Question: Question /> Question 7 10 points Save 1 In 2017, an employee was granted 5,000 options to purchase shares of stock with an exercise price

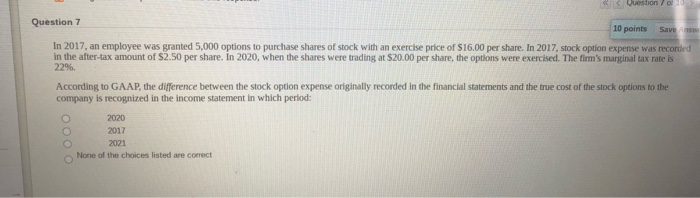

Question /> Question 7 10 points Save 1 In 2017, an employee was granted 5,000 options to purchase shares of stock with an exercise price of $16.00 per share. In 2017, stock option expense was recorded in the after-tax amount of $2.50 per share. In 2020, when the shares were trading at $20.00 per share the options were exercised. The firm's marginal tax rate is 229. According to GAAP, the difference between the stock option expense originally recorded in the financial statements and the true cost of the stock options to the company is recognized in the income statement in which period: 2020 2017 2021 None of the choices listed are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts