Question: Read the attached case, Financial Statement Analysis for Small Business, A Resource Guide. Focus on how the author uses the ratios to interpret the business

Read the attached case, Financial Statement Analysis for Small Business, A Resource Guide. Focus on how the author uses the ratios to interpret the business performance.

Q2-1: Reviewing financial statement (SNT)

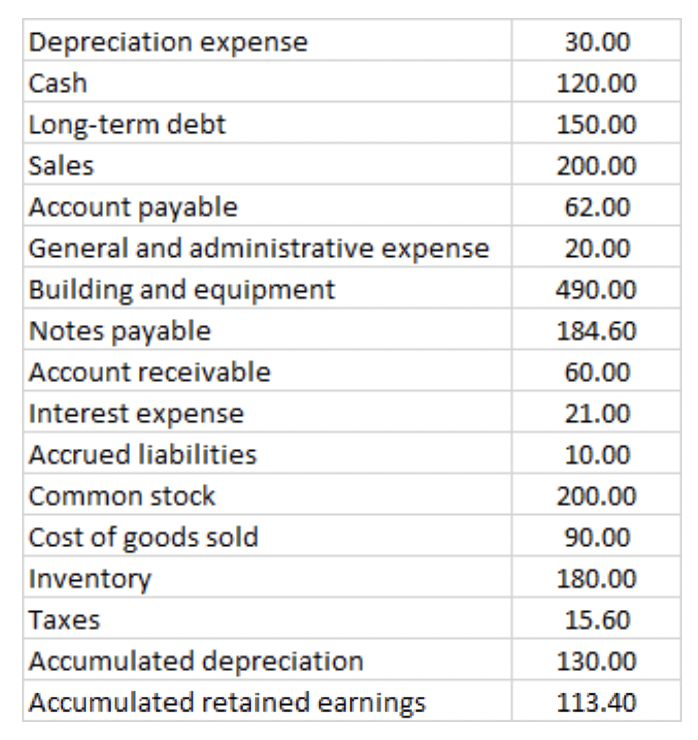

Prepare a balance sheet and income statement for SNT, Inc, from the following scrambled list of items:

2-1-1 Show the balance sheet here

2-1-2 Show the income statement here.

2-1-3 Calculate the following profit indicators

- What is the gross profit?

- What is the net operating profit (EBIT)?

- What is the net income?

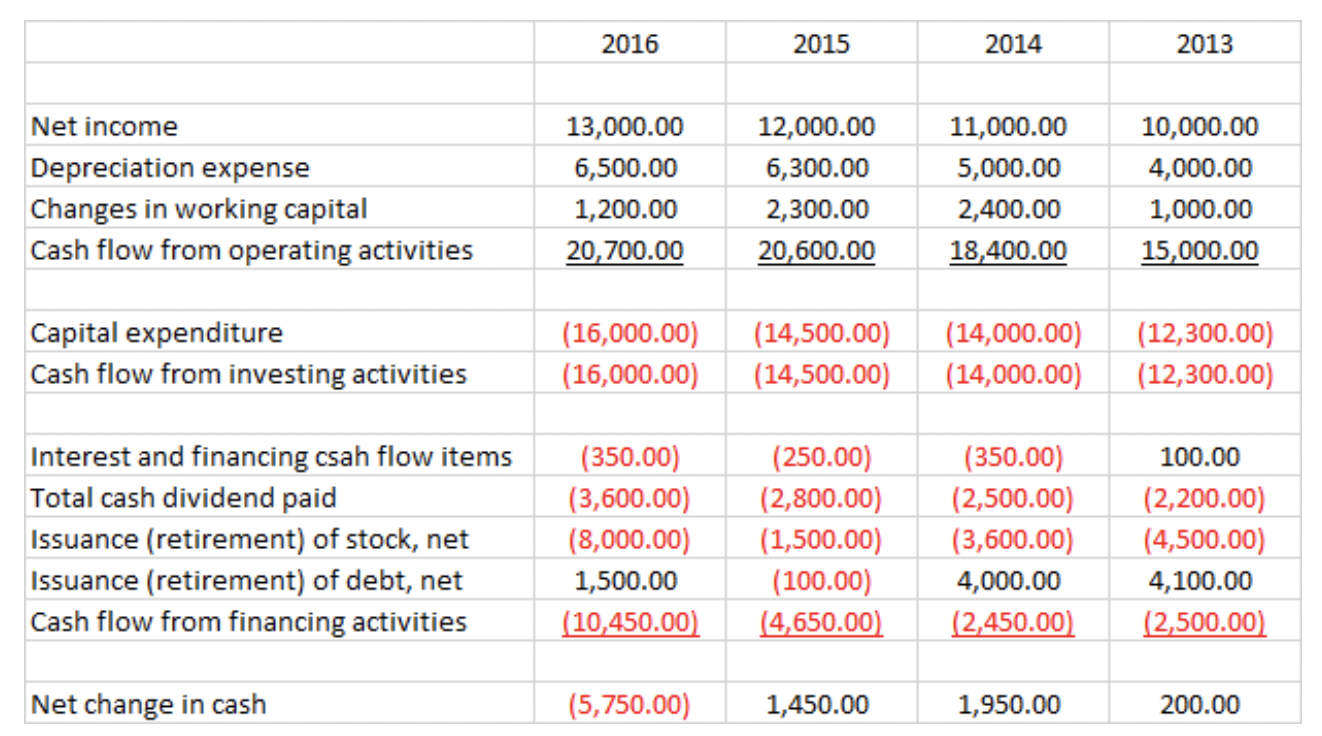

Q2-2 Reviewing cash flow statement (BOX)

Answer the following questions using the information found in these statements.

2-2-1: Did the company generate positive cash flow from its operations?

2-2-2: How much did the company invest in new capital expenditure over these four years?

2-2-3: Describe the sources of financing in the financial markets over these four years.

2-2-4: Based solely on the cash flow statement for 2013 to 2016, writing a brief narrative that describe the major activities of the companys management team over the four years.

Q2-3. Concept

2-3-1. Explain difference between net cash flow, operation cash flow and free cash flow.

2-3-2. Why free cash flow is the most important measure to value a company.

Q2-4. Financial ratio analysis (LYZ)

Data for LYZ Chip Company and its industry average follow.

- Calculate the indicated ratios for LYZ.

- Construct the extended Dupont equation for both LYZ and industry.

- Outline Lozanos strengths and weakness as revealed by your analysis.

30.00 120.00 150.00 200.00 62.00 Depreciation expense Cash Long-term debt Sales Account payable General and administrative expense Building and equipment Notes payable Account receivable Interest expense Accrued liabilities Common stock Cost of goods sold Inventory Taxes Accumulated depreciation Accumulated retained earnings 20.00 490.00 184.60 60.00 21.00 10.00 200.00 90.00 180.00 15.60 130.00 113.40 2016 2015 2014 2013 Net income Depreciation expense Changes in working capital Cash flow from operating activities 13,000.00 6,500.00 1,200.00 20,700.00 12,000.00 6,300.00 2,300.00 20,600.00 11,000.00 5,000.00 2,400.00 18,400.00 10,000.00 4,000.00 1,000.00 15,000.00 Capital expenditure Cash flow from investing activities (16,000.00) (16,000.00) (14,500.00) (14,500.00) (14,000.00) (14,000.00) (12,300.00) (12,300.00) Interest and financing csah flow items Total cash dividend paid Issuance (retirement) of stock, net Issuance (retirement) of debt, net Cash flow from financing activities (350.00) (3,600.00) (8,000.00) 1,500.00 (10,450.00) (250.00) (2,800.00) (1,500.00) (100.00) (4,650.00) (350.00) (2,500.00) (3,600.00) 4,000.00 (2,450.00) 100.00 (2,200.00) (4,500.00) 4,100.00 (2,500.00) Net change in cash (5,750.00) 1,450.00 1,950.00 200.00 30.00 120.00 150.00 200.00 62.00 Depreciation expense Cash Long-term debt Sales Account payable General and administrative expense Building and equipment Notes payable Account receivable Interest expense Accrued liabilities Common stock Cost of goods sold Inventory Taxes Accumulated depreciation Accumulated retained earnings 20.00 490.00 184.60 60.00 21.00 10.00 200.00 90.00 180.00 15.60 130.00 113.40 2016 2015 2014 2013 Net income Depreciation expense Changes in working capital Cash flow from operating activities 13,000.00 6,500.00 1,200.00 20,700.00 12,000.00 6,300.00 2,300.00 20,600.00 11,000.00 5,000.00 2,400.00 18,400.00 10,000.00 4,000.00 1,000.00 15,000.00 Capital expenditure Cash flow from investing activities (16,000.00) (16,000.00) (14,500.00) (14,500.00) (14,000.00) (14,000.00) (12,300.00) (12,300.00) Interest and financing csah flow items Total cash dividend paid Issuance (retirement) of stock, net Issuance (retirement) of debt, net Cash flow from financing activities (350.00) (3,600.00) (8,000.00) 1,500.00 (10,450.00) (250.00) (2,800.00) (1,500.00) (100.00) (4,650.00) (350.00) (2,500.00) (3,600.00) 4,000.00 (2,450.00) 100.00 (2,200.00) (4,500.00) 4,100.00 (2,500.00) Net change in cash (5,750.00) 1,450.00 1,950.00 200.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts