Question: Read the case and answer these 2 questions: Q1: Taking one of the FANG companies, what do you think is its greatest macro-environmental threat, and

Read the case and answer these 2 questions:

Q1: Taking one of the FANG companies, what do you think is its greatest macro-environmental threat, and what is its greatest macro-environmental opportunity?

Q2: Have the opportunities and threats changed since 2018? How would you update this analysis?

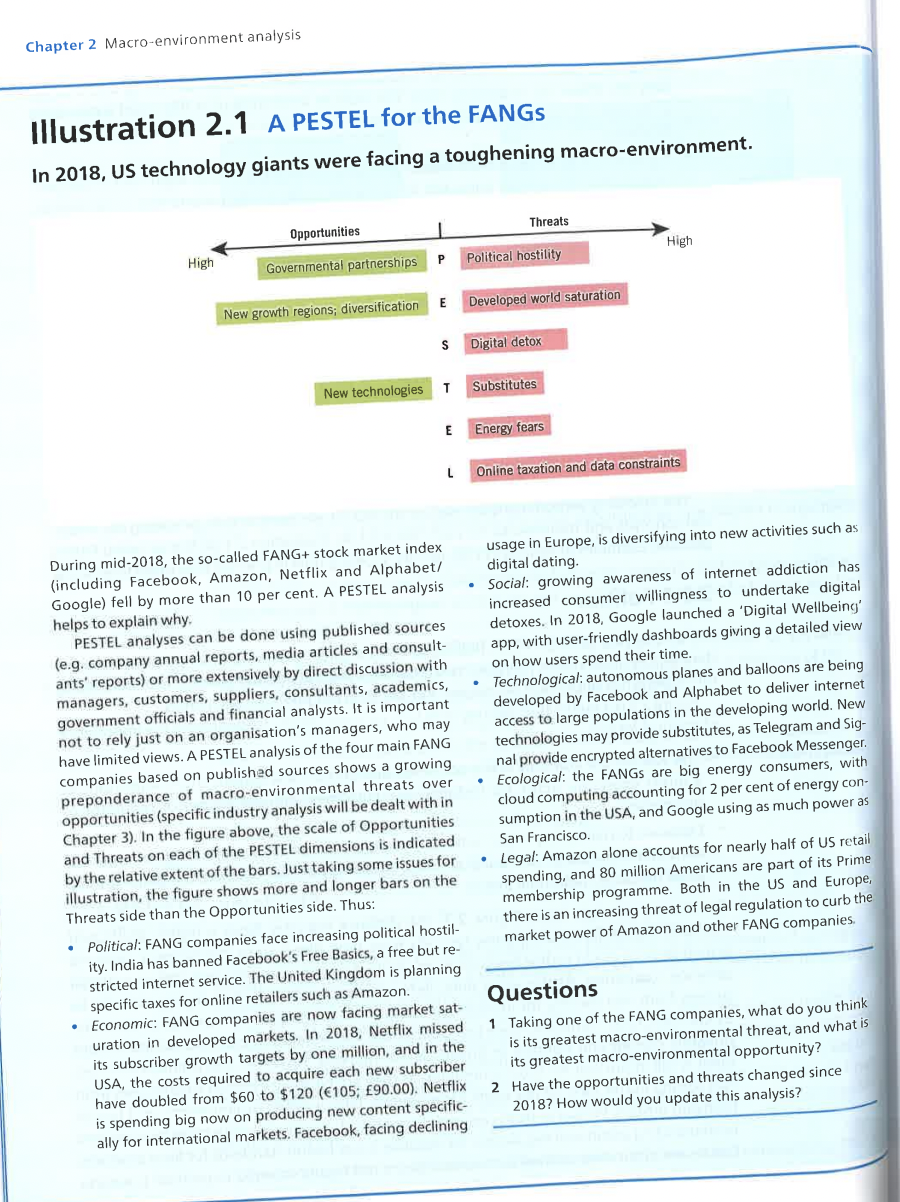

Chapter 2 Macro-environment analysis Illustration 2.1 A PESTEL for the FANGS In 2018, US technology giants were facing a toughening macro-environment. Threats Opportunities High High P Political hostility Governmental partnerships E Developed world saturation New growth regions; diversification S Digital detox T Substitutes New technologies E Energy fears L Online taxation and data constraints During mid-2018, the so-called FANG+ stock market index (including Facebook, Amazon, Netflix and Alphabet/ Google) fell by more than 10 per cent. A PESTEL analysis helps to explain why PESTEL analyses can be done using published sources (e.g. company annual reports, media articles and consult- ants' reports) or more extensively by direct discussion with managers, customers, suppliers, consultants, academics, government officials and financial analysts. It is important not to rely just on an organisation's managers, who may have limited views. A PESTEL analysis of the four main FANG companies based on published sources shows a growing preponderance of macro-environmental threats over opportunities (specific industry analysis will be dealt with in Chapter 3). In the figure above, the scale of Opportunities and Threats on each of the PESTEL dimensions is indicated by the relative extent of the bars. Just taking some issues for illustration, the figure shows more and longer bars on the Threats side than the Opportunities side. Thus: Political: FANG companies face increasing political hostil- ity. India has banned Facebook's Free Basics, a free but re- stricted internet service. The United Kingdom is planning specific taxes for online retailers such as Amazon. Economic: FANG companies are now facing market sat- uration in developed markets. In 2018, Netflix missed its subscriber growth targets by one million, and in the USA, the costs required to acquire each new subscriber have doubled from $60 to $120 (105; 90.00). Netflix is spending big now on producing new content specific- ally for international markets. Facebook, facing declining usage in Europe, is diversifying into new activities such as digital dating. Social: growing awareness of internet addiction has increased consumer willingness to undertake digital detoxes. In 2018, Google launched a 'Digital Wellbeing' app, with user-friendly dashboards giving a detailed view on how users spend their time. Technological: autonomous planes and balloons are being developed by Facebook and Alphabet to deliver internet access to large populations in the developing world. New technologies may provide substitutes, as Telegram and Sig- nal provide encrypted alternatives to Facebook Messenger. Ecological: the FANGS are big energy consumers, with cloud computing accounting for 2 per cent of energy con- sumption in the USA, and Google using as much power as San Francisco Legal: Amazon alone accounts for nearly half of US retail spending, and 80 million Americans are part of its Prime membership programme. Both in the US and Europe, there is an increasing threat of legal regulation to curb the market power of Amazon and other FANG companies Questions 1 Taking one of the FANG companies, what do you think is its greatest macro-environmental threat, and what is its greatest macro-environmental opportunity? 2 Have the opportunities and threats changed since 2018? How would you update this analysisStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts