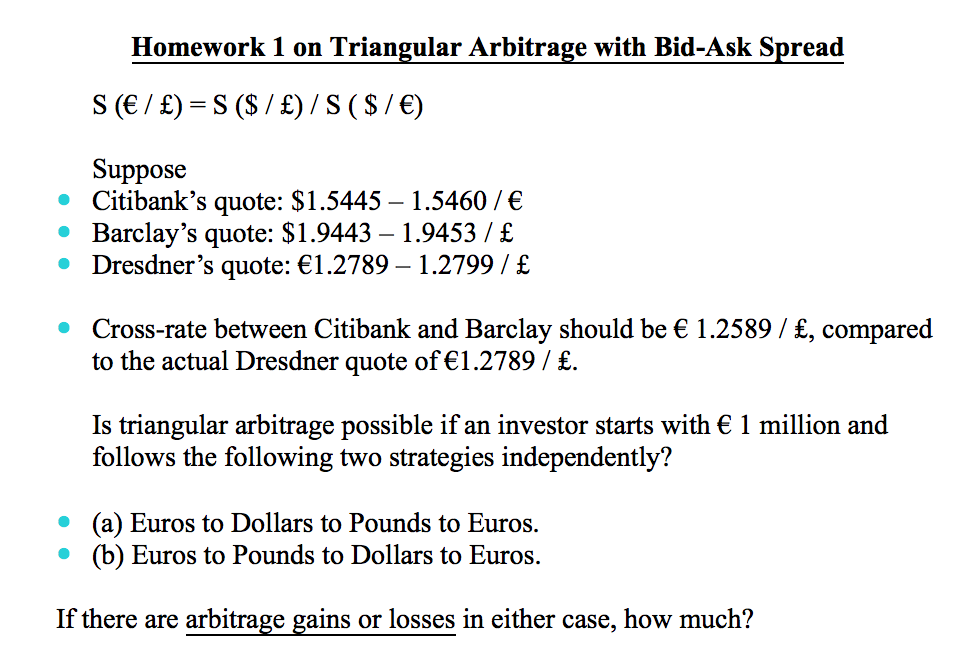

Question: Question on Triangular Arbitrage with Bid-Ask Spread? Homework 1 on Triangular Arbitrage with Bid-Ask Spread Suppose Citibank's quote: $1.5445 1.5460/ Barclay's quote: $1.9443-1.9453 / Dresdner's

Question on Triangular Arbitrage with Bid-Ask Spread?

Homework 1 on Triangular Arbitrage with Bid-Ask Spread Suppose Citibank's quote: $1.5445 1.5460/ Barclay's quote: $1.9443-1.9453 / Dresdner's quote: 1.2789 - 1.2799/ Cross-rate between Citibank and Barclay should be to the actual Dresdner quote of1.2789 / 1.2589 / , compared Is triangular arbitrage possible if an investor starts with follows the following two strategies independently? 1 million and (a) Euros to Dollars to Pounds to Euros. (b) Euros to Pounds to Dollars to Euros. If there are arbitrage gains or losses in either case, how much

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts