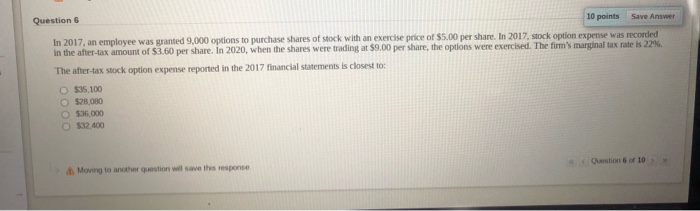

Question: Question 6 10 points Save Answer In 2017, an employee was granted 9,000 options to purchase shares of stock with an exercise price of $5.00

Question 6 10 points Save Answer In 2017, an employee was granted 9,000 options to purchase shares of stock with an exercise price of $5.00 per share. In 2017, stock option expense was recorded In the after-tax amount of $3.60 per share. In 2020, when the shares were trading at $9.00 per share the options were exercised. The firm's marginal tax rate is 22% The after-tax stock option expense reported in the 2017 financial statements is closest to: $35.100 $28.000 $36.000 $32.400 Ostion 6 of 10 Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts