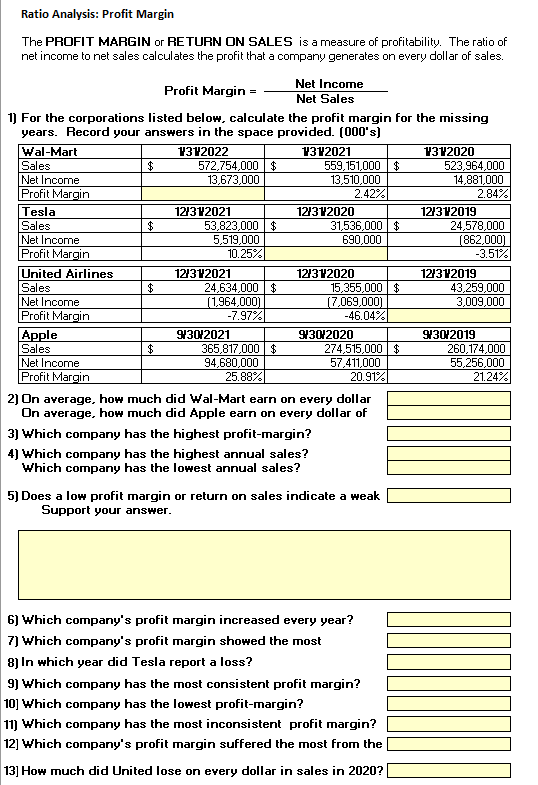

Question: Ratio Analysis: Profit Margin The PROFIT MARGIN or RETURN ON SALES is a measure of profitability. The ratio of net income to net sales calculates

![for the missing years. Record your answers in the space provided. [000's]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ff7ac89883c_14466ff7ac82b76c.jpg)

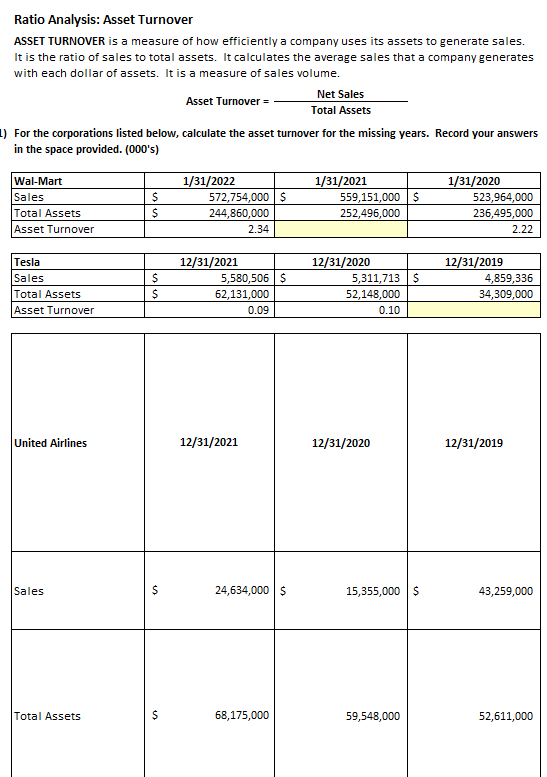

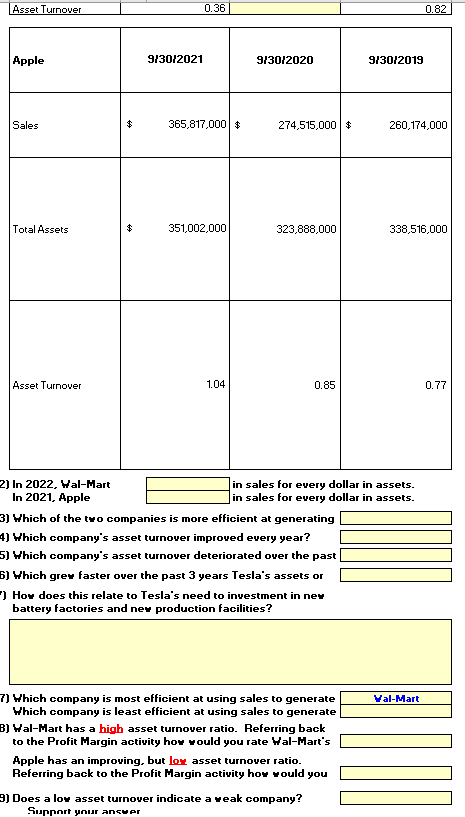

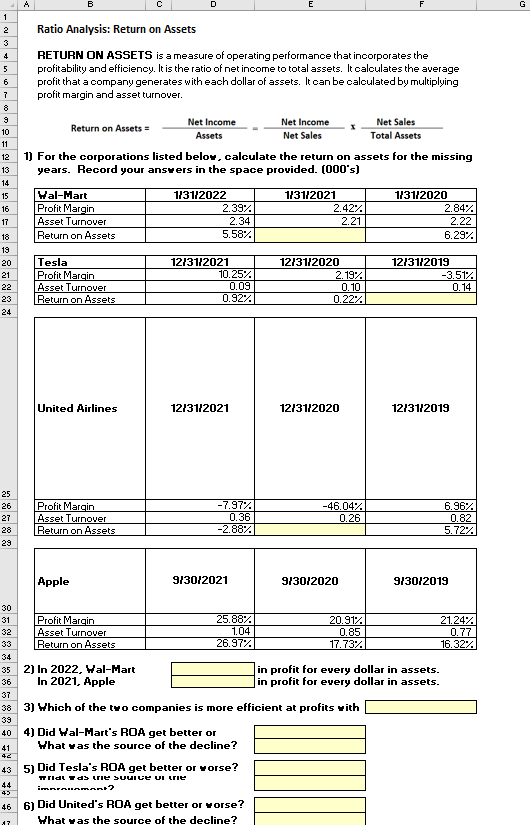

Ratio Analysis: Profit Margin The PROFIT MARGIN or RETURN ON SALES is a measure of profitability. The ratio of net income to net sales calculates the profit that a company generates on every dollar of sales. ProfitMargin=NetSalesNetIncome 1) For the corporations listed below, calculate the profit margin for the missing years. Record your answers in the space provided. [000's] \begin{tabular}{|l|r|r|r|} \hline Wal-Mart & \multicolumn{1}{|c|}{132022} & \multicolumn{1}{c|}{ 1312021 } & \multicolumn{1}{c|}{ 1312020 } \\ \hline Sales & $572,754,000 & $55,151,000 & $523,964,000 \\ \hline Net Income & 13,673,000 & 13,510,000 & 14,881,000 \\ \hline Profit Margin & & 2.42% & 2.84% \\ \hline \end{tabular} 2) On average, how much did Wal-Mart earn on every dollar On average, how much did Apple earn on every dollar of 3) Which company has the highest profit-margin? 4) Which company has the highest annual sales? Which company has the lowest annual sales? 5) Does a low profit margin or return on sales indicate a weak Support your answer. 6) Which company's profit margin increased every year? 7) Which company's profit margin showed the most 8) In which year did Tesla report a loss? 9) Which company has the most consistent profit margin? 10] Which company has the lowest profit-margin? 11) Which company has the most inconsistent profit margin? 12] Which company's profit margin suffered the most from the 13] How much did United lose on every dollar in sales in 2020? Ratio Analysis: Asset Turnover ASSET TURNOVER is a measure of how efficiently a company uses its assets to generate sales. It is the ratio of sales to total assets. It calculates the average sales that a company generates with each dollar of assets. It is a measure of sales volume. AssetTurnover=TotalAssetsNetSales For the corporations listed below, calculate the asset turnover for the missing years. Record your answers in the space provided. (000's) 7) Which company is most efficient at using sales to generate Which company is least efficient at using sales to generate B) Hal-Mart has a high asset turnover ratio. Referring back to the Profit Margin activity how would you rate Mal-Mart's Apple has an improving, but low asset turnover ratio. Referring back to the Profit Margin activity how would you 9) Does a low asset turnover indicate a veak company? Support your ancwer Ratio Analysis: Return on Assets RETURN DN ASSETS is a measure of operating performance that incorporates the profitability and efficiency. It is the ratio of net income to total assets. It calculates the average profit that a company generates with each dollar of assets. It can be caloulated by multiplying profit margin and asset turnover. ReturnonAssets=AssetsNetIncome=NetSalesNetIncomeTotalAssetsNetSales 1) For the corporations listed below, calculate the return on assets for the missing years. Record your answers in the space provided. [000's] 2) In 2022, Hal-Mart in profit for every dollar in assets. In 2021, Apple in profit for every dollar in assets. 3) Which of the two companies is more efficient at profits with 4) Did Mal-Mart's RDA get better or What was the source of the decline? 5) Did Tesla's RDA get better or worse? 6) Did United's ROA get better or worse? 11) An equity muliplier greater than 2.0 means that a debt than equity to finance it assets (higher financial 9) An equity muliplier less than 2.0 means that a company debt than equity to finance it assets. (lower financial

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts