Question: Questions: Fast Services Inc. has bonds with a par value of $ 1 , 0 0 0 and a coupon rate of 4 . 8

Questions:

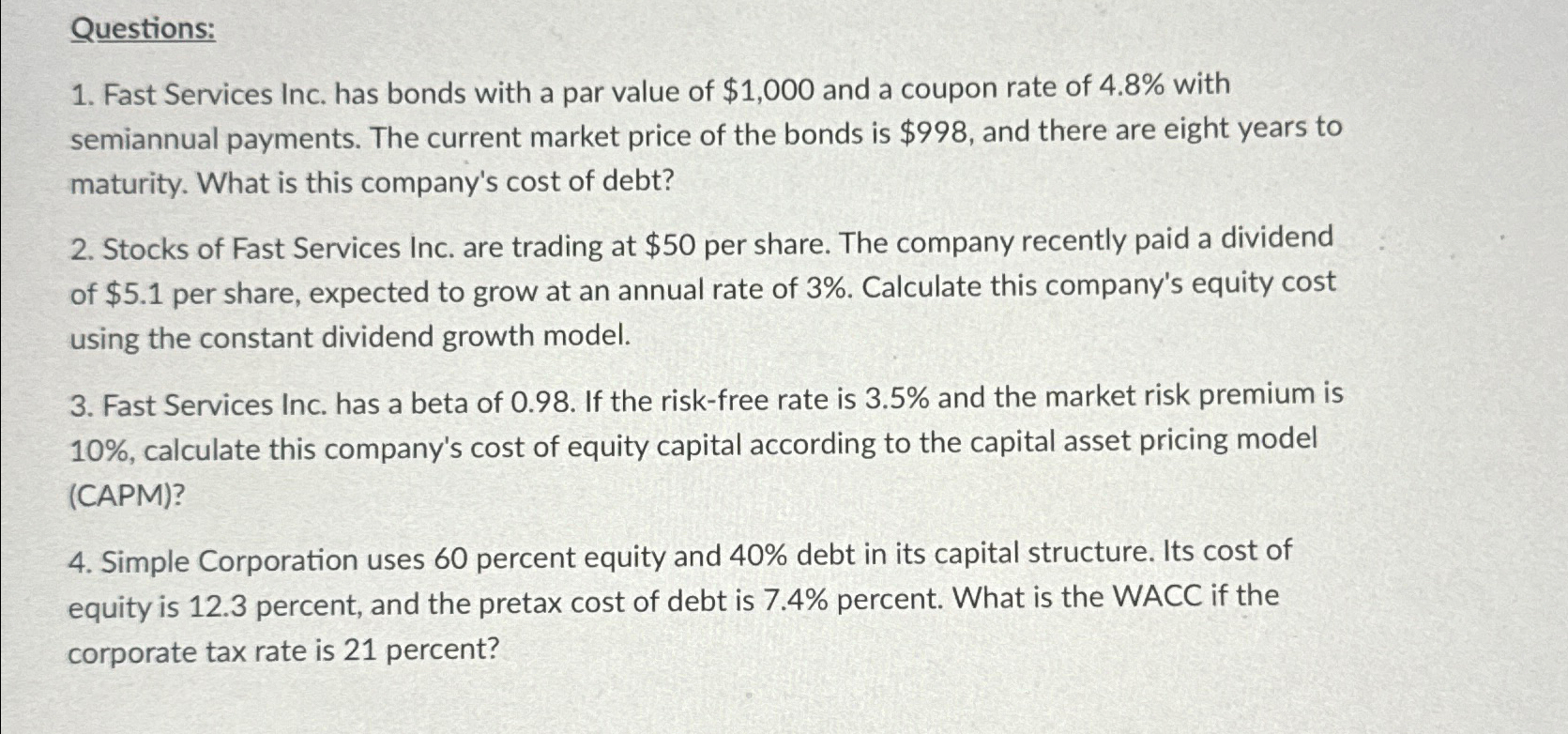

Fast Services Inc. has bonds with a par value of $ and a coupon rate of with semiannual payments. The current market price of the bonds is $ and there are eight years to maturity. What is this company's cost of debt?

Stocks of Fast Services Inc. are trading at $ per share. The company recently paid a dividend of $ per share, expected to grow at an annual rate of Calculate this company's equity cost using the constant dividend growth model.

Fast Services Inc. has a beta of If the riskfree rate is and the market risk premium is calculate this company's cost of equity capital according to the capital asset pricing model CAPM

Simple Corporation uses percent equity and debt in its capital structure. Its cost of equity is percent, and the pretax cost of debt is percent. What is the WACC if the corporate tax rate is percent?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock