Question: rardacademy.com / lms / AFTR - 2 0 2 4 - Exam / 9 2 1 5 8 1 9 2 0 2 2 -

rardacademy.comlmsAFTRExam

CCHS Liv...

KDE Licensure

MyAccount Americ.

FastForwardAcademy

Expungement Certif...

You Will Love Histor..

History Gran

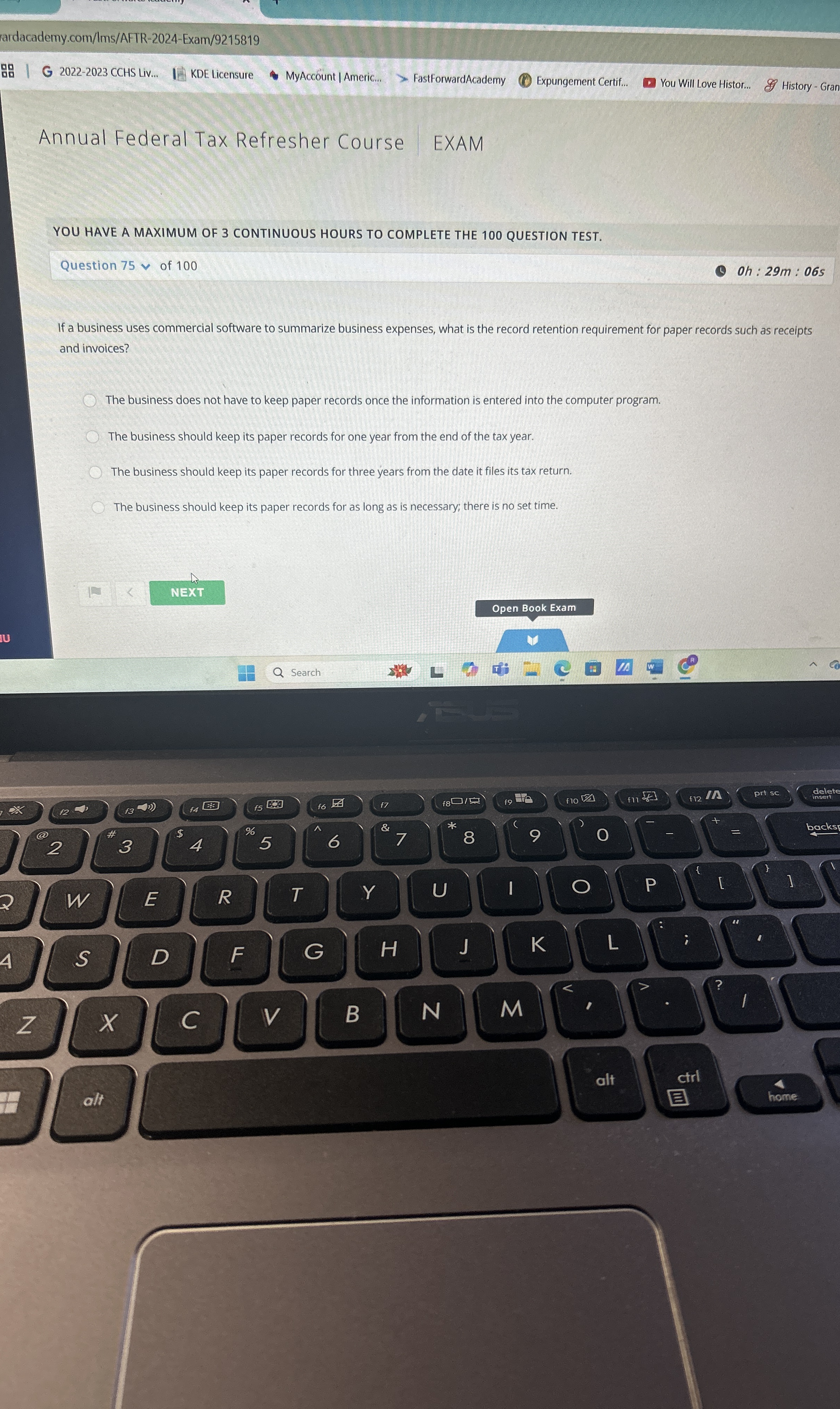

Annual Federal Tax Refresher Course

EXAM

YOU HAVE A MAXIMUM OF CONTINUOUS HOURS TO COMPLETE THE QUESTION TEST.

Question of

Oh : :

If a business uses commercial software to summarize business expenses, what is the record retention requirement for paper records such as receipts and invoices?

The business does not have to keep paper records once the information is entered into the computer program.

The business should keep its paper records for one year from the end of the tax year.

The business should keep its paper records for three years from the date it files its tax return.

The business should keep its paper records for as long as is necessary; there is no set time.

Open Book Exam

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock