Question: Recording Bad Dabt Expense Estimates and Write-Offs Using the Percentage of Credit Sales Method During the current year, Sun Electronics, Incorporated, recorded credit sales of

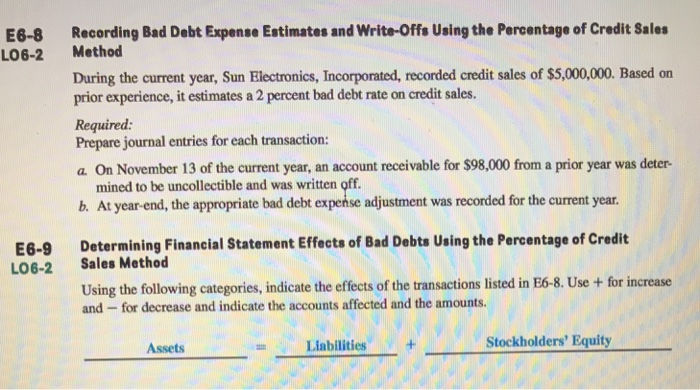

Recording Bad Dabt Expense Estimates and Write-Offs Using the Percentage of Credit Sales Method During the current year, Sun Electronics, Incorporated, recorded credit sales of $5,000,000. Based on prior experience, it estimates a 2 percent bad debt rate on credit sales. Required: Prepare journal entries for each transaction: a On November 13 of the current year, an account receivable for $98,000 from a prior year was deter- E6-8 LO6-2 mined to be uncollectible and was written off b. At year-end, the appropriate bad debt expense adjustment was recorded for the current year Determining Financial Statement Effects of Bad Debts Using the Percentage of Credit Sales Method Using the following categories, indicate the effects of the transactions listed in E6-8. Use + for increase and for decrease and indicate the accounts affected and the amounts. E6-9 LO6-2 Assets Liabilities+ Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts