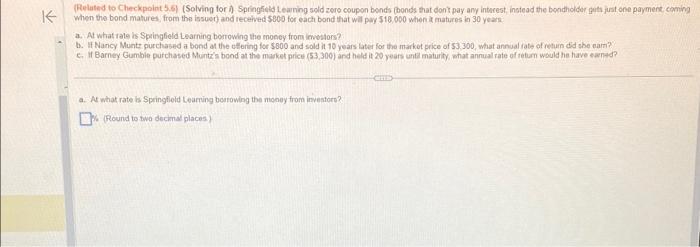

Question: (Reluted to Checkpoint 5.6 ) (Solving for ). Springseld tearning sold zero coupon bonds (bonds that don' pay ary inturest, instead the bondholder gats just

(Reluted to Checkpoint 5.6 ) (Solving for ). Springseld tearning sold zero coupon bonds (bonds that don' pay ary inturest, instead the bondholder gats just one payment coming When the bond matures, from the issuer) and received 5800 for each bond that wal pwy 518,000 when it matures in 30 years: a. At what rate is Springfield Learning borrowing the money from imvition? b. It Nancy Muntr, purchased a bond at the etlering for $800 and sold it 10 years later for the markot price of $3,300, what annual fate of return did she earr? c. If Barney Gumble purchased Muintz's bond at the magket price (53,300) and held it 20 years unti maturity shat annual rate of retuan would he have eaned? a. At what rate is Springfleld Learring boatowing the money from investort? 6. (Round to two dechal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts