Question: Questions 5, 6, and 7. Please show work 5. In the KMV Portfolio Manager model, the expected loss on a loan is A) the product

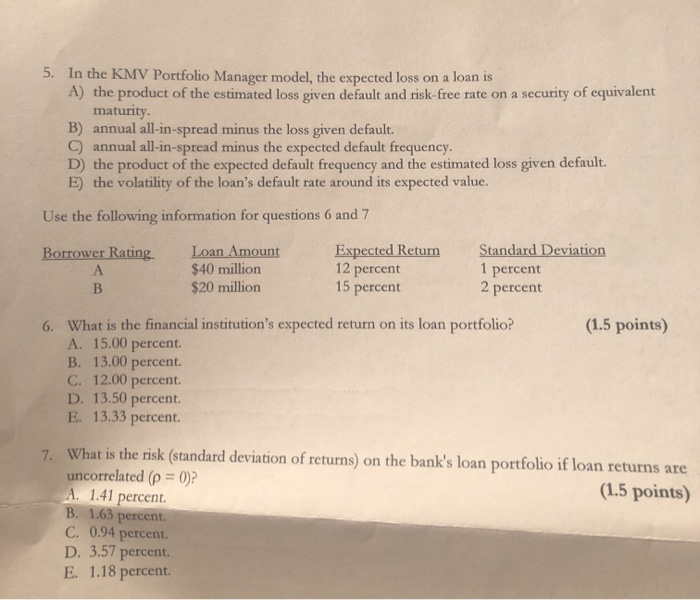

5. In the KMV Portfolio Manager model, the expected loss on a loan is A) the product of the estimated loss given default and risk-free rate on a security of equivalent maturity. B) annual all-in-spread minus the loss given default. C) annual all-in-spread minus the expected default frequency D) the product of the expected default frequency and the estimated loss given default. E) the volatility of the loan's default rate around its expected value. Use the following information for questions 6 and 7 Borrower Rating Loan Amount $40 million $20 million Expected Return 12 percent 15 percent Standard Deviation 1 percent 2 percent (1.5 points) 6. What is the financial institution's expected return on its loan portfolio? A. 15.00 percent B. 13.00 percent C. 12.00 percent. D. 13.50 percent. E. 13.33 percent 7. What is the risk (standard deviation of returns) on the bank's loan portfolio if loan returns are uncorrelated (p = 0)? (1.5 points) A. 1.41 percent. B. 1.63 percent. C. 0.94 percent D. 3.57 percent E. 1.18 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts