Question: really looking for some help on this question. its a big question but half of it is already completed. THANK YOU IN ADVANCE! this part

![2-6, 2-7, 2-8] The general ledger of the Karlin Company. a consulting](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67185a3203b66_20167185a3153bfb.jpg)

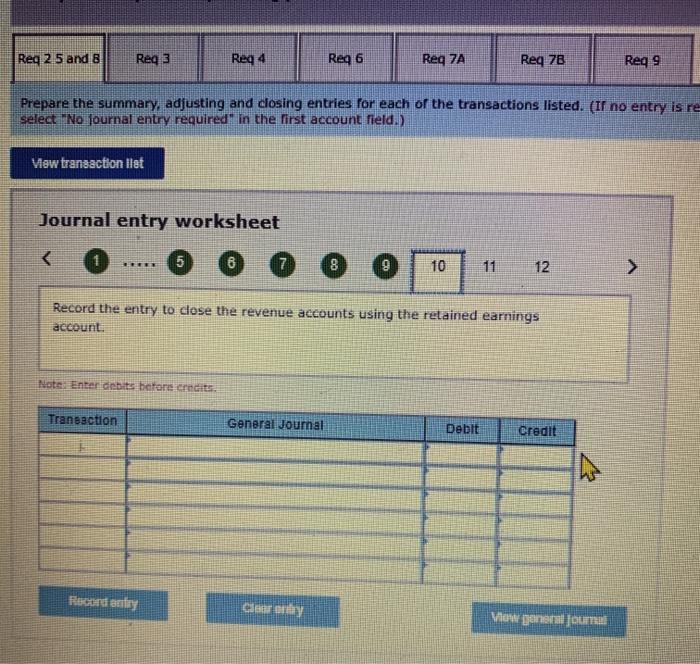

this part should be complete other than the 3 journal entries i have not filled out numbered 10,11,12.

this part should be complete other than the 3 journal entries i have not filled out numbered 10,11,12.

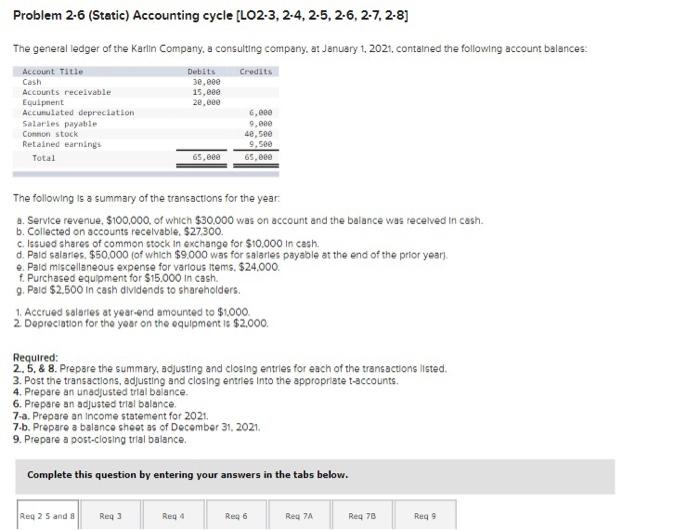

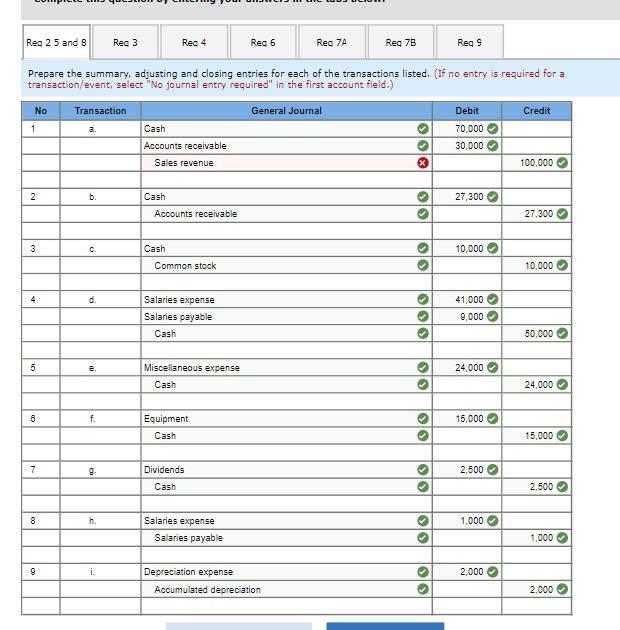

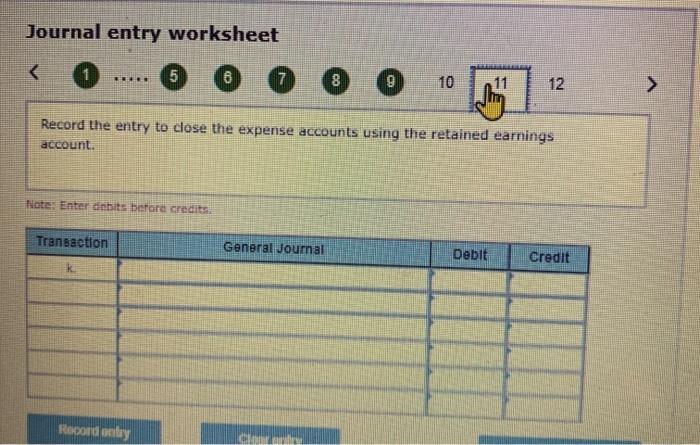

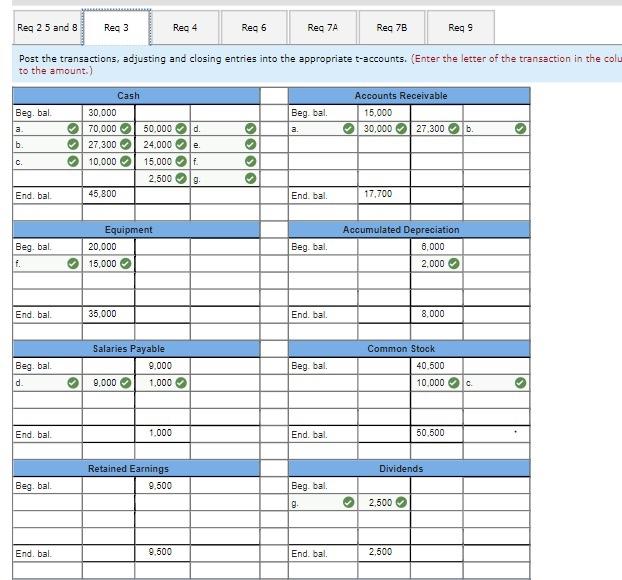

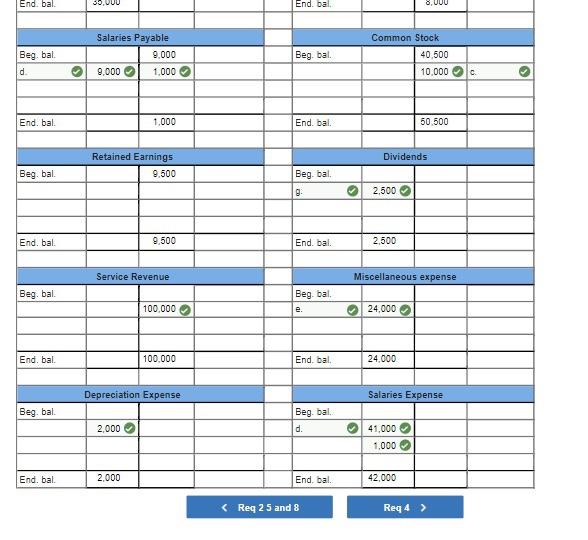

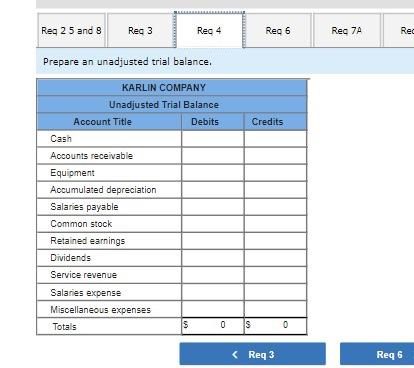

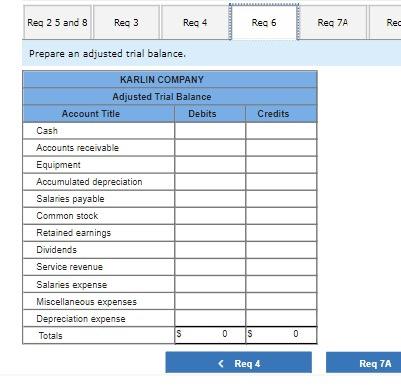

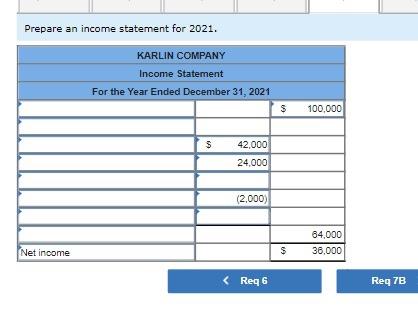

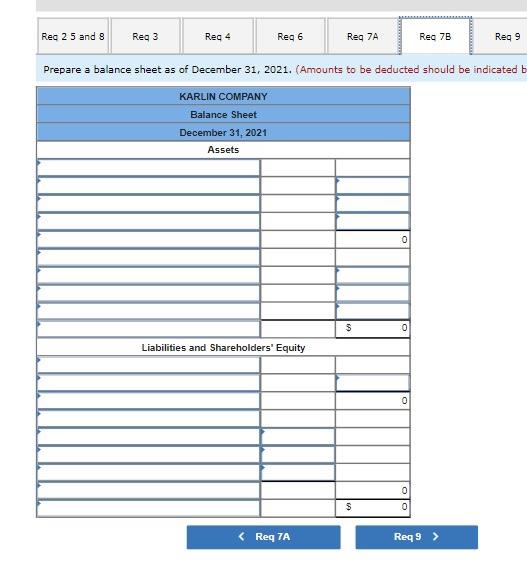

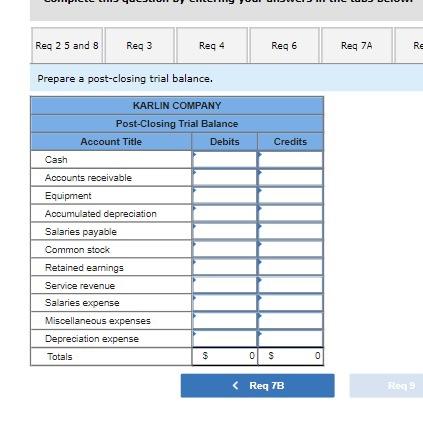

Problem 2-6 (Static) Accounting cycle [LO2-3, 2-4,2-5, 2-6, 2-7, 2-8] The general ledger of the Karlin Company. a consulting company. at January 1, 2021. contained the following account balances Credits 15,eee Accumulated depreciation Account Title Cash Accounts receivable Equipment Debits 30.ece 20.000 Salaries payable Common stock Retained earnings Total 6,000 9.00 48,500 9,500 65.000 65,000 The following is a summary of the transactions for the year. 4. Service revenue. S100,000, of which $30.000 was on account and the balance was received in cash. b. Collected on accounts recevable. $27.300. c. Issued shares of common stock in exchange for $10,000 in cash. d. Pald salaries $50,000 (of which $9.000 was for salaries payable at the end of the prior year) e. Pald miscellaneous expense for various items. $24.000 f. Purchased equipment for $15.000 in cash. 9. Paid $2,500 in cash dividends to shareholders. 1. Accrued salaries at year-end amounted to $1.000. 2. Depreciation for the year on the equipment is $2.000. Required: 2.5.& 8. Prepare the summary, adjusting and closing entries for each of the transactions listed 3. Post the transactions, adjusting and closing entries into the appropriate t-accounts. 4. Prepare an unadjusted trial balance. 6. Prepare an adjusted trial balance 7-a. Prepare an income statement for 2021. 7.b. Prepare a balance sheet as of December 31, 2021 9. Prepare a post-closing trial balance. Complete this question by entering your answers in the tabs below. Reg 25 and 8 Req3 Reg4 Reg 6 Req 7A Req 78 Req9 Reg 25 and 8 Reg 3 Reg 4 Reg 6 Reg 7A Rea 7B Reg 9 Prepare the summary adjusting and closing entries for each of the transactions listed. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Transaction General Journal Debit Credit 1 a. 70,000 Cash Accounts receivable 30,000 Sales revenue 100,000 2 b. Cash 27,300 Accounts receivable 27,300 3 c 10,000 Cash Common stock Olo 10.000 4 d. Salaries expense Salaries payable Cash ololo 41,000 9,000 O 50,000 5 e. 24,000 > Miscellaneous expense Cash SIS 24,000 6 f. 15,000 > Equipment Cash 15,000 7 2,500 Dividends Cash Olo 2.500 8 h. 1,000 Salaries expense Salaries payable 1.000 9 i. 2.000 Depreciation expense Accumulated depreciation Olo 2.000 Reg 25 and 8 Reg 3 Reg 4 Req 6 Req 7A Req 78 Reg 9 Prepare the summary, adjusting and closing entries for each of the transactions listed. (If no entry is re select No journal entry required in the first account field.) Mew transaction let Journal entry worksheet Record the entry to close the revenue accounts using the retained earnings account Note: Enter debits before credits Transaction General Journal Debit Credit Focard any Clear en Men general journa Journal entry worksheet Record the entry to clese the expense accounts using the retained earnings account. Note Enter debits before credits Transaction General Journal Debit Credit ke Record entry Journal entry worksheet Record the entry to close the dividends account. Note: Enter debits before credits. Transaction General Journal Debit Credit Record en Cloeren Vlow general JOLIE Reg 25 and 8 Reg 3 Reg 4 Reg 6 Rea 7A Reg 7B Reg 9 Post the transactions, adjusting and closing entries into the appropriate t-accounts. (Enter the letter of the transaction in the colu to the amount.) Beg bal Beg, bal a. Accounts Receivable 15,000 30,000 27.300 lb. a. d. b. Cash 30,000 70,000 50,000 27,300 24,000 l 10.000 15.000 2.500 45,800 solo olololol lolololo C. g End. bal End, bal 17,700 Beg bal Equipment 20,000 15,000 Beg, bal Accumulated Depreciation 8,000 2,000 f. End. bal. 35,000 End, bal 8,000 Salaries Payable 9,000 9,000 1.000 Beg, bal d. Beg bal. Common Stock 40.500 10.000 c. End, bal 1.000 End, bal 50 500 Dividends Retained Earnings 9.500 Beg bal. Beg. bal 9. 2,500 End, bal 9.500 End. bal. 2,500 End. bal. 39.UUU End. bal. 6.UUU Salaries Payable 9.000 9,000 1.000 Beg bal d Beg bal. Common Stock 40.500 10.000 C End. bal. 1.000 End, bal 50.500 Dividends Retained Earnings 9.500 Beg bal. Beg. bal g. 2,500 End. bal. 9.500 End, bal 2.500 Service Revenue Miscellaneous expense Beg. bal. Beg. bal 100,000 24,000 End. bal 100.000 End. bal. 24,000 Depreciation Expense Salaries Expense Beg bal. Beg, bal d. 2,000 41.000 1.000 End, bal 2,000 End, bal. 42,000 Reg 25 and 3 Reg 3 Rea 4 Reg 6 Rea 7A Rec Prepare an unadjusted trial balance. KARLIN COMPANY Unadjusted Trial Balance Account Title Debits Cash Credits Accounts receivable Equipment Accumulated depreciation Salaries payable Common stock Retained earnings Dividends Service revenue Salaries expense Miscellaneous expenses Totals $ 0 S 0 Req 25 and 8 Reg 3 Reg 4 Reg 6 Req 7A RE Prepare a post-closing trial balance. KARLIN COMPANY Post-Closing Trial Balance Account Title Debits Credits Cash Accounts receivable Equipment Accumulated depreciation Salaries payable Common stock Retained earnings Service revenue Salaries expense Miscellaneous expenses Depreciation expense Totals $ 0 S 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts