Question: QUESTION ONE a) A risk neutral expected utility maximiser is facing an investment opportunity, which is a risky project. Her utility, u(v) is a function

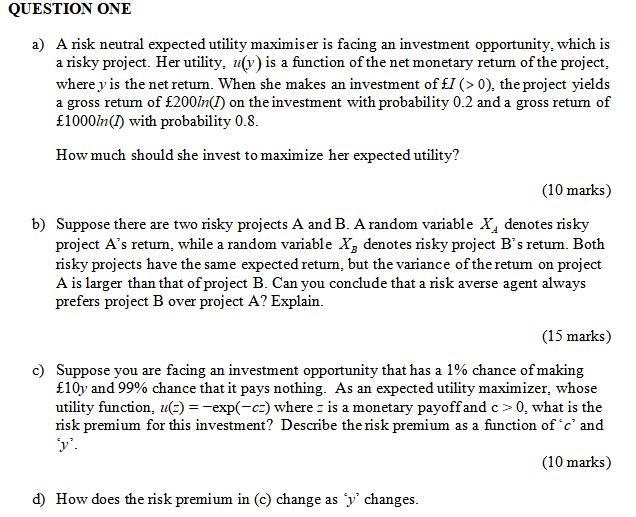

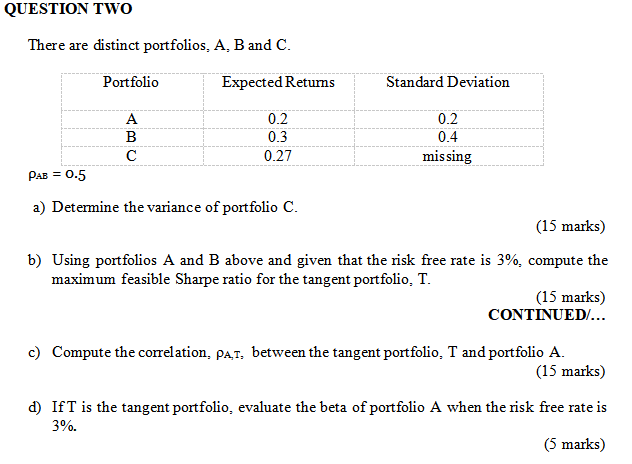

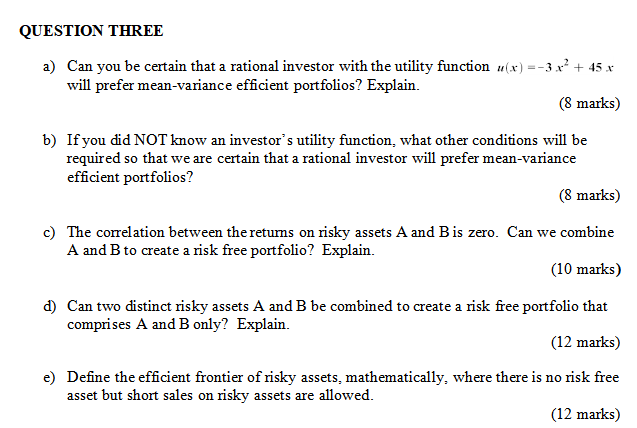

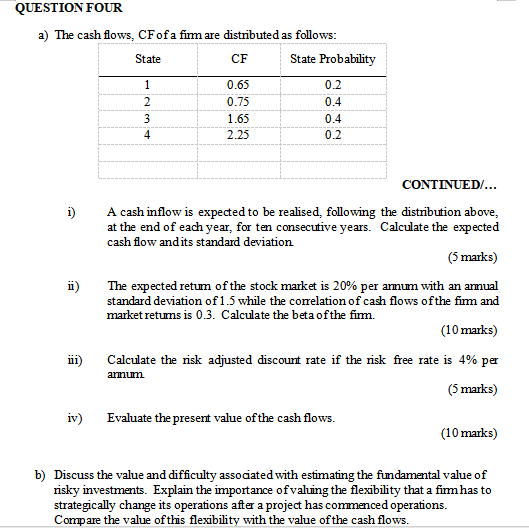

QUESTION ONE a) A risk neutral expected utility maximiser is facing an investment opportunity, which is a risky project. Her utility, u(v) is a function of the net monetary returm of the project, where y is the net returm. When she makes an investment of I (>0), the project yields a gross return of 200ln() on the investment with probability 0.2 and a gross return of 1000In() with probability 0.8. How much should she invest to maximize her expected utility? (10 marks) b) Suppose there are two risky projects A and B. A random variable X, denotes risky project A's returm, while a random variable Xg denotes risky project B's return. Both risky projects have the same expected return, but the variance of the return on project A is larger than that of project B. Can you conclude that a risk averse agent always prefers project B over project A? Explain. (15 marks) c) Suppose you are facing an investment opportunity that has a 1% chance ofmaking 1 Ov and 99% chance that it pays nothing. As an expected utility maximizer, whose utility function,uexp) where is a monetary payoff and c>0, what is the risk premium for his investment? Describe the risk premium as a function of 'e' and (10 marks) d) How does the risk premium in (c) change as 'y' changes. QUESTION TWO There are distinct portfolios, A, B and C Portfolio Expected Returms Standard Deviation 0.2 0.2 0.3 0.4 0.27 missing 0.5 a) Determine the variance of portfolio Q (15 marks) b) Using portfolios A and B above and given that the risk free rate is 3%, compute the maximum feasible Sharpe ratio for the tangent portfolio, T (15 marks) CONTINUED c) Compute the corelation, pAT, between the tangent portfolio, T and portfolio A (15 marks) d) If T is the tangent portfolio, evaluate the beta of portfolio A when the risk free rate is 390. (5 marks) QUESTION THREE a) Can you be certain that a rational investor with the utility function u(x) --3**+45.x will prefer mean-variance efficient porttolios! Explain. (8 marks) b) If you did NOT know an investor's utility function, what other conditions will be required so that we are certain that a rational investor will prefer mean-variance efficient portfolios? (8 marks) c) The corelation between the retums on risky assets A and Bis zero. Can we combine A and B to create a risk free portfolio? Explain. (10 marks) d) Can two distinct risky assets A and B be combined to create a risk free portfolio that comprises A and B only? Explain. (12 marks) e) Define the efficient frontier of risky assets, mathematically, where there is no risk free asset but short sales on risky assets are allowed. (12 marks) QUESTION FOUR a) The cash flows, CF ofa firm are distributed as follows State CF State Probability 0.65 0.2 0.75 0.4 1.65 2.25 0.4 CONTINUED. i A cash inflow is expected to be realised, following the distribution above, at the end of each year, for ten consecutive years. cash flow andits standard deviation Calculate the expected (5 marks) i) The expected retum of the stock market is 20% per annum with an annual standard deviation of1.5 while the correlationof cash flows ofthe fim and market retums is 0.3. Calculate the beta ofthe finm. (10 marks) ii) Calculate the risk adjusted discount rate if the nsk free rate is 4% per armum (5 marks) iv) Evaluate the present value of the cash flows. (10 marks) b) Discuss the value and dificulty associated with estimating the fundamental value of isky investments. Explain the importance ofvaluing the flexibility that a firmhas to strategically change its operations after a project has commenced operations. Compare the value of this flexibility with the value ofthe cash flows QUESTION ONE a) A risk neutral expected utility maximiser is facing an investment opportunity, which is a risky project. Her utility, u(v) is a function of the net monetary returm of the project, where y is the net returm. When she makes an investment of I (>0), the project yields a gross return of 200ln() on the investment with probability 0.2 and a gross return of 1000In() with probability 0.8. How much should she invest to maximize her expected utility? (10 marks) b) Suppose there are two risky projects A and B. A random variable X, denotes risky project A's returm, while a random variable Xg denotes risky project B's return. Both risky projects have the same expected return, but the variance of the return on project A is larger than that of project B. Can you conclude that a risk averse agent always prefers project B over project A? Explain. (15 marks) c) Suppose you are facing an investment opportunity that has a 1% chance ofmaking 1 Ov and 99% chance that it pays nothing. As an expected utility maximizer, whose utility function,uexp) where is a monetary payoff and c>0, what is the risk premium for his investment? Describe the risk premium as a function of 'e' and (10 marks) d) How does the risk premium in (c) change as 'y' changes. QUESTION TWO There are distinct portfolios, A, B and C Portfolio Expected Returms Standard Deviation 0.2 0.2 0.3 0.4 0.27 missing 0.5 a) Determine the variance of portfolio Q (15 marks) b) Using portfolios A and B above and given that the risk free rate is 3%, compute the maximum feasible Sharpe ratio for the tangent portfolio, T (15 marks) CONTINUED c) Compute the corelation, pAT, between the tangent portfolio, T and portfolio A (15 marks) d) If T is the tangent portfolio, evaluate the beta of portfolio A when the risk free rate is 390. (5 marks) QUESTION THREE a) Can you be certain that a rational investor with the utility function u(x) --3**+45.x will prefer mean-variance efficient porttolios! Explain. (8 marks) b) If you did NOT know an investor's utility function, what other conditions will be required so that we are certain that a rational investor will prefer mean-variance efficient portfolios? (8 marks) c) The corelation between the retums on risky assets A and Bis zero. Can we combine A and B to create a risk free portfolio? Explain. (10 marks) d) Can two distinct risky assets A and B be combined to create a risk free portfolio that comprises A and B only? Explain. (12 marks) e) Define the efficient frontier of risky assets, mathematically, where there is no risk free asset but short sales on risky assets are allowed. (12 marks) QUESTION FOUR a) The cash flows, CF ofa firm are distributed as follows State CF State Probability 0.65 0.2 0.75 0.4 1.65 2.25 0.4 CONTINUED. i A cash inflow is expected to be realised, following the distribution above, at the end of each year, for ten consecutive years. cash flow andits standard deviation Calculate the expected (5 marks) i) The expected retum of the stock market is 20% per annum with an annual standard deviation of1.5 while the correlationof cash flows ofthe fim and market retums is 0.3. Calculate the beta ofthe finm. (10 marks) ii) Calculate the risk adjusted discount rate if the nsk free rate is 4% per armum (5 marks) iv) Evaluate the present value of the cash flows. (10 marks) b) Discuss the value and dificulty associated with estimating the fundamental value of isky investments. Explain the importance ofvaluing the flexibility that a firmhas to strategically change its operations after a project has commenced operations. Compare the value of this flexibility with the value ofthe cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts