Question: Read Mini Case 15 Competing on Business Models: Google vs. Microsoft and answer the case study question. The question is: Why are Microsoft and Google

Read Mini Case 15 Competing on Business Models: Google vs. Microsoft and answer the case study question. The question is: Why are Microsoft and Google becoming increasingly direct competitors?

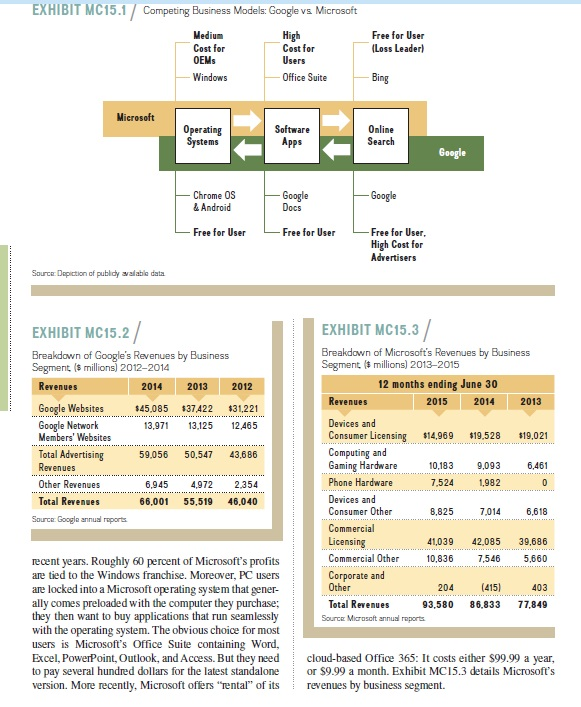

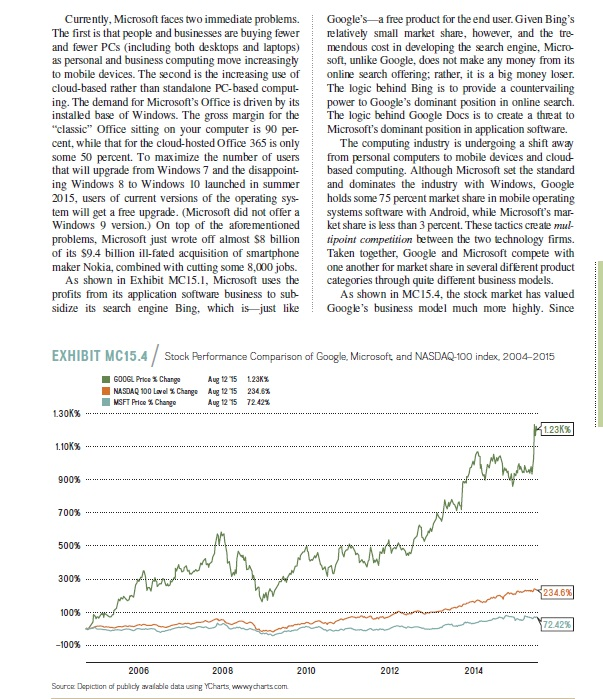

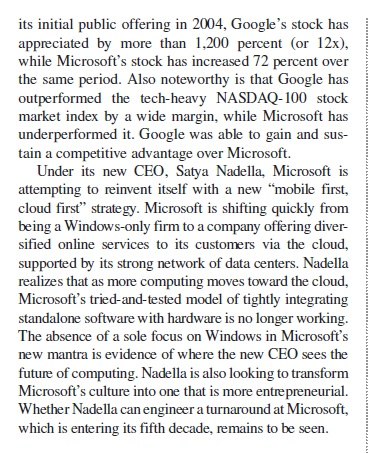

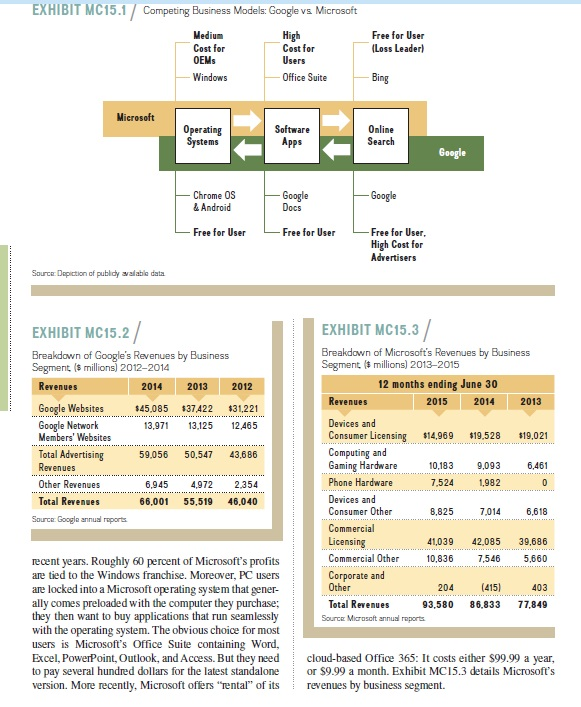

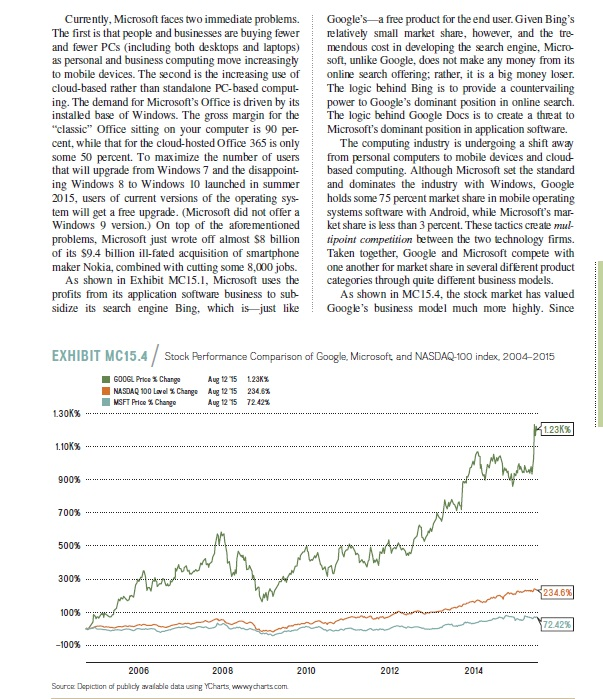

Competing on Business Models: Google vs. Microsoft Google RIVALS OFTEN USE different business models to com- prele will one allier. Because of competitive dynami- ics and industry convergence, Google and Microsoft progressively move on to the other's turf. In many areas, Google and Microsoft are now direct competi- tors. In 2014, Microsoft had $90 billion in revenues and Google $66 billion. Although Google started as an online search and advertising company, it now offers software applications (Google Docs, word pro- cessing, spreadsheet, e-mail, interactive calendar, and presentation software) hosted on the cloud (Google Drive), and also operating systems (Chrome OS for the web and Android for mobile applications), among many other online products and services. In contras., Microsoft began its life by offering an operating sys- tem (since 1985, called Windows), then moved into software applications with its Office Suite, and later into online search and advertising with Bing as well as gaming with Xbox One. Both also compete in mobile devices by offering smartphones. The stage is set for a clash of the technology titans. In competing with each other, Google and Micro- soft pursue very different business models, as detailed in Exhibit MC15.1. Google offers its applications suftware Google Ducs and listing ivice Guogle Drive for free to induce and retain as many users as possible for its search engine. Although Google's fagship search engine is free for the end user, Google makes money from sponsored links by advertisers. The advertisers pay for the placement of their ad on the results pages and each time a user clicks through an ad (which Google calls a "sponsored link"). Many billion mini-transactions add up to a substantial busi- ness. Exhibit MC152 shows how advertising rev enues account for some 90 percent of Google's total revenues. Google uses part of the profits earned from its lucrative online advertising business to subsidize Google Docs (see Exhibit MC 15.1). Giving away products and services to induce widespread use allows Microsoft Sunder Pichal, Google CED (tegl, and Satya Natella, Microsoft CEO (Botton) top Pchi Chuang/Routers/Corbis: bottom; AF Photo/Enc Rosberg Google to benefit from network effects the increase in the value of a product or service as more people use it. Google can charge advertisers for highly targeted and effective ads, allowing it to subsidize other prod- uct offerings that compete directly with Microsoft. Microsoft's business model, however, is almost the reverse of Google's (sootho opposing arrows in Exhibit MC 15.1). Initially, Microsoft focused on creating a large installed base of users for its PC operating sys- tem Wind:ws. It hokis some 90 percent market share in operating system software for personal computers worldwide, although the PC has become less impor- tant as mobile devices have become more important in 465 EXHIBIT MC15.1 / Competing Business Models Google vs Microsoft Medium High Cost for Cost for OEMS Users Office Suite Free for User (Loss Leader) Windows Bing Microsoft Online Operating Systems Software Apps Search Google Chrome OS & Android Google Docs - Google Free for User Free for User -Free for User High Cost for Advertisers Source: Depiction of publidysvalable data EXHIBIT MC15.3/ Breakdown of Microsoft's Revenues by Business Segment ($ millions) 2013-2015 12 months ending June 30 Revenues 2015 2014 2013 EXHIBIT MC15.2 / Breakdown of Google's Revenues by Business Segment ($ millions) 2012-2014 Revenues 2014 2013 2012 Google Websites $45,085 $37,422 $31,221 Google Network 13,971 13.125 12,465 Members' Websites Total Advertising 59,056 50,547 43.686 Revenues Other Revenues 6.945 4,972 2.354 Total Revenues 66,001 55,519 46,040 Source: Google annual reports $19,528 $19,021 6,461 9,093 1,982 0 *********************** 7,014 6,618 Devices and Consumer Licensing $14.969 Computing and Gaming Hardware 10,183 Phone Hardware 7.524 Devices and Consumer Other 8,825 Commercial Licensing 41,039 Commercial Other 10.836 Corporate and Other 204 Total Revenues 93.580 Source Microsoft annual reports 42,085 7,546 39,686 5.660 (415) 403 86.833 77,849 recent years. Roughly 60 percent of Microsoft's profits are tied to the Windows franchise. Moreover, PC users are locked into a Microsoft operating system that gener- ally comes preloaded with the computer they purchase; they then want to buy applications that run seamlessly with the operating system. The obvious choice for most users is Microsoft's Office Suite containing Word, Excel, PowerPoint, Outlook, and Access. But they need to pay several hundred dollars for the latest standalone version. More recently, Microsoft offers "rental" of its cloud-based Office 365: It costs either $99.99 a year, or $9.99 a month. Exhibit MC15.3 details Microsoft's revenues by business segment. Currently, Microsoft faces two immediate problems. The first is that people and businesses are buying fewer and fewer PCs (including both desktops and laptops) as personal and business computing move increasingly to mobile devices. The second is the increasing use of cloud-based rather than standalone PC-based comput- ing. The demand for Microsoft's Office is driven by its installed base of Windows. The gross margin for the "classic" Office sitting on your computer is 90 per- cent, while that for the cloud-hosted Office 365 is only some 50 percent. To maximize the number of users that will upgrade from Windows 7 and the disappoint- ing Windows 8 to Windows 10 launched in summer 2015, users of current versions of the operating sys- tem will get a free upgrade. (Microsoft did not offer a Windows 9 version.) On top of the aforementioned problems, Microsoft just wrote off almost $8 billion of its $9.4 billion ill-fated acquisition of smartphone maker Nokia, combined with cutting some 8,000 jobs. As shown in Exhibit MC15.1, Microsoft uses the profits from its application software business to sub- sidize its search engine Bing, which is just like Google's a free product for the end user. Given Bing's relatively small market share, however, and the tre- mendous cost in developing the search engine, Micro- soft, unlike Google, does not make any money from its online search offering; rather, it is a big money loser. The logic behind Bing is to provide a countervailing power to Google's dominant position in online search The logic behind Google Docs is to create a threat to Microsoft's dominant position in application software. The computing industry is undergoing a shift away from personal computers to mobile devices and cloud based computing. Although Microsoft set the standard and dominates the industry with Windows, Google holds some 75 percent market share in mobile operating systems software with Android, while Microsoft's mar- ket share is less than 3 percent. These tactics create mul- tipoint competition between the two technology firms. Taken together, Google and Microsoft compete with one another for market share in several different product categories through quite different business models. As shown in MC15.4, the stock market has valued Google's business model much more highly. Since EXHIBIT MC15.4 / Stock Performance Comparison of Google, Microsoft and NASDAQ-100 index, 2004-2015 GOOGL Price Change Aug 125 123KX NASDAQ 100 Lavel Change Aug 12 234.6% MSFT Price% Change Aug 12 15 72.42% 1.30K% 1.23% 1.10K% A 900% 700% 500% want 300% 234.6% 100%" 72.42% -100% 2010 2012 2014 2006 2008 Source Depiction of pubilldy available data using YCharts, wwwycharts.com its initial public offering in 2004, Google's stock has appreciated by more than 1,200 percent (or 12x), while Microsoft's stock has increased 72 percent over the same period. Also noteworthy is that Google has outperformed the tech-heavy NASDAQ-100 stock market index by a wide margin, while Microsoft has underperformed it. Google was able to gain and sus- tain a competitive advantage over Microsoft. Under its new CEO, Satya Nadella, Microsoft is attempting to reinvent itself with a new "mobile first, cloud first strategy. Microsoft is shifting quickly from being a Windows-only firm to a company offering diver- sified online services to its customers via the cloud, supported by its strong network of data centers. Nadella realizes that as more computing moves toward the cloud, Microsoft's tried-and-tested model of tightly integrating standalone software with hardware is no longer working. The absence of a sole focus on Windows in Microsoft's new mantra is evidence of where the new CEO sees the future of computing. Nadella is also looking to transform Microsoft's culture into one that is more entrepreneurial. Whether Nadella can engineer a turnaround at Microsoft, which is entering its fifth decade, remains to be seen