Question: show work thanks Homework 1 on Triangular Arbitrage with Bid-Ask Spread Suppose * Citibank's quote: $1.5445-1.5460/ Barclay's quote: $1.9443-1.9453/ Dresdner's quote: 1.2789-1.2799/ Cross-rate between Citibank

show work thanks

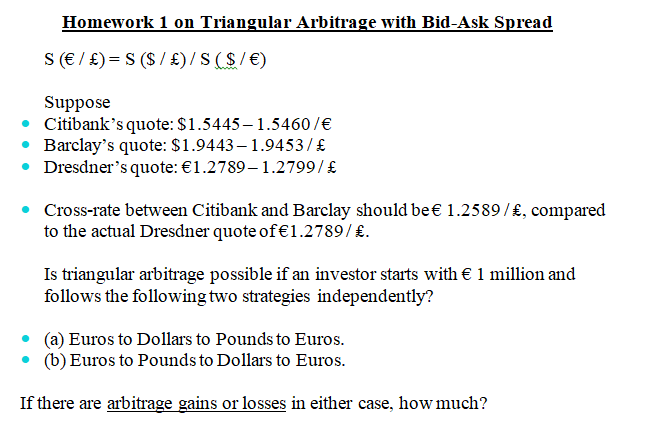

Homework 1 on Triangular Arbitrage with Bid-Ask Spread Suppose * Citibank's quote: $1.5445-1.5460/ Barclay's quote: $1.9443-1.9453/ Dresdner's quote: 1.2789-1.2799/ Cross-rate between Citibank and Barclay should be1.2589/E, compared to the actual Dresdner quote of1.2789/E. Is triangular arbitrage possible if an investor starts with follows the following two strategies independently? 1 million and (a) Euros to Dollars to Pounds to Euros. (b) Euros to Pounds to Dollars to Euros. . If there are arbitrage gains or losses in either case, how much

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts