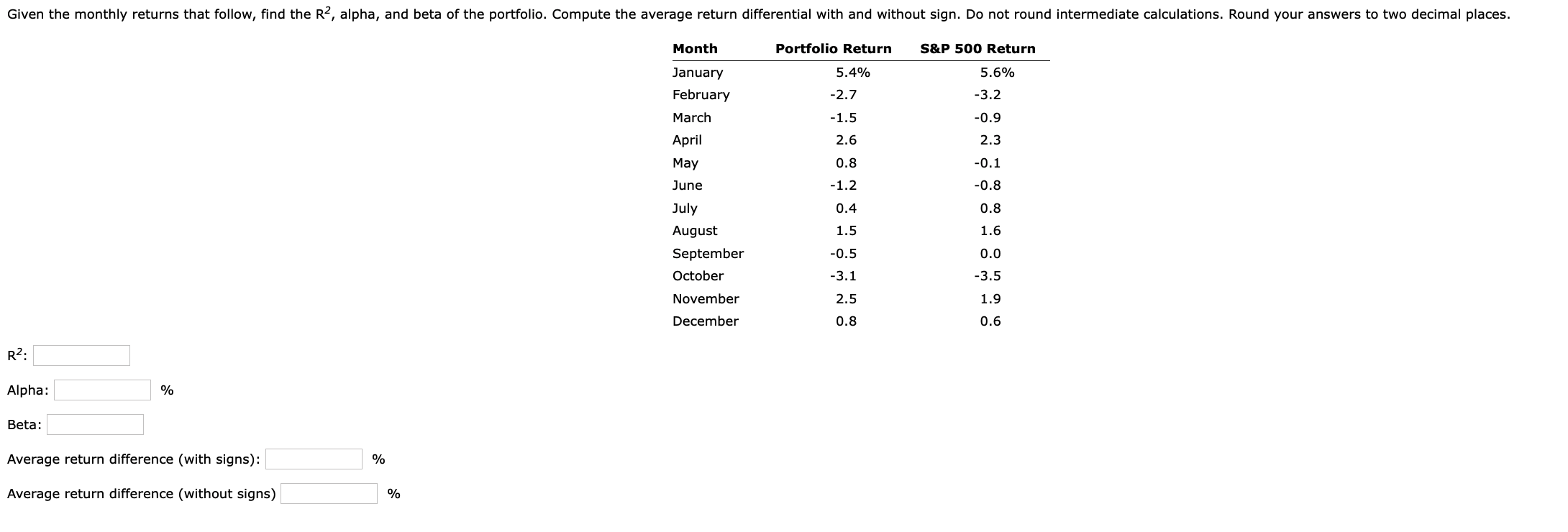

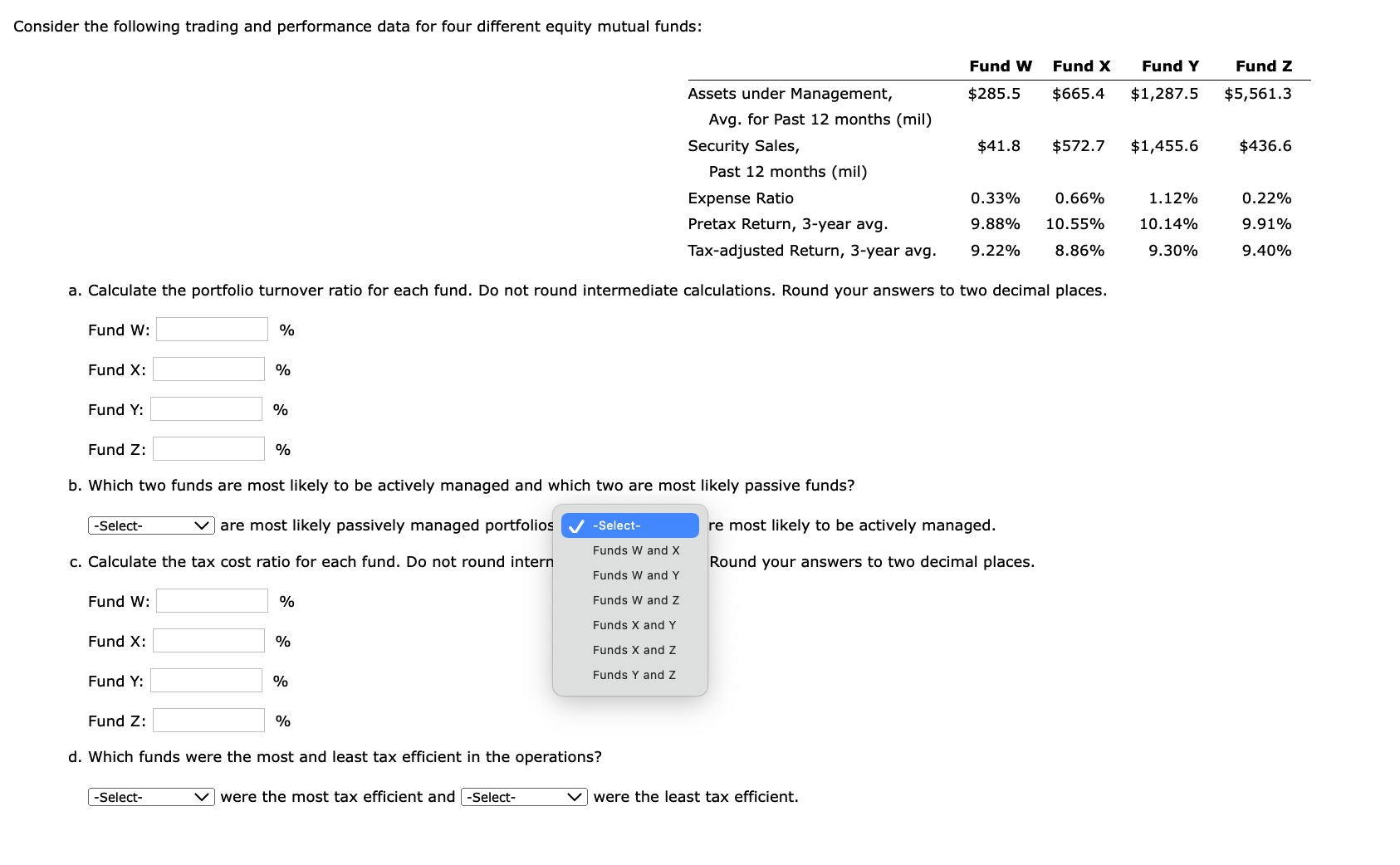

Question: R2 Alpha % Beta: Average return difference (with signs): % Average return difference (without signs) % Consider the following trading and performance data for four

R2 Alpha % Beta: Average return difference (with signs): % Average return difference (without signs) % Consider the following trading and performance data for four different equity mutual funds: a. Calculate the portfolio turnover ratio for each fund. Do not round intermediate calculations. Round your answers to two decimal places. Fund W: % Fund X : % Fund Y: % Fund Z: % b. Which two funds are most likely to be actively managed and which two are most likely passive funds? are most likely passively managed portfolios c. Calculate the tax cost ratio for each fund. Do not round intern Fund W: Fund X: Fund Y: Fund Z: % % % % re most likely to be actively managed. Round your answers to two decimal places. d. Which funds were the most and least tax efficient in the operations? were the most tax efficient and were the least tax efficient

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts