Question: Questions and Problems: (Note: students will be responsible for checking each question to make sure it is free of mistakes with regard to numbers and

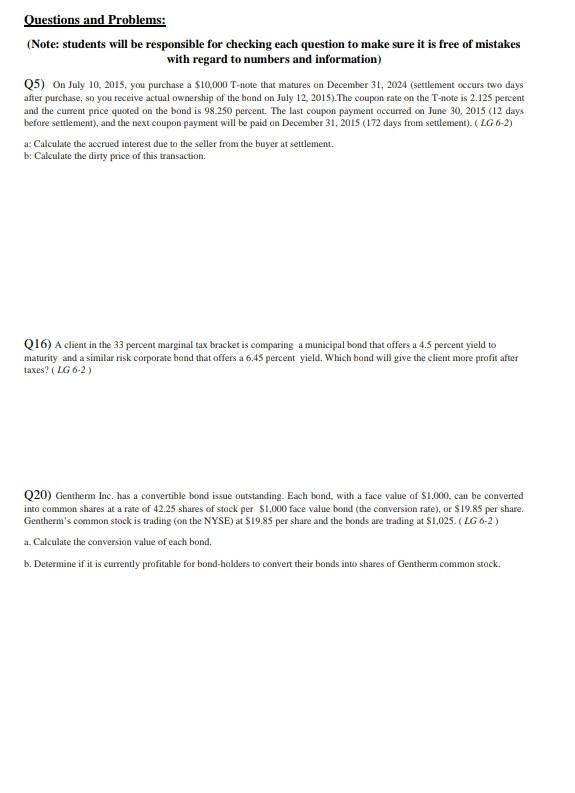

Questions and Problems: (Note: students will be responsible for checking each question to make sure it is free of mistakes with regard to numbers and information) (5) On July 10, 2015. you purchase a $10.000 T-note that matures on December 31, 2024 (settlement occurs two days after purchase, so you receive actual ownership of the hand on July 12, 2015). The coupon rate on the T-note is 2.125 percent and the current price quoted on the bond is 98.250 percent. The last coupon payment occurred on June 30, 2015 (12 days before settlement), and the next coupon payment will be paid on December 31, 2015 (172 days from settlement). (LG 6-2) a Calculate the accrued interest due to the seller from the buyer at settlement. b: Calculate the dirty price of this transaction. Q16) A client in the 33 percent marginal tax bracket is comparing a municipal bond that offers a 4.5 percent yield to maturity and a similar risk corporate band that offers a 6.45 percent yield. Which bond will give the client more profit after taxes? (LG 6-2) Q20) Gentherm Inc. has a convertible bond issue outstanding. Each band, with a face value of $1,000, can be converted inta common shares at a rate of 42.25 shares of stock per $1,000 face value bond (the conversion rate), or $19.85 per share. Gentherm's common stock is trading on the NYSE) a $19.85 per share and the bonds are trading at $1,025. (LG 6-2) a. Calculate the conversion value of each bond. b. Determine if it is currently profitable for bond-holders to convert their bonds into shares of Gentherm common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts