Question: Read the textbook, lecture notes and all other posts BEFORE you post. Using a current or prior place of work as an example business, discuss

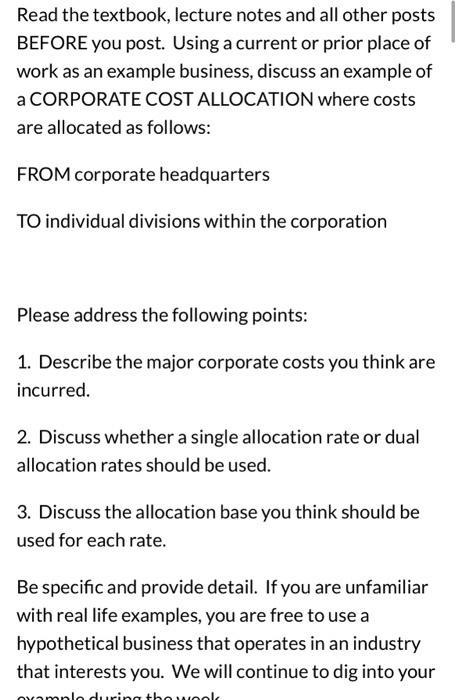

Read the textbook, lecture notes and all other posts BEFORE you post. Using a current or prior place of work as an example business, discuss an example of a CORPORATE COST ALLOCATION where costs are allocated as follows: FROM corporate headquarters TO individual divisions within the corporation Please address the following points: 1. Describe the major corporate costs you think are incurred. 2. Discuss whether a single allocation rate or dual allocation rates should be used. 3. Discuss the allocation base you think should be used for each rate. Be specific and provide detail. If you are unfamiliar with real life examples, you are free to use a hypothetical business that operates in an industry that interests you. We will continue to dig into your Read the textbook, lecture notes and all other posts BEFORE you post. Using a current or prior place of work as an example business, discuss an example of a CORPORATE COST ALLOCATION where costs are allocated as follows: FROM corporate headquarters TO individual divisions within the corporation Please address the following points: 1. Describe the major corporate costs you think are incurred. 2. Discuss whether a single allocation rate or dual allocation rates should be used. 3. Discuss the allocation base you think should be used for each rate. Be specific and provide detail. If you are unfamiliar with real life examples, you are free to use a hypothetical business that operates in an industry that interests you. We will continue to dig into your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts