Question: Questions 2 2 - 2 3 Fallon Inc reports taxable income of $ 5 0 0 , 0 0 0 for 2 0 1 1

Questions

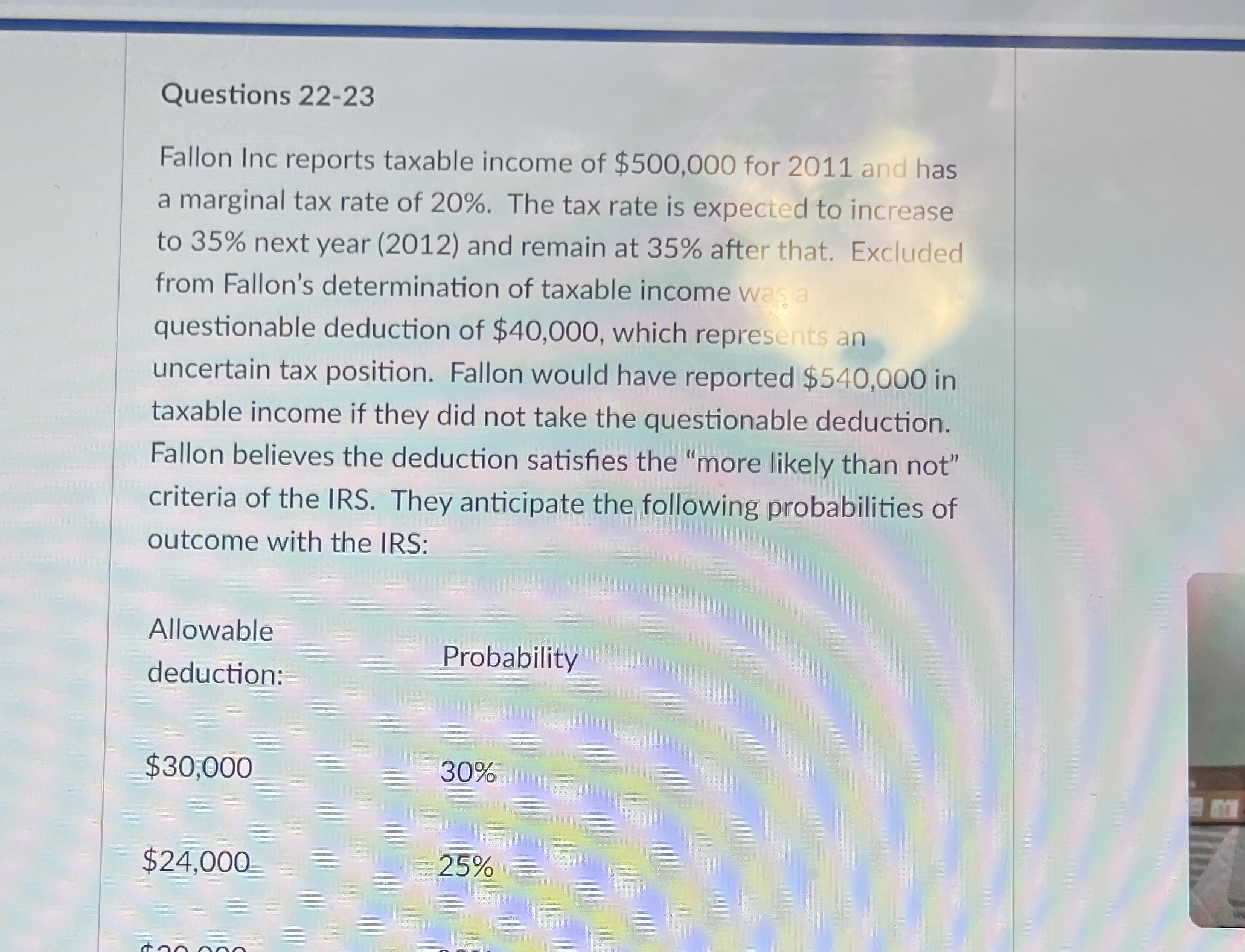

Fallon Inc reports taxable income of $ for and has a marginal tax rate of The tax rate is expected to increase to next year and remain at after that. Excluded from Fallon's determination of taxable income was a questionable deduction of $ which represents an uncertain tax position. Fallon would have reported $ in taxable income if they did not take the questionable deduction. Fallon believes the deduction satisfies the "more likely than not" criteria of the IRS. They anticipate the following probabilities of outcome with the IRS:

Allowable deduction: Probability

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock