Question: really need help on this one. its only one question, H, just has different parts 141 h. (1.) Identify (a) the stated, or quoted, or

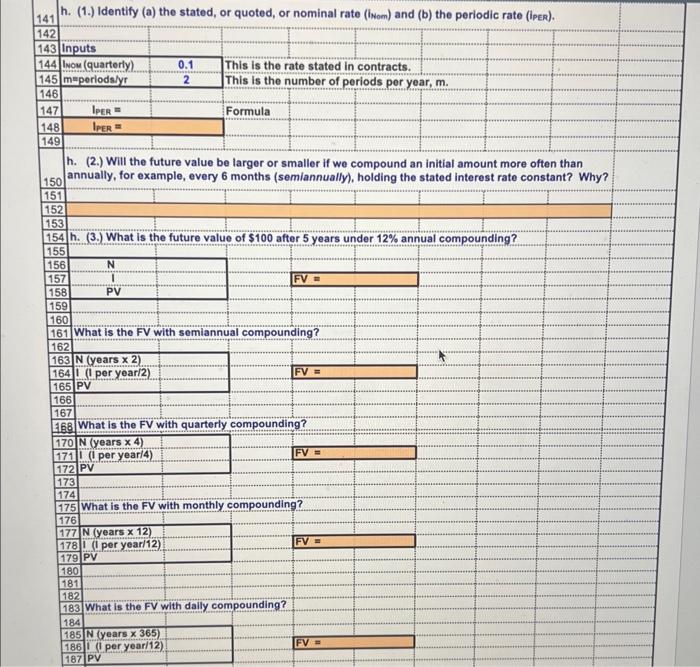

141 h. (1.) Identify (a) the stated, or quoted, or nominal rate (iNom) and (b) the periodic rate (iper). \begin{tabular}{|c|l|c|} \hline 142 & & \\ \hline 143 & Inputs & \\ \hline 144 & Nou (quarterly) & 0.1 \\ \hline 145 & maperiodslyr & 2 \\ \hline 146 & & \\ \hline \end{tabular} This is the rate stated in contracts. This is the number of periods per year, m. \begin{tabular}{|l|l|} \hline 147 & IPER = \\ \hline 148 & IPER = \\ \hline 149 & \\ \hline \end{tabular} Formula h. (2.) WiIl the future value be larger or smaller if we compound an initial amount more often than 150 annually, for example, every 6 months (semiannually), holding the stated interest rate constant? Why? \begin{tabular}{|l|l|l|} \hline 151 & & \\ \hline 152 & & \\ \hline 153 & & \\ \hline 154 & h. (3.) What is the future value of $100 after 5 years under 12% annual compounding? \\ \hline 155 & & \end{tabular} 162161 163 N (years 2) 164 I (1 per year/2). 165 PV 166 167 168 What is the FV with quarterly compounding? \begin{tabular}{|l|l|l|} \hline 170 & N (years x 4) \\ \hline 171 & 1 ( per yeari4) \\ \hline 172 & PV & \\ \hline 173 & & \\ \hline 174 & & \\ \hline 175 & What is the FV with monthly compounding? \\ \hline 176 & \end{tabular} 176175 \begin{tabular}{|l|l|} \hline 177 & N(years12) \\ \hline 178 & (12peryearf12) \\ \hline \end{tabular} 178 i ( ( per yeari12). 178 PV 180 181 184

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts