Question: Questions 3 and 4. C Secure https://compass2g illinois.edu/bbcswebdav/pid-2699159-dt content-rid-28390971 1/courses/se_261 120178 15 e o 2 (10 pts) You borrow $40,000 from the local bank at

Questions 3 and 4.

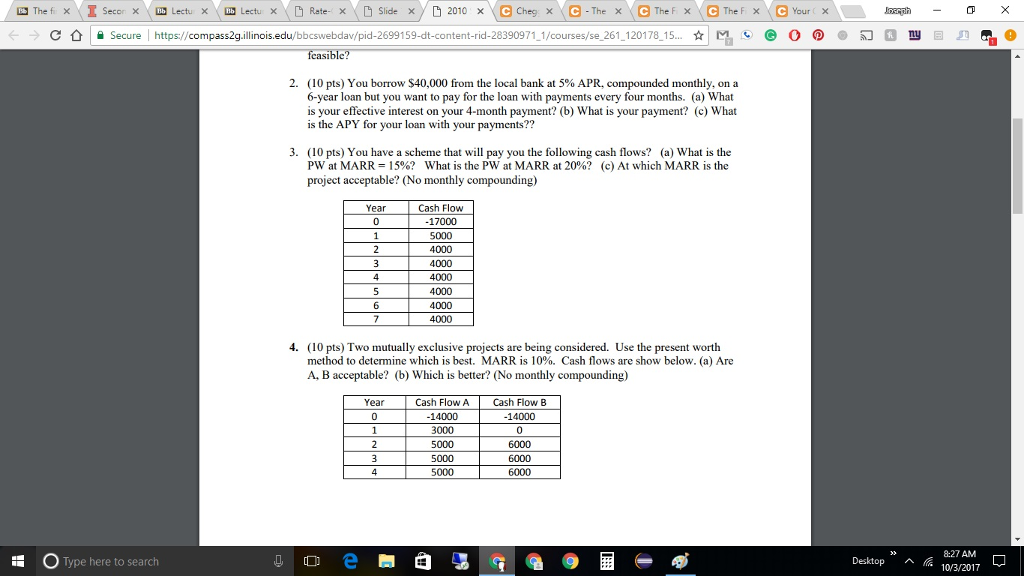

C Secure https://compass2g illinois.edu/bbcswebdav/pid-2699159-dt content-rid-28390971 1/courses/se_261 120178 15 e o 2" (10 pts) You borrow $40,000 from the local bank at 5% APR, compounded monthly, on a 6-year loan but you want to pay for the loan with payments every four months. (a) What is your effective interest on your 4-month payment? (b) What is your payment? (c) What is the APY for your loan with your payments?? 3. (a) What is the (10 pts) You have a scheme that will pay you the following cash flows? PW at MARR = 15%? What is the PW at MARR at 20%? (c) At which MARR is the project acceptable? (No monthly compounding) Cash Flow 17000 Year 4000 4000 4. (10 pts) Two mutually exclusive projects are being considered. Use the present worth method to determine which is best. MARR is 10%. Cash flows are show below. (a) Are A, B acceptable? (b) Which is better? (No monthly compounding) Year Cash Flow A Cash Flow B 14000 3000 5000 5000 14000 6000 6000 8:27 AM Desktop ^10/3/2017 Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts