Question: Question/answer needed is bolded below 1. In class, we learned that we can assess the impact of a macro indicator by running a regression of

Question/answer needed is bolded below

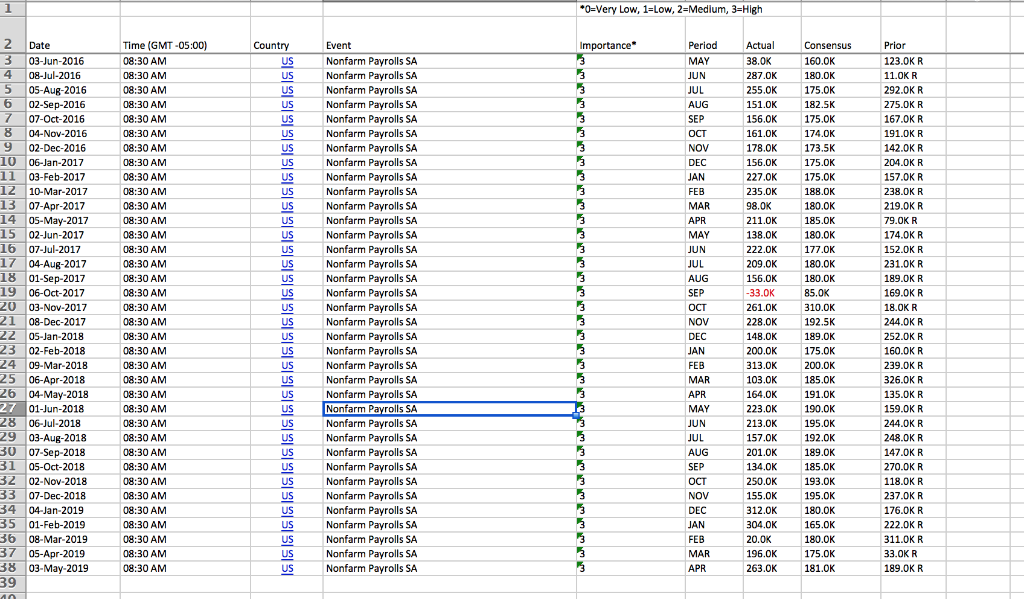

1. In class, we learned that we can assess the impact of a macro indicator by running a regression of the appropriate measure of stock market returns on the appropriate measure of the surprise contained in the announcement of the macro indicator

a. Using the posted spreadsheet, how exactly would you measure a surprise in nonfarm payrolls? Please state your answer by copying and pasting the corresponding Excel formula with cell references below.

b. Using the posted spreadsheet, how exactly would you measure the stock return associated with the nonfarm payroll announcement? Please state your answer by copying and pasting the corresponding Excel formula with cell references below.

2. Using your answer to question 1, estimate a regression of announcement returns on nonfarm payroll surprises. Copy and paste the regression statistics below. Based on your results, are nonfarm payroll surprises a statistically significant determinant of stock market returns? How does the economic magnitude of their effect compare to that of ISM surprises (put differently, which macro indicator has been a more powerful driver of stock returns during the past 3 years)?

.0 K 0 0 0 0 0 0 0 0 0 K 0 0 0 0 0 K 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 K 0 0005 .O 0 5 0 0 0 0 0 0 0 0 0 K 0 5 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 68525 74 3 5 5 8 8 5 80 7 8 8 5 1 9 95 al-K OK K KKKKKKKKKKKK OK OK OK OK KKKKKKKKKKKK OK OK K OK OK igh Act 8 2 5 5 5 6 8 6 2 3 9 2 1 2 2 1 33 2 2 4 2 3 1 1 2 2 1 2 1 2 1 3 04 20 6 3 try-uuuuuuuuuuuuuuuu_uuuuuuuuuuuuuuuuuuuu 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 8 6 Dat-03 08. 05 02 07 04 02 06 03 10-07 05 02 07 04 01 06 03. 08, 05 02 09 06. 04. 01 06 03 07 05 02 07 04 01 08 05 03 3 4 5 6 78 9 01234567890 22 3333333333-4 0123 4 5 6 7 9 0 1 23456789 1 2 .0 K 0 0 0 0 0 0 0 0 0 K 0 0 0 0 0 K 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 K 0 0005 .O 0 5 0 0 0 0 0 0 0 0 0 K 0 5 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 68525 74 3 5 5 8 8 5 80 7 8 8 5 1 9 95 al-K OK K KKKKKKKKKKKK OK OK OK OK KKKKKKKKKKKK OK OK K OK OK igh Act 8 2 5 5 5 6 8 6 2 3 9 2 1 2 2 1 33 2 2 4 2 3 1 1 2 2 1 2 1 2 1 3 04 20 6 3 try-uuuuuuuuuuuuuuuu_uuuuuuuuuuuuuuuuuuuu 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 08 8 6 Dat-03 08. 05 02 07 04 02 06 03 10-07 05 02 07 04 01 06 03. 08, 05 02 09 06. 04. 01 06 03 07 05 02 07 04 01 08 05 03 3 4 5 6 78 9 01234567890 22 3333333333-4 0123 4 5 6 7 9 0 1 23456789 1 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts