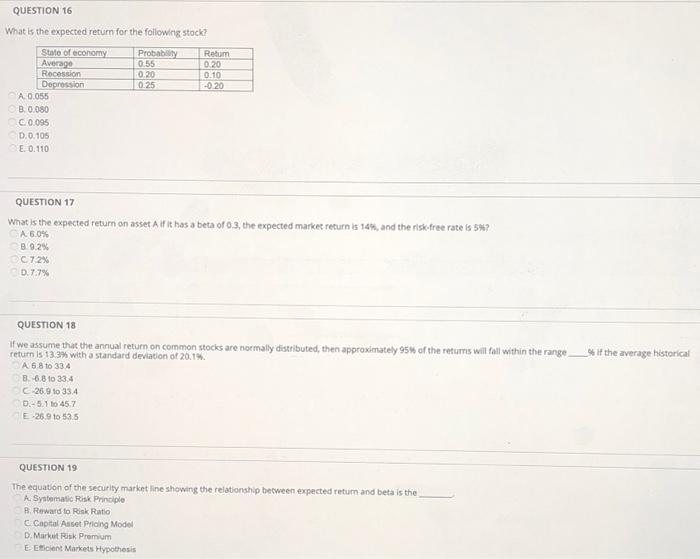

Question: questions (16-19) QUESTION 16 What is the expected return for the following stock? State of economy Probably Retum Average 0.55 0120 Recession 0.20 0.10 Depression

QUESTION 16 What is the expected return for the following stock? State of economy Probably Retum Average 0.55 0120 Recession 0.20 0.10 Depression 025 -020 A 0.055 B. 0.080 C. 0.095 0.0.105 E 0.110 QUESTION 17 What is the expected return on asset A if it has a beta of 0.3, the expected market return is 14%, and the risk free rate is 5%? A 6.0% 8.9.2% 0.72% 0.7.7% QUESTION 18 if we assume that the annual return on common stocks are normally distributed, then approximately 95% of the returns will fall within the range_If the average historical return is 13.3% with a standard deviation of 20.1 A 6 8 to 334 8.-8.8 10 33.4 26.0 to 33.4 D.-5.1 to 45.7 E 26.910 53.5 QUESTION 19 The equation of the security market line showing the relationship between expected return and beta is the A. Systematic Risk Principle Reward to Risk Ratio Capital Asset Pricing Model D. Market Risk Premium E Etient Markets Hypothesis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts