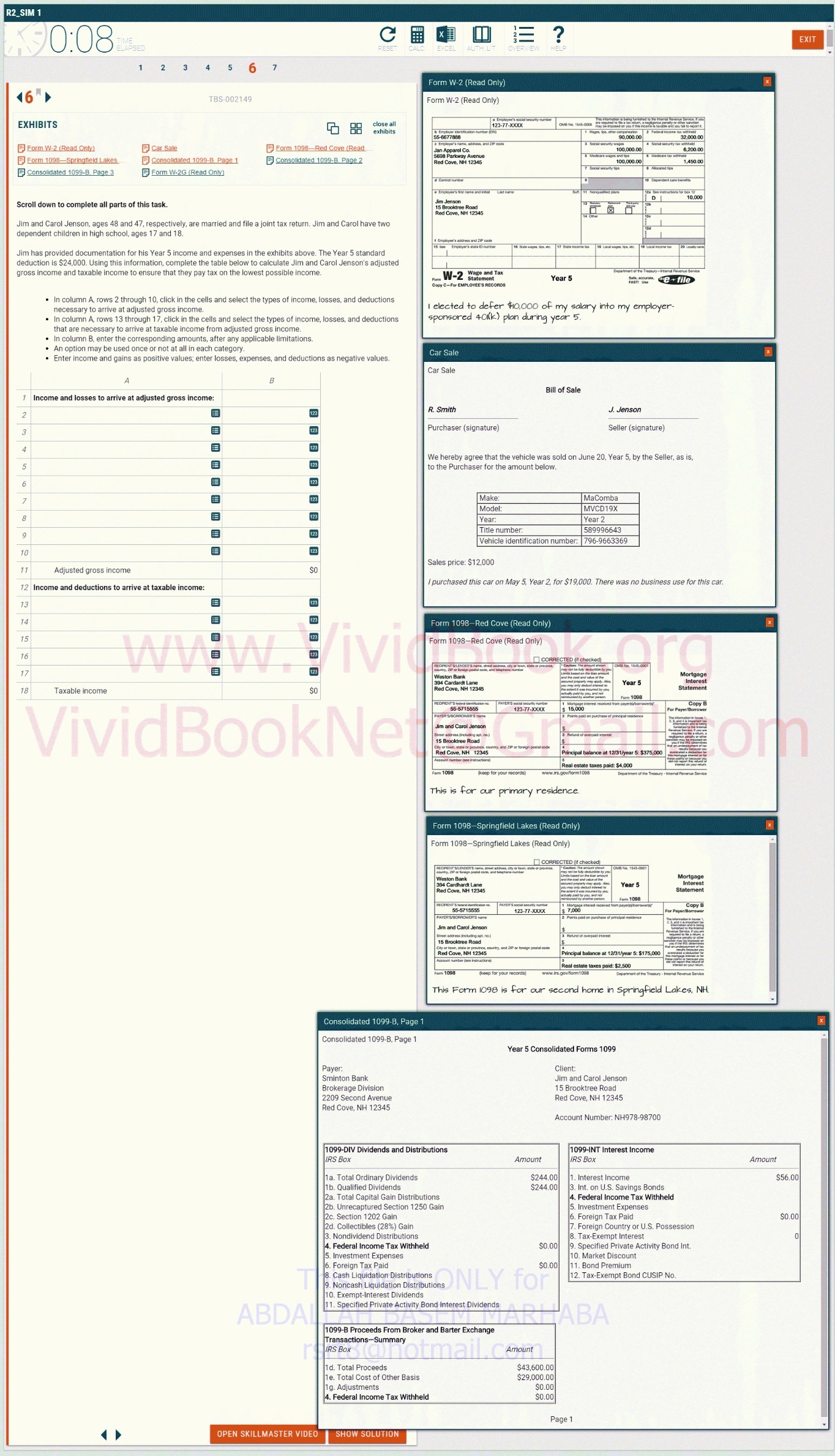

Question: R2_SIM 1 0:08 MESED EXIT 2 3 4 5 6 7 Form W-2 (Read Only) 16 TBS-002149 orm W-2 (Read Only) EXHIBITS 88 close all

R2_SIM 1 0:08 MESED EXIT 2 3 4 5 6 7 Form W-2 (Read Only) 16 TBS-002149 orm W-2 (Read Only) EXHIBITS 88 close all 123-77-XXXX 55-6877808 90,000.00 Form W-2 (Read Only) car Sale Form 1098-Red Cove (Read Jan Apparel Co 100,000.00 Form 1098-Springfield Lakes Consolidated 1099-B. Page 1 Consolidated 1099-B. Page 2 Red Cove. NH 12345 lackcars wages and too 100,000.00 1,450.00 Consolidated 1099-8 Page 3 Form W-2G (Read Only) 10,000 Scroll down to complete all parts of this task. Jim Jenson Red Cove. NH 12345 Jim and Carol Jenson, ages 48 and 47, respectively, are married and file a joint tax return. Jim and Carol have two dependent children in high school, ages 17 and 18. Jim has provided documentation for his Year 5 income and expenses in the exhibits above. The Year 5 standard deduction is $24,000. Using this information, complete the table below to calculate Jim and Carol Jenson's adjusted gross income and taxable income to ensure that they pay tax on the lowest possible income. . W-2 Wage and Tax Copy C- For EMPLOYEE'S RECORD Year 5 more file . In column A, rows 2 through 10, click in the cells and select the types of income, losses, and deductions necessary to arrive at adjusted elected to defer $10,000 of my salary into my employer- . In column A, rows 13 through 17, click in the cells and select the types of income, losses, and deductions sponsored 40 (k) plan during year 5. that are necessary to arrive at taxable income from adjusted gross income. In column B, enter the corresponding amounts, after any applicable limitations. An option may be used once or not at all in each category. . Enter income and gains as positive values; enter losses, expenses, and deductions as negative values. ar Sale Car Sale B Bill of Sale 1 Income and losses to arrive at adjusted gross income: R. Smith J. Jenson N Purchaser (signature) Seller (signature) We hereby agree that the vehicle was sold on June 20, Year 5, by the Seller, as is, to the Purchaser for the amount below. Make: MaComba Model: MVCD19X Year: Year 2 Title number: 589996643 Vehicle identification number: 796-9663369 17 Sales price: $12,000 Adjusted gross income 12 Income and deductions to arrive at taxable income: I purchased this car on May 5, Year 2, for $19,000. There was no business use for this car. ivi Form 1098-Red Cove (Read Only) WW Form 1098-Red Cove (Read Only) 304 Cardard La Mortgage 18 Red Cove, NH 12345 Year 5 Taxable income Form 1098 VividBookNe 123-77-XXXX 15,000 Jim and Carol Jens 15 Brooktree Road Red Cove , NH 12345 al balance at 12/31/year 5: $375,000 orn estate taxes paid: $4,000 This is for our primary residence. Form 1098-Springfield Lakes (Read Only) Form 1098-Springfield Lakes (Read Only) Weston Bank Mortgag Red Cove, NH 12345 Year 5 Statement Form 1098 55-5715555 $ 7,000 PAYER S/BORROWERS 123-77-XXXX Copy B Jim and Carol Jenson 15 Brooktree Road Red Cove, NH 12345 Principal balance at 12/31/year 5: $175,000 Account number (and instructorel taxes paid: $2.500 This Form 1098 is for our second home in Springfield Lakes, NH Consolidated 1099-B, Page 1 Consolidated 1099-B, Page 1 Year 5 Consolidated Forms 1099 Payer: Client: Sminton Bank Jim and Carol Jenson Brokerage Division 15 Brooktree Road 209 Second Avenue Red Cove, NH 12345 Red Cove, NH 12345 Account Number: NH978-98700 1099-DIV Dividends and Distributions 1099-INT Interest Income IRS BO Amount IRS Box Amount 1a. Total Ordinary Dividends $244.00 1. Interest Income $56.00 1b. Qualified Dividends $244.00 3. Int. on U.S. Savings Bonds 2a. Total Capital Gain Distributions 4. Federal Income Tax Withheld 2b. Unrecaptured Section 1250 Gain 5. Investment Expenses 2c. Section 1202 Gain 6. Foreign Tax Paid $0.00 2d. Collectibles (28%) Gain 7. Foreign Country or U.S. Possession 3. Nondividend Distributions 8. Tax-Exempt Interest 4. Federal Income Tax Withheld $0.00 9. Specified Private Activity Bond Int. 5. Investment Expenses 10. Market Discoun 6. Foreign Tax Paid $0.00 11. Bond Premium 8. Cash Liquidation Distributions NLY for 12. Tax-Exempt Bond CUSIP No. 9. Noncash Liquidation Distributions 10. Exempt-Interest Dividends ABDAL 1 1. Specified Private Activity Bond Interest Dividends BA 1099-B Proceeds From Broker and Barter Exchange Transactions-Summary IRS BOX imal Amount 1d. Total Proceeds $43,600.00 1e. Total Cost of Other Basis $29,000.00 1g. Adjustments $0.00 4. Federal Income Tax Withheld $0.00 Page 1 OPEN SKILLMASTER VIDEO SHOW SOLUTION