Question: quick answer pls Quint Systems, Inc. is evaluating two mutually exclusive projects, whose cash flows are projected as below. The company's cost of capital is

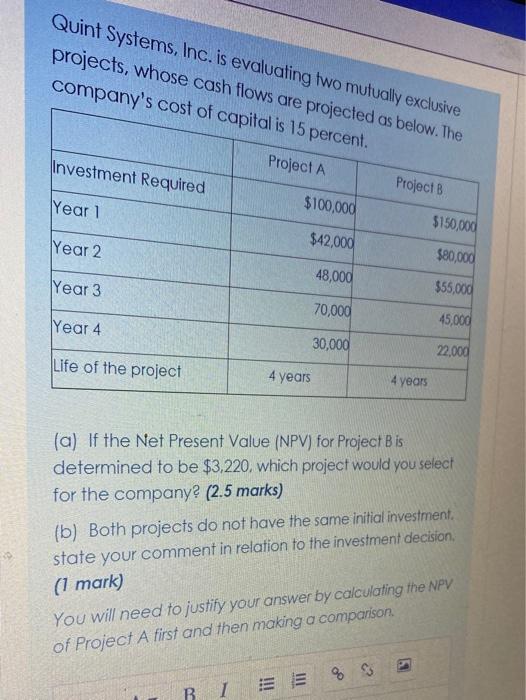

Quint Systems, Inc. is evaluating two mutually exclusive projects, whose cash flows are projected as below. The company's cost of capital is 15 percent. Project A Project B Investment Required Year 1 $100,000 $150,000 Year 2 $42,000 $80,000 48,000 Year 3 $55,000 70,000 Year 4 45,000 30,000 22,000 Life of the project 4 years 4 years (a) If the Net Present Value (NPV) for Project Bis determined to be $3,220, which project would you select for the company? (2.5 marks) (b) Both projects do not have the same initial investment. state your comment in relation to the investment decision, (1 mark) You will need to justify your answer by calculating the NPV of Project A first and then making a comparison % 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts