Question: a) A risk neutral expected utility maximiser is facing an investment opportunity, which is a risky project. Her utility, u(y) is a function of

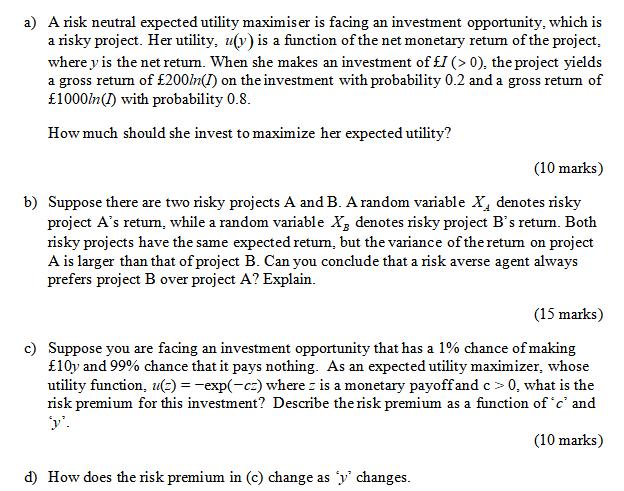

a) A risk neutral expected utility maximiser is facing an investment opportunity, which is a risky project. Her utility, u(y) is a function of the net monetary return of the project. where y is the net return. When she makes an investment of / (>0), the project yields a gross return of 200/n() on the investment with probability 0.2 and a gross return of 1000/n() with probability 0.8. How much should she invest to maximize her expected utility? (10 marks) b) Suppose there are two risky projects A and B. A random variable X, denotes risky project A's return, while a random variable X, denotes risky project B's return. Both risky projects have the same expected return, but the variance of the return on project A is larger than that of project B. Can you conclude that a risk averse agent always prefers project B over project A? Explain. (15 marks) c) Suppose you are facing an investment opportunity that has a 1% chance of making 10y and 99% chance that it pays nothing. As an expected utility maximizer, whose utility function, u(z) = -exp(-cz) where z is a monetary payoff and c > 0, what is the risk premium for this investment? Describe the risk premium as a function of 'c' and y'. (10 marks) d) How does the risk premium in (c) change as 'y' changes.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts