Question: Does it surprise you that the CPA had to resort to reviewing court cases to find out if points are deductible? Does it surprise you

Does it surprise you that the CPA had to resort to reviewing court cases to find out if points are deductible?

Does it surprise you that the “correct” answer differs depending what state you live in? How is it possible that the Internal Revenue Code can be interpreted and enforced differently for people living in different parts of the country?

What do you think about a tax code that even the IRS and CPA's must look outside the IRS Code to find answers?

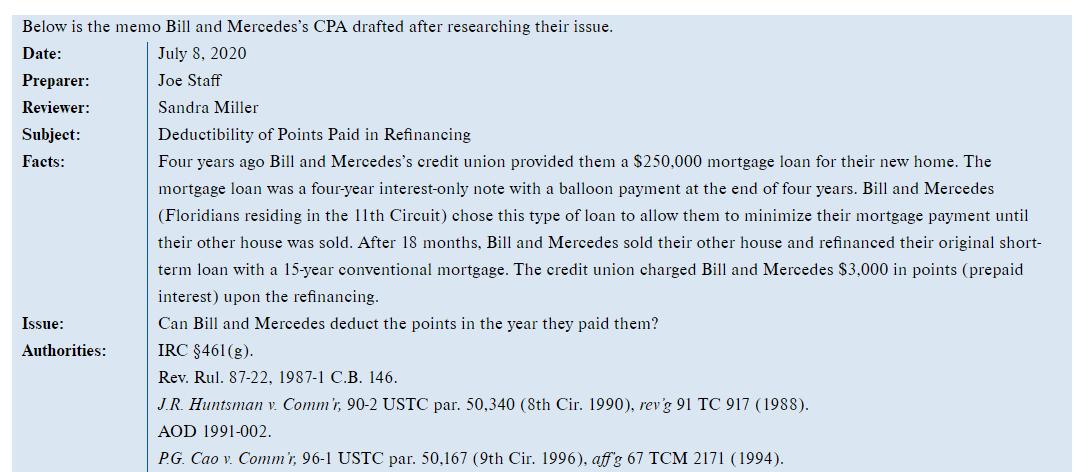

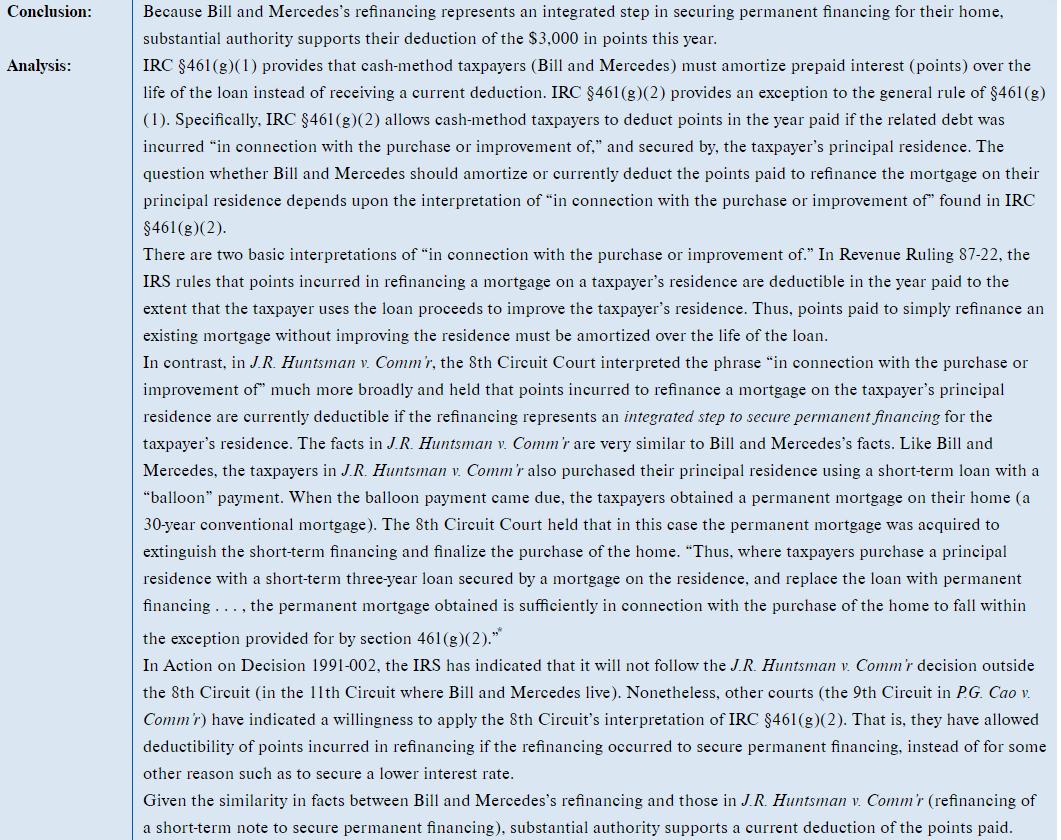

Below is the memo Bill and Mercedes's CPA drafted after researching their issue. Date: July 8, 2020 Preparer: Joe Staff Reviewer: Sandra Miller Subject: Deductibility of Points Paid in Refinancing Facts: Four years ago Bill and Mercedes's credit union provided them a $250,000 mortgage loan for their new home. The mortgage loan was a four-year interest-only note with a balloon payment at the end of four years. Bill and Mercedes (Floridians residing in the 11th Circuit) chose this type of loan to allow them to minimize their mortgage payment until their other house was sold. After 18 months, Bill and Mercedes sold their other house and refinanced their original short- term loan with a 15-year conventional mortgage. The credit union charged Bill and Mercedes $3,000 in points (prepaid interest) upon the refinancing. Issue: Can Bill and Mercedes deduct the points in the year they paid them? Authorities: IRC 461(g). Rev. Rul. 87-22, 1987-1 C.B. 146. J.R. Huntsman v. Comm'r, 90-2 USTC par. 50,340 (8th Cir. 1990), rev'g 91 TC 917 (1988). AOD 1991-002. P.G. Cao v. Comm'r, 96-1 USTC par. 50,167 (9th Cir. 1996), aff g 67 TCM 2171 (1994).

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Employees including business owneremployees often are required to pay expenses out of pocket on behalf of their employer or business In most cases they do so either expecting to be reimbursed or until ... View full answer

Get step-by-step solutions from verified subject matter experts