Question: Record straight-line amortization expense ($777/5 = $155.4) and adjust the ROU asset accordingly Record interest expense ($777 0.7% = $5.4) and reduction in principal ($150

- Record straight-line amortization expense ($777/5 = $155.4) and adjust the ROU asset accordingly

- Record interest expense ($777 0.7% = $5.4) and reduction in principal ($150 - $777 0.7% = $144.6) for lease liability

(in thousands of dollars)

| DATE | ACCOUNTS | DEBIT | CREDIT |

| 12/31/21 | Amortization Expense | $155.4 | |

| ROU Asset | $155.4 | ||

| 12/31/21 | Interest Expense | $5.4 | |

| Finance Lease Liability | $144.6 | ||

| Cash | $150.0 |

At the end of year 2:

- Record straight-line amortization expense ($777/5 = $155.4) and adjust the ROU asset accordingly

- Record interest expense (($777 ? $144.6) 0.7% = $4.4) and reduction in principal ($155 ? ($777 ? $144.6) 0.7% = $150.6) for lease liability

(in thousands of dolllars)

| DATE | ACCOUNTS | DEBIT | CREDIT |

| 12/31/22 | Amortization Expense | $155.4 | |

| ROU Asset | $155.4 | ||

| 12/31/22 | Interest Expense | $4.4 | |

| Finance Lease Liability | $150.6 | ||

| Cash |

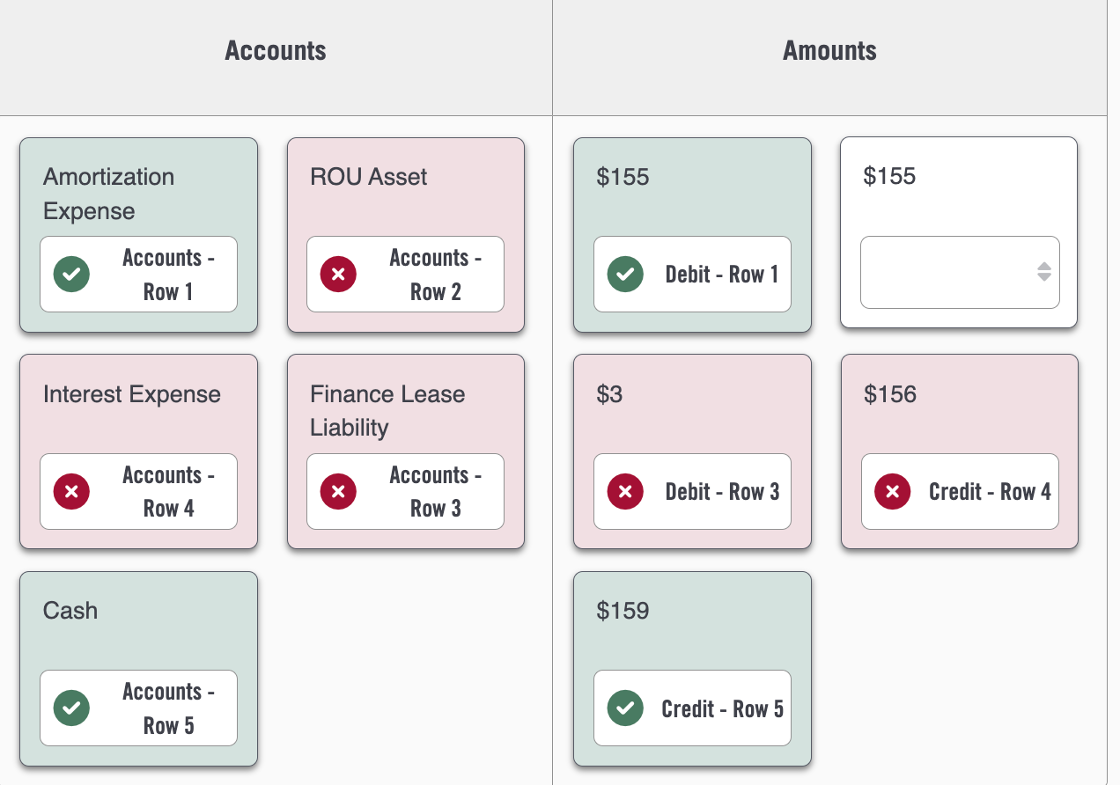

1) Record straight-line amortization expense and adjust the ROU asset accordingly. 2) Record interest expense and reduction in principal for lease liability.Rounding to the nearest integer (in thousands of dollars.)

(in thousands of dollars) I need calculations (formulas to be insert excel chart)

Amortization Expense Accounts - Row 1 Accounts ROU Asset Accounts - Row 2 $155 Interest Expense Finance Lease $3 Liability Accounts - Row 4 Accounts - Row 3 Cash Accounts - Row 5 $159 Debit - Row 1 Amounts $155 $156 Debit - Row 3 Credit - Row 4 Credit - Row 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts