Question: really need help tysm GLO402 (Algo) - Based on Problem 4-1A LO P2 On April 1, Leslie Adams created a new travel agency, Adams Travel.

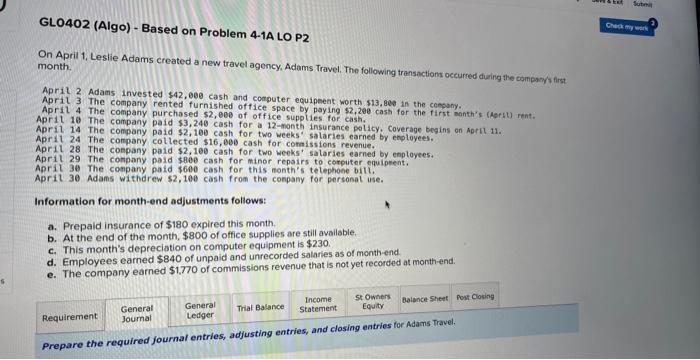

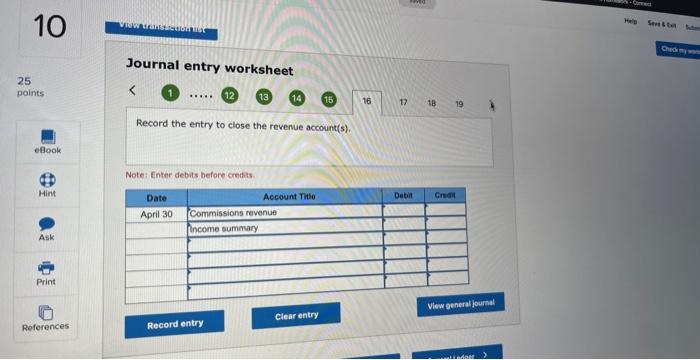

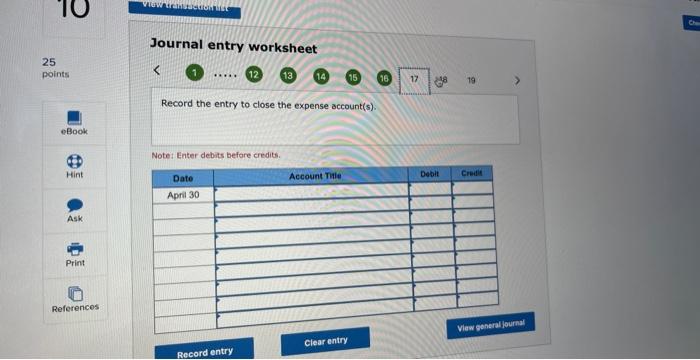

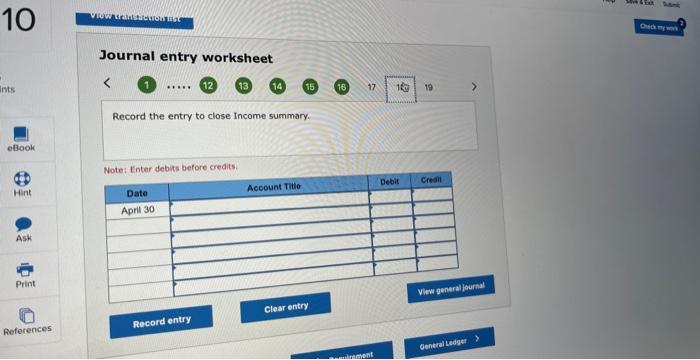

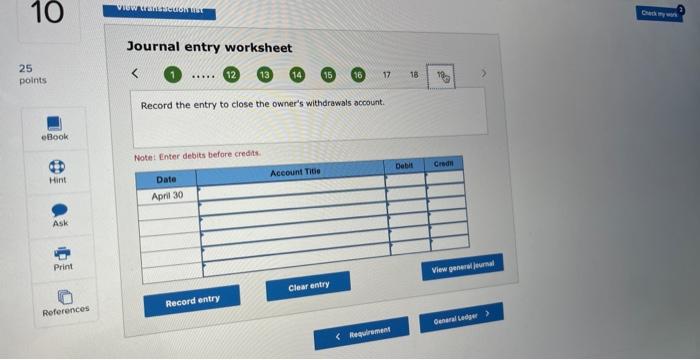

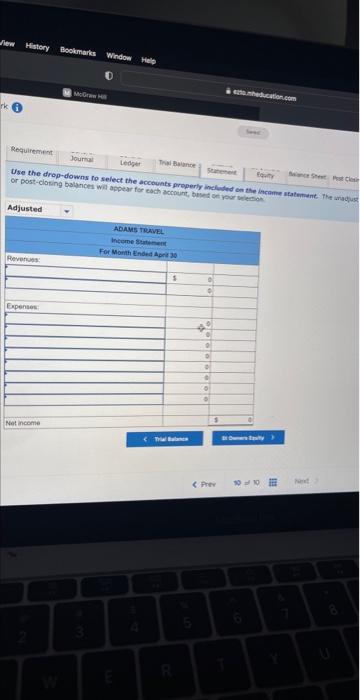

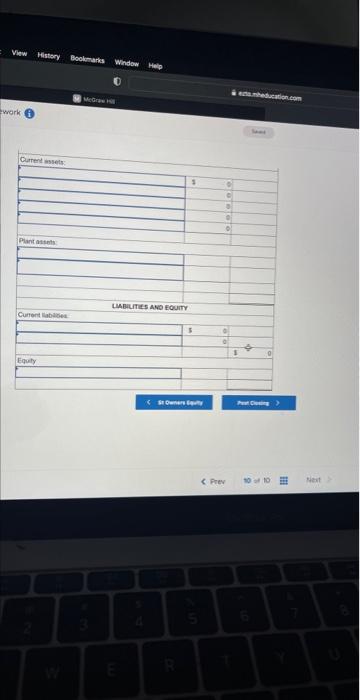

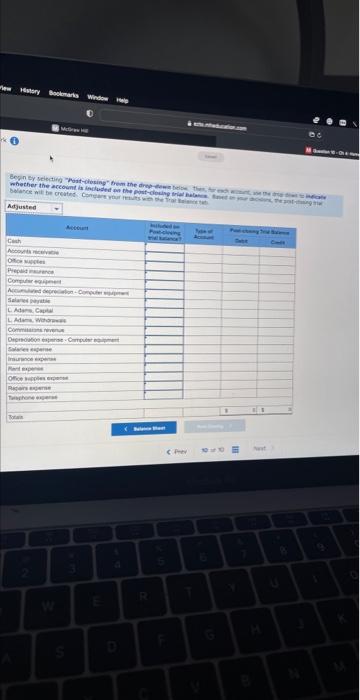

GLO402 (Algo) - Based on Problem 4-1A LO P2 On April 1, Leslie Adams created a new travel agency, Adams Travel. The following transactions occurred dueing the company/s fist month. Aprit 2 Adams Invested $42,000 cash and computer equipent, worth 513,800 in the coesuny. April 3 The company rented furnished of conpe spoce by paying $2,208 cash for the first month's (Aerht) rent. April 4 The company purchased $2,000 of office supplies for cash. Aprit 16 The company paid 53,240 cash for Aprit 10 The company paid $3,240 cash for a 12 -nonth insurance policy. Coverage begins on April 11. Aprit 14 The conpany paid $2,100 cash for two weeks" salaries earned by enoloyeel. Aprit 28 The conpany paid $2,100 cosh for twor cornisstons revenue. Aprit 29 The conpany paid \$2,100 cash for two weeks' salaries earned by enployees. April 30 The conpany paid s8ee cash for minor repairs to corputer equiptent. Aprit 36 Adams withdrew $2,100 cash for this nonth's telephone bitl. Information for month-end adjustments follows: a. Prepaid insurance of $180 expired this month. b. At the end of the month, $800 of office supplies are still available. c. This month's depreciation on computer equipment is $230. d. Employees earned $840 of unpaid and unrecorded salaries as of month-end. e. The company earned $1,770 of commissions revenue that is not yet recorded at month-end. Prepare the required journat entries, adjusting entries, and closing entries for Adams Travel. Journal entrv wnileha. Note: tnrer debits berore crethts Journal entry worksheet Journal entry worksheet Journal entry worksheet isosa dintar detaith. befiore crech to Use the drop-downs to select the accounts preperly inelluded on the incame itatement. The arad,ug Viw Histery Bookmarks wh We travish work (i) GLO402 (Algo) - Based on Problem 4-1A LO P2 On April 1, Leslie Adams created a new travel agency, Adams Travel. The following transactions occurred dueing the company/s fist month. Aprit 2 Adams Invested $42,000 cash and computer equipent, worth 513,800 in the coesuny. April 3 The company rented furnished of conpe spoce by paying $2,208 cash for the first month's (Aerht) rent. April 4 The company purchased $2,000 of office supplies for cash. Aprit 16 The company paid 53,240 cash for Aprit 10 The company paid $3,240 cash for a 12 -nonth insurance policy. Coverage begins on April 11. Aprit 14 The conpany paid $2,100 cash for two weeks" salaries earned by enoloyeel. Aprit 28 The conpany paid $2,100 cosh for twor cornisstons revenue. Aprit 29 The conpany paid \$2,100 cash for two weeks' salaries earned by enployees. April 30 The conpany paid s8ee cash for minor repairs to corputer equiptent. Aprit 36 Adams withdrew $2,100 cash for this nonth's telephone bitl. Information for month-end adjustments follows: a. Prepaid insurance of $180 expired this month. b. At the end of the month, $800 of office supplies are still available. c. This month's depreciation on computer equipment is $230. d. Employees earned $840 of unpaid and unrecorded salaries as of month-end. e. The company earned $1,770 of commissions revenue that is not yet recorded at month-end. Prepare the required journat entries, adjusting entries, and closing entries for Adams Travel. Journal entrv wnileha. Note: tnrer debits berore crethts Journal entry worksheet Journal entry worksheet Journal entry worksheet isosa dintar detaith. befiore crech to Use the drop-downs to select the accounts preperly inelluded on the incame itatement. The arad,ug Viw Histery Bookmarks wh We travish work (i)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts