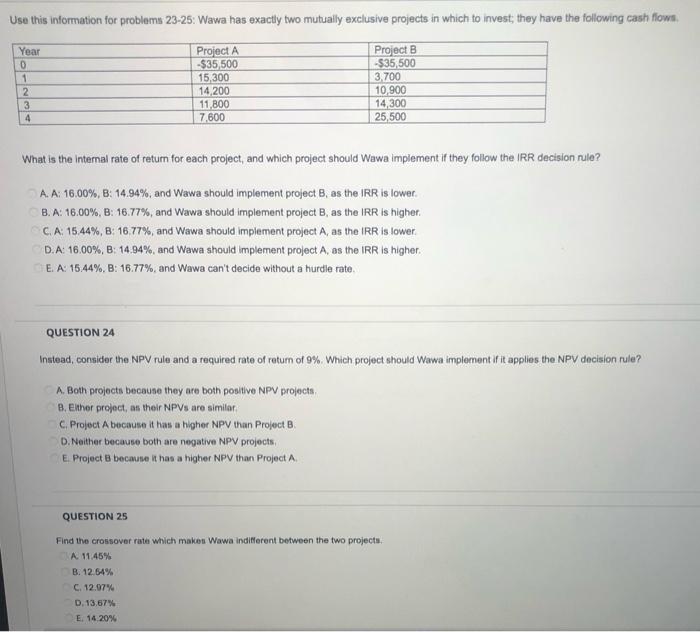

Question: Questions 23-25 Use this information for problems 23-25: Wawa has exactly two mutually exclusive projects in which to invest; they have the following cash flows.

Use this information for problems 23-25: Wawa has exactly two mutually exclusive projects in which to invest; they have the following cash flows. Year 0 Project A -$35,500 15,300 Project B -$35,500 3,700 14,200 10,900 3 11,800 14,300 4 7,600 25,500 What is the internal rate of return for each project, and which project should Wawa implement if they follow the IRR decision rule? A. A: 16.00%, B: 14.94%, and Wawa should implement project B, as the IRR is lower. B. A: 16.00 %, B: 16.77%, and Wawa should implement project B, as the IRR is higher. C.A: 15.44%, B: 16.77%, and Wawa should implement project A, as the IRR is lower. D.A: 16.00%, B: 14.94%, and Wawa should implement project A, as the IRR is higher. E.A: 15.44%, B: 16.77%, and Wawa can't decide without a hurdle rate. QUESTION 24 Instead, consider the NPV rule and a required rate of return of 9%. Which project should Wawa implement if it applies the NPV decision rule? A. Both projects because they are both positive NPV projects. B. Either project, as their NPVs are similar. C. Project A because it has a higher NPV than Project B D. Neither because both are negative NPV projects, E. Project B because it has a higher NPV than Project A. QUESTION 25 Find the crossover rate which makes Wawa indifferent between the two projects. A. 11.45% B. 12.64% C. 12.97% D.13.67% E. 14.20 % 1 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts